Applications are open for the 2023 – 2024 Export Market Development Grant (2023 – 2024 EMDG)

The 2023 – 2024 Export Market Development Grant (2023 – 2024 EMDG) provides funding for exporters with revenue below $20 million.

2023 – 2024 EMDG Program itself

The 2023 – 2024 EMDG Program is an eligibility based program, which means if you are eligible, and you incur appropriate expenses, you will receive a grant agreement to cover money you expect to spend in future periods.

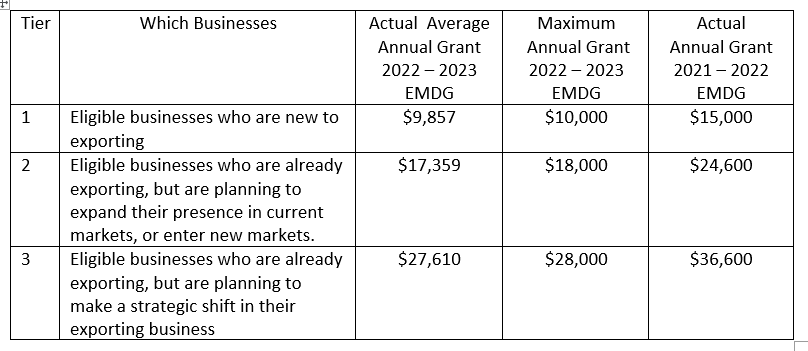

But, there is a limit to how much money is available under the program and the grant amount you be offered in your grant agreement depends on how many applications there are each year. For the 2022 – 2023 program the amounts for each tier were:

At the end of each year, you prepare a declaration showing how much you spent on eligible expenditure in that year. Providing you have spent at least double the grant amount in the grant agreement, you will receive the amount in the grant agreement.

For example if you are a Tier 1 exporter and applied under the 2022 – 2023 EMDG, and you spent $25,000 on eligible expenditure, you will receive a maximum of $10,000. If you only spent $15,000, you will only receive $7,500 (being 50% of your actual spend) out of the $10,000 in the grant agreement.

Note previously grant agreements were multi year. Now they are only for 1 year and it is unclear whether you need to apply for new grant for the 2024 – 2025 year or will be offered an extension.

Business Eligibility for the 2023 – 2024 EMDG

The key eligibility requirements is that the business:

- has an ABN (and this includes sole traders, partnerships and trusts),

- has revenue or turnover of less than $20 million for the year ended 30 June 2022

- is exporting eligible products of substantially Australian origin to overseas countries other than New Zealand.

- For Tier 1 you must be ready to export

- For Tier 2 and 3, you must show you are expanding your marketing activities. This must be shown in a plan to market and must be able to be demonstrated if required.

- For Tier 3 grant, you also need to show in your plan to market that you are making a strategic shift in your marketing or promotional activities. A strategic shift is a change in your business strategy that supports: expanding your marketing or promotional activities to target a new export market in a new country, and/or expanding your marketing or promotional activities to support a substantive change of your eligible product, to be exported to a new market in a new country, or an existing export market.

- Are up to date with tax lodgements

- Have provided a plan to market

Note you can receive up to 8 years of grants so you can apply again.

What are Eligible Products under the 2023 – 2024 EMDG

To be an eligible product, your product(s) must be of substantially Australian origin and can be goods, services, events, intellectual property, know-how and software.

Services include tourism services within Australia provided to foreign persons. Non tourism services can include services provided in Australia as long as certain conditions are met and the services are not specifically excluded.

Events can include online events if held by an Australian business.

For software the work to develop the software needs to be substantially done in Australia.

Remember, getting a foreign person or business to spend money in Australia may qualify as an eligible product.

There are some specifically excluded services such as migration, unlawful services.

What Eligible Expenses can you get funding for

Eligible Expenses are those expenses incurred in respect of a promotional activity undertaken for the purposes of marketing an eligible product in a foreign country (other than NZ), or training activities to develop skills in such marketing.

Eligible promotional activities include:

- Maintaining representative in foreign country.

- Short trips to foreign countries (maximum claim of 21 days per trip).

- Payments to consultants to research into the market in the foreign country for the eligible product; or undertake promotional activities to market the eligible product in the foreign country.

- Short trips in Australia in order to undertake activities that relate to marketing the eligible product to potential foreign buyers of the eligible product (maximum claim of 21 days per trip).

- Seeking the granting, registration or extension of intellectual property rights of your eligible product in a foreign country. Such as payments to patent and trademark attorneys and to relevant government trademark and patent offices.

