NSW Covid-19 Business Support Grants

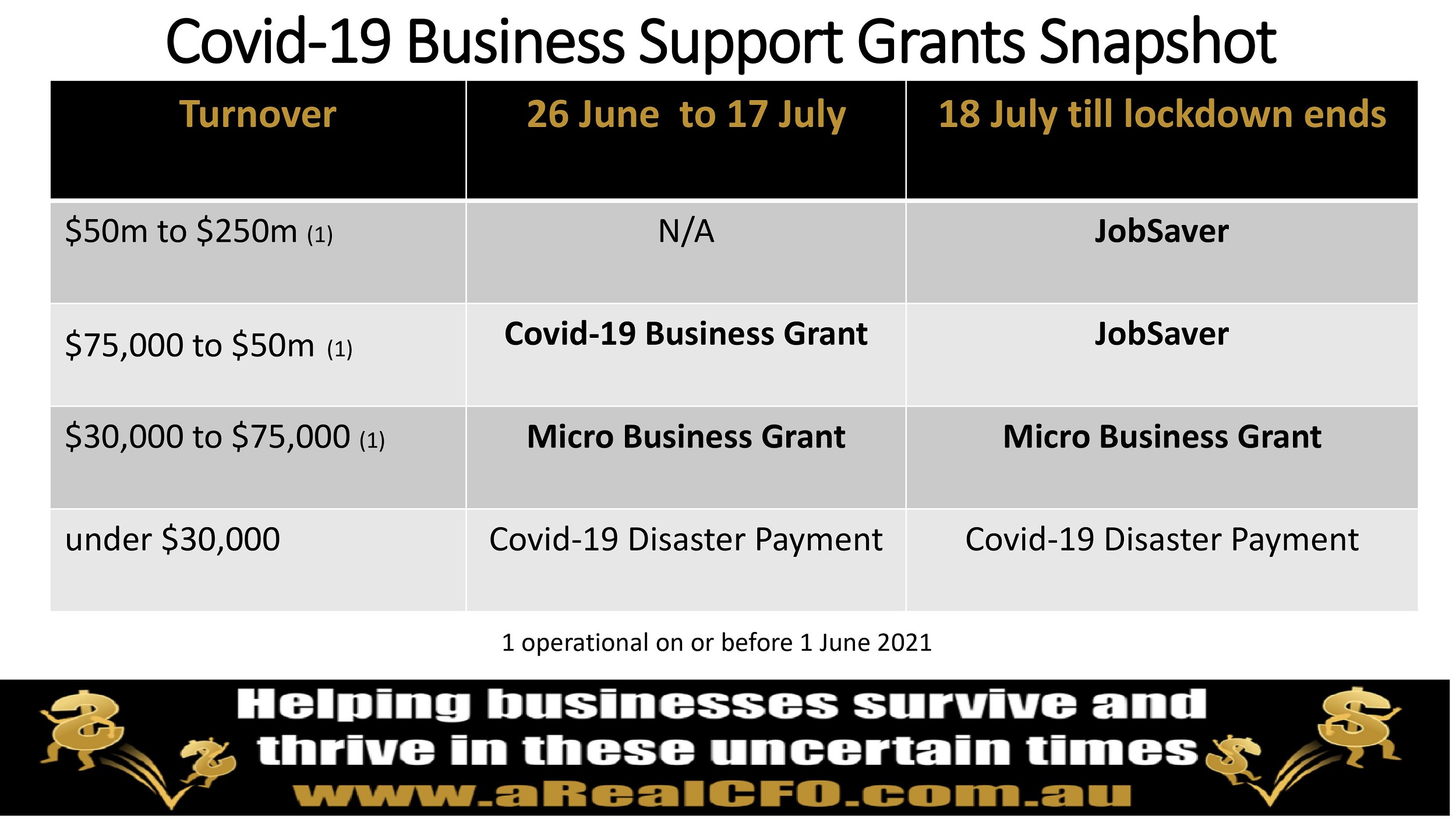

If you are confused about the NSW Covid-19 Business Support Grants, don’t worry you are not alone.

Here is my understanding of the NSW Covid-19 Business Support Grants as at 17 August 2021. I will update this when the rules are changed. Note your business may be eligible under multiple options below.

