2021 Tax Tips – Loss Carry Back

One of the measures the Federal Government announced to help businesses during COVID was the Loss Carry Back Tax offset.

Normally if you have a tax loss, this can be only offset against future taxable income.

But this Loss Carry Back Tax offset allows eligible business who have experienced a tax loss in the 2020-2021 tax year, to offset this against taxable income in previous selected years. This may then result in a cash refund of tax paid in previous years, or a reduction in the debt you owe the Australian Taxation Office (ATO).

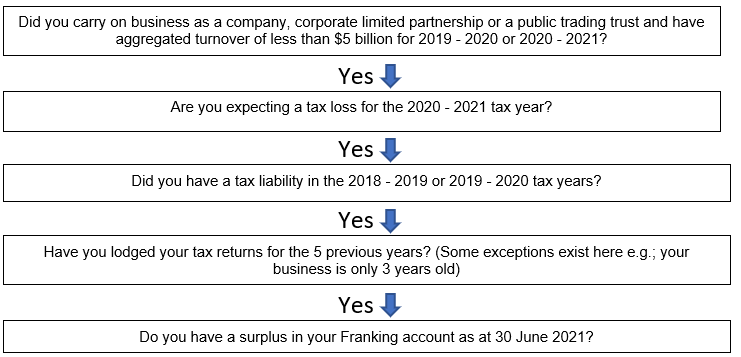

Loss Carry Back – How does it work for the 2020-2021 year?

If you answered yes to all of the above, you may be able to claim the Loss Carry Back Tax offset.

Examples

Set out below are some examples but please make sure you talk to your professional tax advisor to confirm your numbers. especially around any exempt income and the balance of your franking account.

|

Company A |

Company B | Company C | ||

| 1 | Aggregate Revenue | $1 million | $1 million | $1 million |

| 2 | 2020 – 2021 expected tax loss | $50,000 | $100,000 | $200,000 |

| 3 | Taxable Income 2019-2020 | $100,000 | $100,000 | $100,000 |

| 4 | Exempt Income in 2019-2020 | $0 | $0 | $20,000 |

| 5 | Tax rate 2020 – 2021 | 26% | 26% | 26% |

| 6 | Maximum Possible tax offset being (lessor of 2 or 3 less 4) *5 | $13,000 | $26,000 | $20,800 |

| 7 | Franking Account Balance 30 June 2021 | $35,000 | $20,000 | $35,000 |

| 8 | Claimable tax offset (lessor of 6 or 7) | $13,000 | $20,000 | $20,800 |

If you want some help to understand your business finances, contact me below.

If you like this, why not share this with a friend, simply click on one of the icons to the left or below

[simple-social-share]

Contact Wayne Wanders for your FREE Business Survival Session

To ensure I help your business specifically, the best approach I have found is to have an obligation free session with you. In this session we will review your current business in a factual and objective manner, to better understand the challenges that you face. And this session does not need to be face to face. At the end of this session, you will have multiple ideas on how your business can survive and thrive in these uncertain times. Simply fill in the contact form below or email me at wayne@aRealCFO.com.au or call me on 0412 227 052 to organise one of these obligation free sessions.

To get help you successfully navigate your way through your financial challenges so your business can survive and thrive in these uncertain times, simply use the contact form on the left to email Wayne or call him on 0412 227 052.

We promise to keep your email address safe.

Let Wayne Wanders, a fully qualified and experienced CFO, help you successfully navigate your way through your financial challenges so your business can survive and thrive in these uncertain times. Wayne Wanders, A Real CFO wayne@aRealCFO.com.au

If you like this, why not share this with a friend, simply click on one of the icons to the left or below