2022 Tax Tips – Loss Carry Back

One of the measures the Federal Government announced to help businesses during COVID was the Loss Carry Back Tax offset.

Normally if you have a tax loss, this can be only offset against future taxable income.

But this Loss Carry Back Tax offset allows eligible business who have experienced a tax loss in the 2021-2022 tax year, to offset this against taxable income in previous selected years. This may then result in a cash refund of tax paid in previous years, or a reduction in the debt you owe the Australian Taxation Office (ATO).

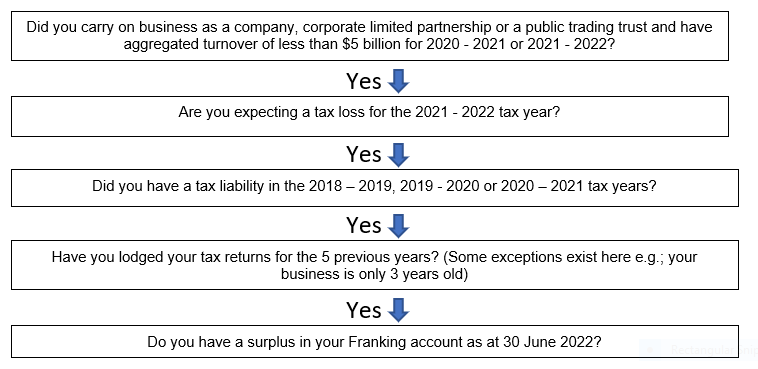

Loss Carry Back – How does it work for the 2021-2022 year?

If you answered yes to all of the above, you may be able to claim the Loss Carry Back Tax offset.

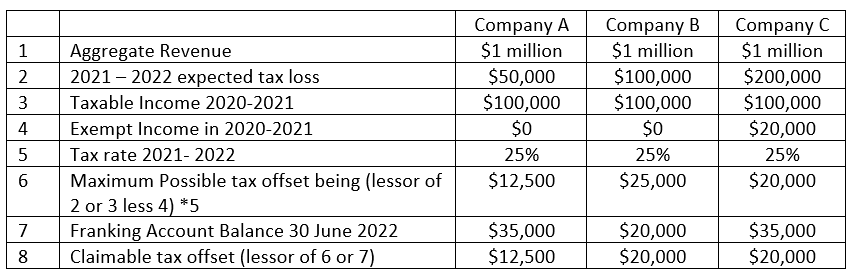

Examples

Set out below are some examples but please make sure you talk to your professional tax advisor to confirm your numbers. especially around any exempt income and the balance of your franking account.

If you want some help to understand your business finances, contact me below.

Contact Wayne Wanders for your FREE Business Survival Session