- Foreign Buyer Visits.

- Promotional and advertising material.

Excluded Expenses includes:

- Capital expenses

- Expenses to solicit sponsorship for an event

- Staff remuneration in respect of someone ordinarily employed in Australia by the business.

- Any sort of remuneration or remuneration-like expenses are not eligible expenses if they are made by reference to sales or other commercial transactions in relation to the eligible product such as salaries, retainers, fees, discounts, or credits.

The 2023 – 2024 EMDG Process

The process for receiving a grant will be as follows:

- You apply for a grant before you spend money on promotional activities. Note this grant is not a competitive grant. You don’t need to “beat” other applicants, you just need to meet all the eligibility rules and spend the money for eligible purposes.

- Grant applications close 4.00 pm AEST, Friday 14 April 2023.

- Once all applications have been assessed, Austrade offers a grant agreement to each eligible applicant for the funds available for the 2023 – 2024 year.

- You enter into a grant agreement with Austrade. You then undertake your promotional activities as agreed in the grant agreement.

- You request milestone payments in accordance with your grant agreement. This will involve you providing proof that the money was spend on eligible expenses.

- Your grant agreement will set out when your milestone payments should be made and what you need to do in order to receive these payments.

How to Apply for the 2023 – 2024 EMDG

Click here to go to learn more about the 2023 – 2024 EMDG Program

Click here to apply.

Just remember that applications close 4.00 pm AEST, Friday 14 April 2023 and if you don’t apply by then you will not get a second chance to apply in respect of the 2023 – 2024 year. You will need to wait until sometime in March or April 2024 to apply for the 2024 – 2025 year.

If you need help with this please reach out

Wayne Wanders is an experienced Business Advisor skilled in analysing business financial performance and cash flow. Wayne may also be able to assist you in preparing your grant application. Contact Wayne below for a free no obligation session.

Also, if you want some more information on grants, contact me below

Contact Wayne Wanders for your FREE Business Survival Session

At the end of this session, you will have multiple ideas on how your business can survive and thrive in these uncertain times.

Simply fill in the contact form below or email me at wayne@aRealCFO.com.au or call me on 0412 227 052 to organise one of these obligation free sessions.

Wayne Wanders, A Real CFO

wayne@aRealCFO.com.au

April 2021 Jobs Data

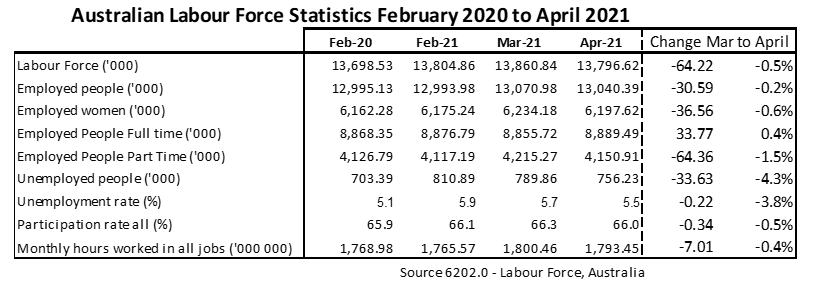

The April 2021 Jobs Data released today is the first jobs data after the end of JobKeeper.

At one level it looks like the end of JobKeeper did not have a big impact as the unemployment rate fell from 5.7% in March to 5.5% in April.

But if you look behind the numbers you see a different story.

Firstly, the number of employed people fell by nearly 31,000 between March and April. Women suffered the worst here, with the number of employed women falling by over 36,000. From a state perspective, the biggest job losses were in NSW which had nearly 37,000 less people working in April compared to March.

Secondly, the total labour force fell by over 64,000 people between March and April. This means that over 64,000 people stopped working, or stopped looking for work in April. For people who were unemployed in March and stopped looking for work in April, they are no longer counted as unemployed.

Thirdly, whilst the number of unemployed people of nearly 34,000 people in April, this can be reasonably attributed to less people looking for work and not actual job creation (especially as there are nearly 31,000 less people working in April).

My conclusion

I think the end of JobKeeper in March, has meant a lot of people gave up hope of getting work in April.

If you want a confidential discussion on your business situation, contact me below

Contact Wayne Wanders for your FREE Business Survival Session

At the end of this session, you will have multiple ideas on how your business can survive and thrive in these uncertain times.

Simply fill in the contact form below or email me at wayne@aRealCFO.com.au or call me on 0412 227 052 to organise one of these obligation free sessions.

Wayne Wanders, A Real CFO

wayne@aRealCFO.com.au