NSW Event Saver

If you are an organiser of an event in the current world we live in, one of your biggest concerns is the financial cost to you, if your event is significantly disrupted or even cancelled due to Public Health Orders.

The NSW Government has recognised that the risk of this financial cost may mean that you don’t actually organise the event in the first place.

So they have put in place what I effectively call a pandemic insurance scheme available to Eligible Applicants who are organising Eligible Events from 15 December 2021 up to and including 31 December 2022. The Event Saver is intended to contribute towards eligible unrecoverable costs incurred by organisers of affected events. Note is does not compensate event organisers for loss of revenue or loss of profit.

Eligible Applicant

To be an Eligible Applicant, you must:

- be an Australian Entity.

- be planning to hold an Eligible Event between 15 December 2021 and 31 December 2022.

- hold cancellation insurance for the Eligible Event (excluding pandemic coverage).

- have a risk management and COVID-19 Safety Plan for the Eligible Event.

- provide evidence that the company is solvent at the time of making an application.

- agree to abide by the Event Saver Guidelines.

You are not an eligible applicant if you are the organisers and / or promoters of professional sporting events or a Government entity and/or entities that are substantially funded by State, Federal or Local Government.

Eligible Event

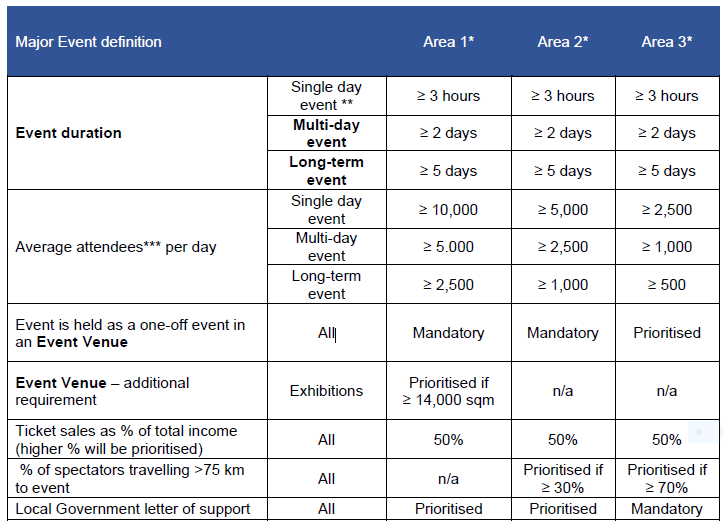

Is an event that is ticketed and with the attributes described below.

* Area refers to the Local Government Area (LGA) the event is held in. In general terms Area 1 is Sydney LGAs. Area 2 is Blue Mountains, Central Coast, Kiama and Wollongong. Area 3 is all other NSW LGAs.

The Event Venue means the Eligible Events needs to be held either on a site specifically modified for the event – that is, staging constructed specifically for the event, or at an established venue where they are not the resident production company or regularly perform at the venue.

Applying for Event Saver

Applying for Event Saver is a 2 step process.

Step 1 is to submit an Expression of Interest (EOI) which will then check to see if you and your event are eligible. This process will also set out what the government calls the total agreed base amount which is used to determine how much you may be able to claim. Note you need a separate EOI for each event.

Step 2 is the actual claim, if your EOI is accepted, and your eligible event has been significantly impacted by a public health order. Note the actual claim amount, up to a maximum of $10m per event, will depend on when the event is disrupted by the public health order.

Next Steps

If you are planning to hold an eligible event in NSW, it is recommended that you lodge your expression of interest ASAP.

If your event is being held after 30 April 2022, you need to lodge your expression of interest at least 90 days before the event and no later than 30 September 2022.

To learn more about Event Saver and to get the full guidelines click here

To register your expression of interest for Event Saver, click here

If you want a confidential discussion on your business situation, or help with this grant contact me below

Contact Wayne Wanders for your FREE Business Survival Session

To ensure I help your business specifically, the best approach I have found is to have an obligation free session with you. In this session we will review your current business in a factual and objective manner, to better understand the challenges that you face. And this session does not need to be face to face.

At the end of this session, you will have multiple ideas on how your business can survive and thrive in these uncertain times.

Simply fill in the contact form below or email me at wayne@aRealCFO.com.au or call me on 0412 227 052 to organise one of these obligation free sessions.

To get help you successfully navigate your way through your financial challenges so your business can survive and thrive in these uncertain times, simply use the contact form on the left to email Wayne or call him on 0412 227 052.

Let Wayne Wanders, a fully qualified and experienced CFO, help you successfully navigate your way through your financial challenges so your business can survive and thrive in these uncertain times.

Wayne Wanders, A Real CFO

wayne@aRealCFO.com.au