What is in the 2021 budget for Small and Medium Business Owners

The 2021 budget was announced last night spraying a lot of cash around. But how much of that cash will go to small and medium business owners?

Here are some of the winners:

- Support continues for industries impacted by the Covid shutdowns such as entertainment, arts, tourism, hospitality and aviation.

- If your business employs apprentices and trainees, there are more incentives for you to employ these staff, assuming you can find these people in the current job market.

- If your business supports infrastructure projects, then you may benefit from more work. But conversely you may be adversely impacted by the lack of staff to deliver on these projects.

- If you need to buy capital assets, then the ability to claim a 100% write off has been extended giving you more time to get the capital item installed and ready for use. But, if you don’t have access to funding to do this, your ability to utilise this may be limited.

- If your business is in the digital space such as artificial intelligence and cyber security there are some new programs that may benefit your business.

If your business is outside of these, the direct benefit to your business in this budget is limited.

One positive output from the 2021 budget is that, small to medium businesses (with a turnover of less than $50 million) will still benefit from the reduction in the company tax rate from 26% to 25% applicable from 1 July 2021, announced in previous budgets. But remember this will adversely impact your franking credits.

My biggest disappointment in this budget is that it fails to address what I see as one of the major issues facing many small and medium businesses right now. This is the ability to find and retain good quality staff today – not in 6 months when they may have been re-trained. This issue has the capacity to constrain the growth of the economy in the immediate future.

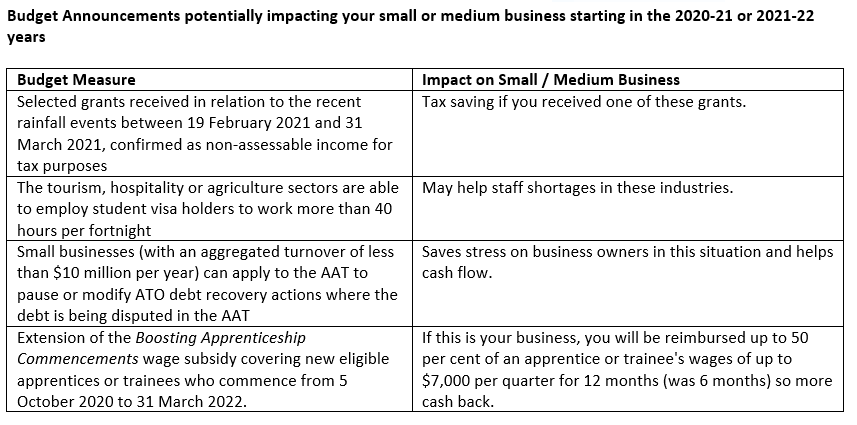

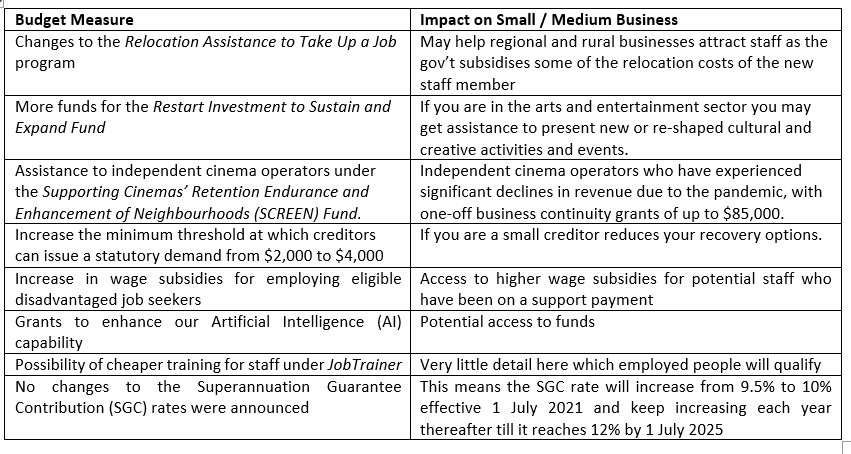

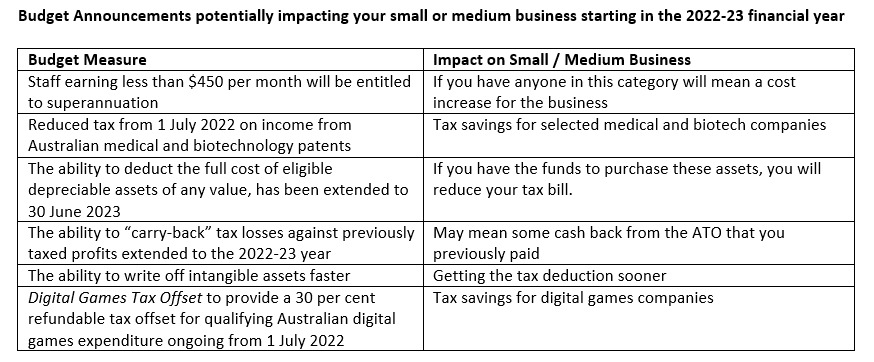

Here are 2021 budget announcements potentially impacting your small or medium business.

If you want some help, contact me below.

Contact Wayne Wanders for your FREE Business Survival Session

At the end of this session, you will have multiple ideas on how your business can survive and thrive in these uncertain times.

Simply fill in the contact form below or email me at wayne@aRealCFO.com.au or call me on 0412 227 052 to organise one of these obligation free sessions.

Wayne Wanders, A Real CFO

wayne@aRealCFO.com.au