Why JobKeeper will be a failure!

Unfortunately, I am declaring that JobKeeper will be a failure!

One reason why the JobKeeper scheme will be a failure is that it is a reimbursement scheme that will be paid by the ATO monthly in arrears.

In simple English, this means the employer pays the employee in advance and the government reimburses the employer later. The employer has to pay their staff in what the government calls the JobKeeper Scheme “payment period”. The first payment period is 30 March to 2020 to 12 April 2020. The next is 13 to 26 April 2020 etc till 14 to 27 September 2020. People on monthly pays are apportioned into fortnights.

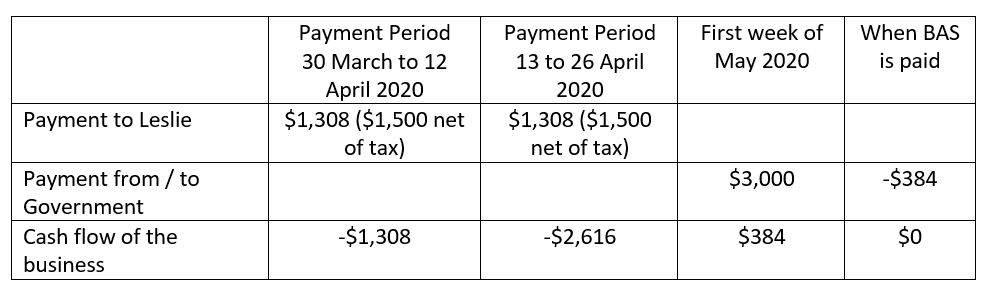

The table below shows how it would work for Leslie if she was paid $1,500 a fortnight before tax.

Over time the employer is not out of pocket, but in the above example, for the month of April they are $2,616 out of pocket for Leslie, till the government pays the money sometime early May. And this would be repeated each month.

Now if they had 10 employees, they would be $26,160 out of pocket.

Now that is all well and good if the employer has cash to fund being $26,160 out of pocket. But what if they did not?

What if Leslie was working full time at a gym, but she was stood down with no pay on March 25, after the government announced that the gyms had to shut to contain the spread of coronavirus. With her last pay date being 27 March.

And, the gym owner has no surplus cash and is not able to pay Leslie (and their other staff) in either of the payment periods in April.

Therefore, the employer is not eligible to include Leslie in their JobKeeper claim, so Leslie will not get any JobKeeper payment.

And here is the really stupid part

The Government specifically acknowledges this issue. In its “JobKeeper Payment – Frequently Asked Questions” they say that if you are in this position, speak to your bank.

Now anyone who has a small business and tried to deal with the banks will know, they only lend money when you don’t need it. So good luck getting a loan from the bank for this.

How many businesses will therefore be automatically excluded from the JobKeeper scheme because they don’t have the cash to pay the employee before they get a re-imbursement?

And this is one of the reasons why I am predicting that JobKeeper will be a failure.

And this is what happens when politicians and bureaucrats, who most likely have never run a business in their life, try and deliver legislation that works in the real world, instead of rarefied air of Canberra.

Contact Wayne Wanders for your FREE Business Survival Session

At the end of this session, you will have multiple ideas on how your business can survive and thrive in these uncertain times.

Simply fill in the contact form below or email me at wayne@aRealCFO.com.au or call me on 0412 227 052 to organise one of these obligation free sessions.

Wayne Wanders, A Real CFO

wayne@aRealCFO.com.au