Understanding Preference Shares and the possible sting in the tail for founders

When you hear investors talk about preference shares, it can sound technical. But the way these shares are structured often determines how much money founders really receive when the business is sold.

Founders tend to focus on valuation and ownership percentage. Those matter. But preference rights, especially liquidation preferences, matter even more for what ends up in your pocket on exit.

What Are Preference Shares?

Preference shares are a class of equity that grant holders special rights ahead of ordinary shareholders. These rights typically include:

- Priority on payouts in the event of a sale, liquidation, or wind-up

- Return of invested capital before common shareholders

- Sometimes participation in additional proceeds after their preference is paid

Investors usually receive preference shares. Founders and employees typically hold ordinary shares. This means investors get paid before you do in many exit scenarios.

Why Preference Shares Matter More Than You Think

Most founders are comfortable agreeing to preference shares during fundraising because they see only the valuation headline. But preference terms create a payout waterfall — a sequential hierarchy of who gets paid and when.

That’s why two companies with the same sale price can produce very different take-home amounts for founders depending on preference terms

The easiest way to understand this is by looking at some examples.

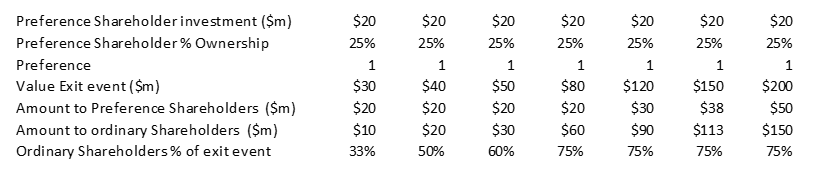

In Company A below, the preference shareholders invest $20m for a 25% share of the business and there is 1x preference.

Company A

If the business ultimate sells for $30m, the preference shareholder get $20m, and the other 75% shareholders get $10m or just 33% of the sale value. If it sells for $50m, preference shareholders still get their $20m, but the 75% other shareholders now get $30m, or 60% of the sale value. It is only when the sale value exceeds $80m do the other shareholders get their 75% of the sale value.

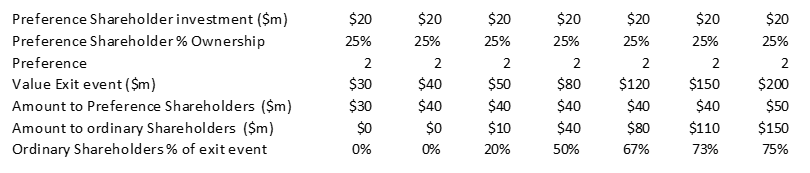

Now let’s look at Company B, where the preference shareholders invest $20m for a 25% share of the business with 2x preference.

Company B

In this case, with a $20m investment by the preference shareholders, the other shareholders in Company B, will not get any return until the sale value exceeds $40m (being $20m investment x 2). Whereas in Company A, the shareholders will start to get some money back if the business is sold for in excess of $20m.

And if the business is widely successful, for example with a $200 million exit, this higher preference in Company B may not be a problem. Both the founders and other earlier shareholders in Company A and Company B get to share $150m.

But if the business is not as successful, and the exit is say, $80 million. The founders and earlier shareholders in company A will split $60 million vs the founders and earlier shareholders in Company B will only split $40 million.

Now what if the businesses are less successful and the exit is $40m. The founders and earlier shareholders in company A will split $20 million vs the founders and earlier shareholders in Company B getting nothing.

In the last 2 cases, same investment, different preference and different outcome for the founders and earlier shareholders

And we have not considered preference stacking in the above example. This is where there are multiple preference shares with some ranking ahead of others. Which complicates this and may make the outcome for the founder even financially worse.

Final Thought

Price and valuation matter, but preference terms determine payouts.

Two startups can sell for the same amount, yet as was shown above founders can walk away with wildly different results simply because of the preference structure.

Understanding preference shares is not academic. It’s financial strategy and should be treated as a core part of your capital-raising playbook.

Contact Wayne on wayne@arealcfo.com.au or 0412 227 052.

Click on the below buttons to access free Resources developed by Wayne Wanders, A Real CFO to help your business scale and grow profitably

Want a confidential discussion on your business situation, help with your grant application or to learn more about my Outsourced CFO Services, simply email me at wayne@aRealCFO.com.au or call me on 0412 227 052