Business Survival rates

Even before Covid-19 hit, according to data from the ABS, a new business has a:

- 1 in 10 chance of closing in the first year;

- 1 in 5 chance of closing in the first 2 years;

- 1 in 4 chance of closing within 3 years; and a

- 1 in 3 chance of closing within 4 years.

And according to ASIC, in over 50% of these business failures, inadequate cashflow is a significant contributing factor. And these stats will only be worse when the full impact of the Covid-19 shutdowns are seen.

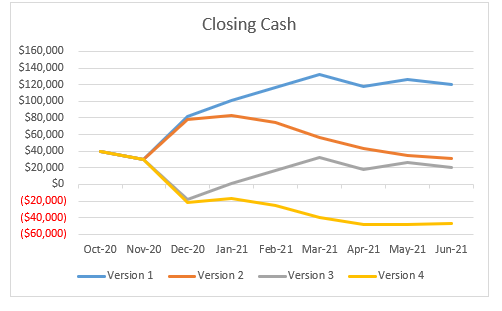

If you don’t want to be one of the failure statistics, you need to know now if your business has adequate cashflow going forward. A cash forecast is a must. And if you are like the business I worked with yesterday, you may need more than 1 (they needed 4 cash forecasts for different possible business outcomes).

And that’s where I can help you. I have developed, reviewed and updated thousands of daily, weekly and monthly cash flow forecasts over the past 20 years. Through the ups and downs including the GFC.

I am happy to spend an hour of my time at no cost to you, to learn more about your business and its challenges. From this I can give you a fixed price quote to develop or review your cash flow forecast so you can increase your business survival rates.

If you want to take up this offer, just contact me below.

Contact Wayne Wanders for your FREE Business Survival Session

At the end of this session, you will have multiple ideas on how your business can survive and thrive in these uncertain times.

Simply fill in the contact form below or email me at wayne@aRealCFO.com.au or call me on 0412 227 052 to organise one of these obligation free sessions.

Wayne Wanders, A Real CFO

wayne@aRealCFO.com.au