2021 Tax Tips – Change in tax rates for small to medium businesses

Today I want give you another 2021 financial year Tax Planning tip. And that is around the change in tax rates for small to medium businesses

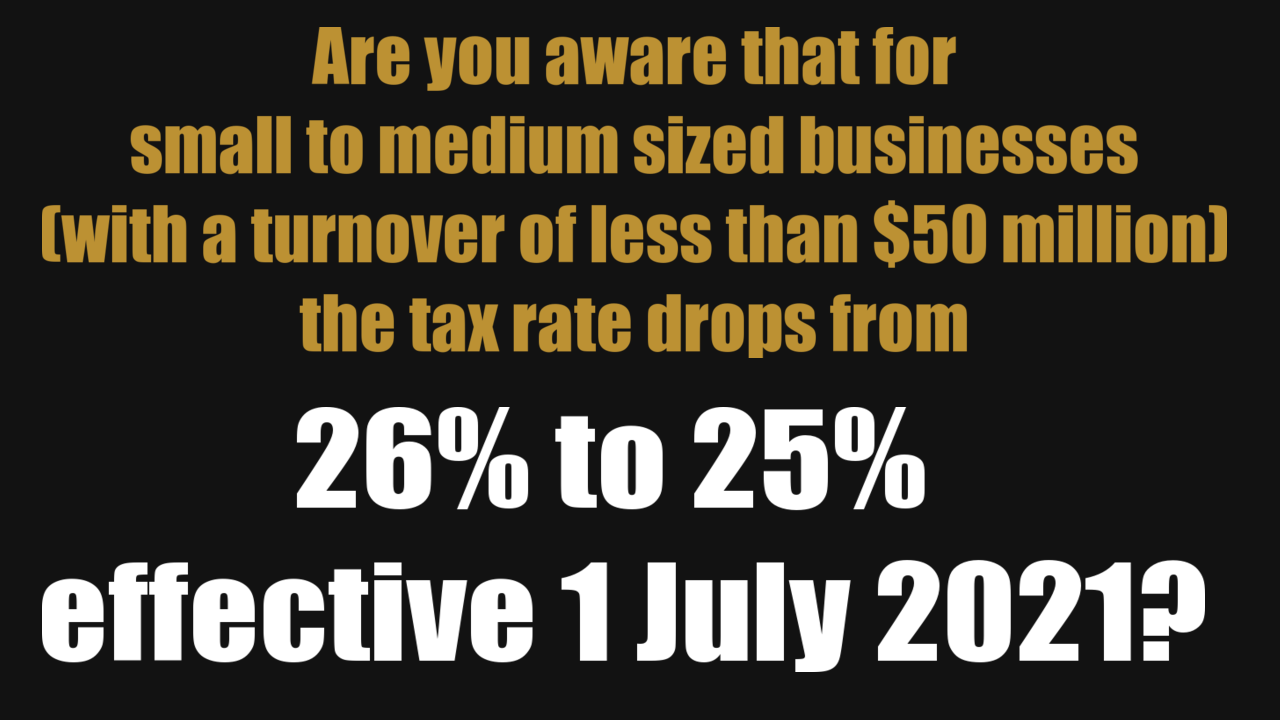

Are you aware that for small to medium sized businesses (with a turnover of less than $50 million) the tax rate drops from 26% to 25% effective 1 July 2021?

Putting it another way, if you spend $1,000 on a deductible business expense on 30 June 2021, your tax saving is $260. If you spend the same $1,000 on 1 July 2021, your tax saving is reduced to $250.

Because of this, it makes sense to think about things your business needs to spend money on and have a look at the timing of doing so.

For example, if you have the cash think about:

- Paying your employees super before 1 July (as you can only claim the tax deduction when you pay your super).

- Prepay some expenses early. The typical example I see here is annual software subscriptions for technology or other products and services you use. And you may even get a discount for paying a year in advance.

- Think about any capital or asset items you are planning to purchase. For example, a new computer or new equipment. Under the temporary full expensing rules, you may be able to get a 100% deduction for the purchase of new and second hand assets. Why not get a bigger tax deduction this year, if you were going to purchase this anyway!

Note, I do not recommend spending money to get the tax break. Only spend money on things that add value to your business.

In summary, if you have the cash, it make sense to bring forward spending on deductible business expenses to before 1 July 2021.

If you want some help to understand your business finances, contact me below.

Contact Wayne Wanders for your FREE Business Survival Session

At the end of this session, you will have multiple ideas on how your business can survive and thrive in these uncertain times.

Simply fill in the contact form below or email me at wayne@aRealCFO.com.au or call me on 0412 227 052 to organise one of these obligation free sessions.

Wayne Wanders, A Real CFO

wayne@aRealCFO.com.au