Are you aware that changes to statutory demands could increase the risk that a creditor commences action to close your business?

What is a Statutory Demand?

Statutory demands are documents issued by a creditor seeking repayment of moneys owed to them.

If the company within the required time frame after the demand is served, fails to:

- pay the debt;

- come to a suitable arrangement with the creditor; or,

- make an application to set the demand aside within that time period,

then the company is presumed to be insolvent.

Once there is a presumption of insolvency, then it is open to the creditor to commence proceedings to wind up the company.

The Federal Government had put in some temporary rule changes to statutory demands as part of its response to Covid-19.

But these temporary rule changes are ending on 31 December 2020, making it easier for creditors to issue a statutory demand.

From 31 December 2020, a creditor, owed just $2,000 could get a statutory demand issued, and you have 21 days to either pay the debt, come to an agreement with the creditor so they withdraw the statutory demand, or incur legal costs to defend the creditors claim.

If you are suffering from financial distress, what do you do before you get the statutory demand?

If you are not worried about the impact on your staff, suppliers and customers, you can simply put the business into liquidation.

If you potentially want to lose your house and other assets, just do nothing.

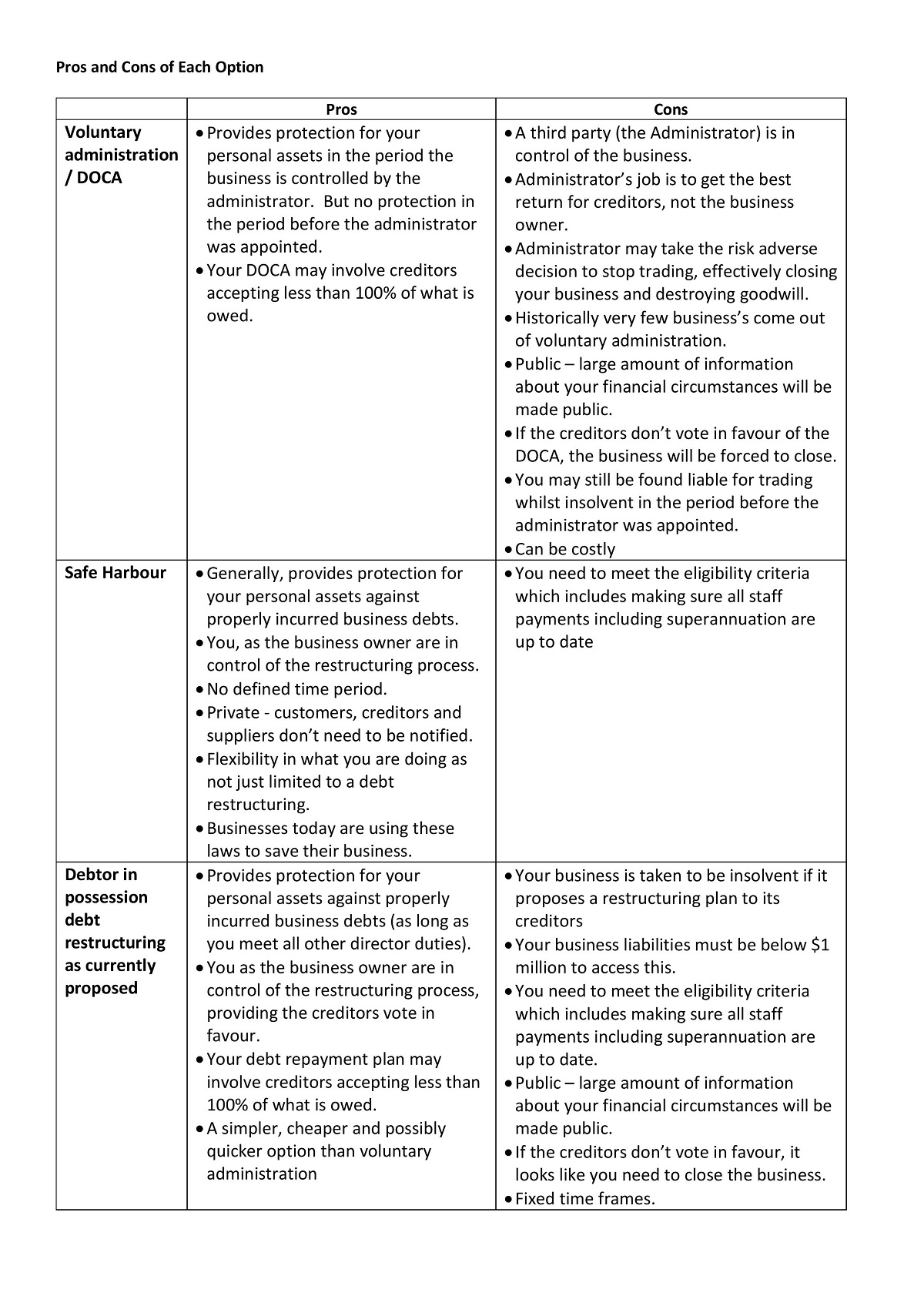

But if you want to save your business, you need to look at other options. The 3 key options are:

- Voluntary administration / DOCA

- Safe Harbour

- Debtor in possession debt restructure

The pros and cons of these are below.

And we are happy to come and have an obligation free chat with you to see if utilising the Safe Harbour laws are the best option for your business.

Contact Wayne Wanders for to see if you can access the Safe Harbour Laws

At the end of this session, you will have some clarity around whether you can access the Safe Harbour Laws..

Simply fill in the contact form below or email me at wayne@aRealCFO.com.au or call me on 0412 227 052 to organise one of these obligation free sessions.

Wayne Wanders, A Real CFO

wayne@aRealCFO.com.au