How my Bucket Accounting System can help you profitably grow your business

The other day I spoke about growing your business profitably, is that the money, time and effort you spend to acquire a new customer, is less than the money you make from that customer. If you are not doing this, you are growing broke.

What information do you need?

In order to determine if you are growing profitably or growing broke you need to understand the lifetime value of a customer and the acquisition costs to get that customer.

Unfortunately, I see very few accounting systems set up to provide this information. For example, most users of small business accounting software such as Xero or MYOB, use the standard accounts to record costs. These start at A such as accounting fees and end at W, X, Y or Z such as wages.

But this does not tell you what business activities you are actually doing. Let’s take wages for example. The accounting system typically has one account for wages. But in this account, you will have the costs for:

- People selling your product and service such as sales people (acquisition costs).

- People delivering the product or service such as warehouse staff (direct cost of sales).

- People supporting your customers such as customer service or account managers (retention costs).

- People supporting the business as a whole such as the bookkeeper (overheads).

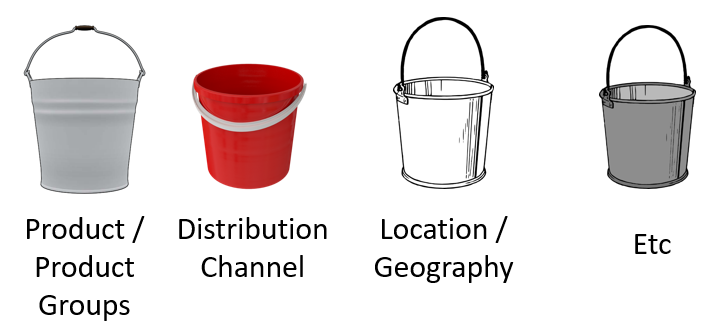

What you need to start to do is stop thinking in alphabetical order and start thinking in buckets. What I have called my Bucket Accounting System.

How do you use my Bucket Accounting System?

Step 1

The starting point for your buckets is the core way you review your business. This could be by product or product group, by distribution channel (for example, retail or wholesale), by geographical area or what ever way you review your business.

Or if you use multiple of these, make one a sub bucket of the other.

Then make sure all revenue and costs are recorded in the right bucket.

If you do this for the core parts of your business, you now have in effect a profit and loss for each part of your business.

The benefit of this is that you can now start to see where you are making (or not making) your money. Your most profitable segments and your least profitable segments. And it would make sense to:

- grow your most profitable segments; and,

- work out how to improve the profitability of your least profitable segments before you even consider growing them.

- Look at your least profitable segments and consider shutting these down.

Step 2

Now this mini profit and loss for each segment still does not allow you to determine if you are growing profitably or growing broke within that business segment. Typically, I would split each of these buckets into the following sub buckets:

Customer Acquisition includes all the costs you incur to acquire a customer. This is not just marketing but could include sales people’s salary, commissions you pay to someone for referring the customer.

Direct costs of sales includes the direct cost of selling / delivering something. For example, you resell something, the cost of buying, storing and delivering this would go here. If you have people delivering the service, the cost of those people delivering the service.

Customer Retention includes the costs you incur to retain a customer. It could be customer service / care. It could be account management.

Overheads are all other administration and overhead costs.

Step 3

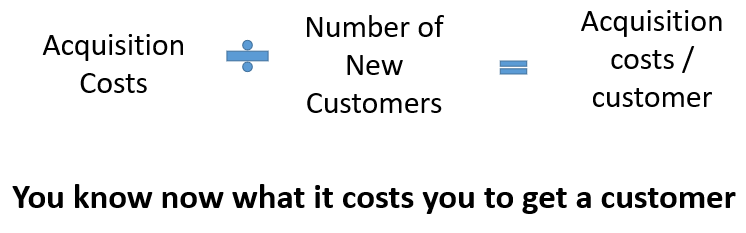

Once we have these costs in the sub buckets, we can start to calculate some Key Performance Indicators (KPIs) to see if the business is actually growing profitably.

Step 3a

The first KPI you want to work out is the acquisition cost per customer. You simply add up all the acquisition costs in the bucket for the month and divide by the number of new customers for the month.

You now know what it costs you to get a customer.

Step 3b

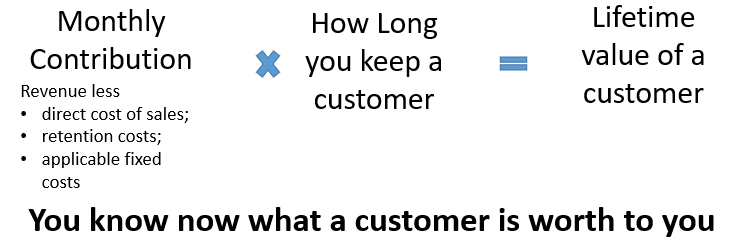

The second KPI you want to work out is the monthly contribution by customer.

The monthly contribution is simply monthly revenue less direct cost of sales; an appropriate share of retention costs; an appropriate share of applicable fixed costs. And to get the monthly contribution by customer, simply divide by the total number of customers.

Step 3c

The next KPI to understand is how long you keep your customer. Is it for a month, six months, a year?

Step 3d

Your next KPI is the lifetime value of a customer. Being the monthly contribution x the number of months on average they remain a customer.

You know now what a customer is worth to you.

Step 4

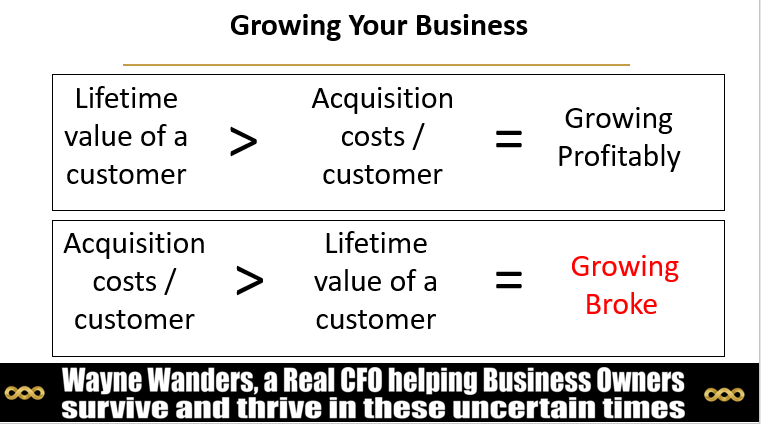

Now you can use my Bucket Accounting System to work out if you are profitably growing your business.

.

If you are growing profitably, the lifetime value of your customer is more than the acquisition cost per customer.

If the acquisition cost per customer is more than the lifetime value of the customer, you are growing broke and you need to change your strategy. Steps you can take include:

- Get more revenue from the customer each month

- Increase the time the customer stays with you

- Reduce the costs to deliver the product or service

- Reduce the costs to acquire the customer

- Do all or several of these

And that’s how my Bucket Accounting System helps you avoid growing broke and instead, grow profitably.

If you want help working out what your buckets should be, contact me below

Contact Wayne Wanders for your FREE Business Survival Session