Business has revenue over $75,000, and total annual Australia wages of less than $10m – Covid 19 Business Grant

Note your business must be registered for GST on or before 1 June 2021.

The grant amount depends on the decline in revenue your business experiences. This is determined by comparing your revenue in the two weeks in the period 26 June to 17 July 2021 compared to:

- the same period in 2019, or

- the same period in 2020, or

- the 2-week period immediately before the Greater Sydney lockdown commenced (12 June to 25 June 2021)

The tax free grant is:

- $7,500 payment for a decline of 30% or more in revenue.

- $10,000 for a decline of 50% or more or more in revenue.

- $15,000 for a decline of 70% or more or more in revenue.

This is a once off payment designed to cover the first 3 weeks of lockdown.

To learn more about the Covid-19 Business Grant click here.

Business has revenue between $75,000 and $50 million – JobSaver

Note your business must be operational on 1 June 2021. And you can also be eligible for the Covid 19 Business Grant and get JobSaver.

From 18 July 2021 you may be entitled to a tax free rebate of 40 percent of your weekly wages. The minimum is $1,500 per week up to a maximum of $100,000.

To be eligible, your revenue must be have experienced a decline in turnover of 30% or more due to the Public Health Orders over a minimum 2-week period in the current Sydney lockdowns, compared to

-

- the same period in 2019, or

- the same period in 2020, or

- the 2-week period immediately before the Greater Sydney lockdown commenced (12 June to 25 June 2021).

And you must maintain your full time, part time and long term casual staffing level as of 13 July 2021.

If you don’t employ staff, the payment will be set at $1,000 per week from 18 July 2021.

Note it is conceivable you get no money for the period pre 18 July 2021 (Australian wages above $10 million) and then get this support.

To learn more about this grant click here.

Business has revenue between $30,000 and $75,000 – Micro Business Grant

Note your business be operational on 1 June 2021. Note if you apply for the Covid 19 Business Grant, JobSaver or the Commonwealth Covid Disaster Payment you are not eligible for this grant.

A fortnightly grant of $1,500 during the lockdown to all these businesses who have experienced a decline in turnover of 30% or more due to the Public Health Orders over a minimum 2-week period from 26 June 2021 when the lockdown ends (currently 28 August 2021) compared to

-

- the same period in 2019, or

- the same period in 2020, or

- the 2-week period immediately before the Greater Sydney lockdown commenced (12 June to 25 June 2021).

To learn more about this grant click here.

Business has total annual Australian payroll of $1.2 million and $10 million

A 25 percent reduction in payroll tax if the business experiences a decline in turnover of 30 per cent.

If your business is in the accommodation sector

In addition to the Covid 19 business grant, JobSaver, COVID-19 Micro Business Grants, you may be eligible for accommodation provider support payments If your business lost room nights between 25 June and 11 July 2021. Click here to learn more

More information about the NSW Covid-19 Business Support Grants

For the Covid-19 Business Grant click here..

For JobSaver click here.

For the Micro Business Grant click here.

For more information about the Accommodation Provider Support Payments click here.

Also, make sure your business address is correct in the Australian Business Register and you have a business profile on your MyServiceNSW account

If you want a confidential discussion on your business situation, or help with these grants contact me below

Contact Wayne Wanders for your FREE Business Survival Session

To ensure I help your business specifically, the best approach I have found is to have an obligation free session with you. In this session we will review your current business in a factual and objective manner, to better understand the challenges that you face. And this session does not need to be face to face.

At the end of this session, you will have multiple ideas on how your business can survive and thrive in these uncertain times.

Simply fill in the contact form below or email me at wayne@aRealCFO.com.au or call me on 0412 227 052 to organise one of these obligation free sessions.

To get help you successfully navigate your way through your financial challenges so your business can survive and thrive in these uncertain times, simply use the contact form on the left to email Wayne or call him on 0412 227 052.

Let Wayne Wanders, a fully qualified and experienced CFO, help you successfully navigate your way through your financial challenges so your business can survive and thrive in these uncertain times.

Wayne Wanders, A Real CFO

wayne@aRealCFO.com.au