EMDG Update October 2023

There is bad news and hopefully some good news about the Export Market Development Grant (EMDG) this week

First the bad news. It appears that there will be no EMDG grants available for export development expenditure in the 2024-2025 year unless you have this as part of a previous EMDG grant agreement.

Now hopefully the good news, Austrade is conducting a review of the EMDG.

For me the current format of the EMDG (implemented from 1 July 2021 onwards) has some positives but has one large negative.

The positives are around the fact that the successful applicant has a grant agreement upfront. This means that as long as they spend the money on eligible items, they know how much money they will get back. For example, if they successfully applied for Tier 1 for 2022 – 2023 they would have been given a grant agreement of $15,000. They know as long as they spend over $30,000 on eligible expenses, they will get $15,000 back and can plan accordingly.

To me the negative of the current program is that for businesses who are planning on spending large amounts of money to develop their export markets, the EMDG is becoming less and less of an attraction.

For example, I know if a business in the 2022 – 2023 year who spent over $300,000 on eligible expenses and received a grant of $15,000. Less than 5% of their spend. And for the 2023-2024 year, they will continue to spend this amount of money (if not more) and only have a grant agreement of $12,000. Compare this to another business who spent just over $14,000 in the 2022 – 2023 year and got back just over $7,000 or 50% of their spend.

And now let’s compare to the previous system and to another business I know that in 2013 – 2014 spent over $160,000 on eligible expenses and received a EMDG grant of over $50,000.

In my personal opinion the current system is great for the business who wants to start putting their toes in the water overseas and wants some certainty about how much they can get under the grant.

For a business who are seriously committed to expanding overseas, the value of the current EMDG is becoming less and less. As a result, this will have less and less an impact on how business start to structure their overseas operations. With the likely result, less and less of this export income will be taxable in Australia.

Wayne Wanders is an experienced Business Advisor skilled in analysing business financial performance and cash flow. Wayne may also be able to assist you in preparing your grant application. Contact Wayne below for a free no obligation session.

Also, if you want some more information on grants, contact me below

Contact Wayne Wanders for your FREE Business Survival Session

At the end of this session, you will have multiple ideas on how your business can survive and thrive in these uncertain times.

Simply fill in the contact form below or email me at wayne@aRealCFO.com.au or call me on 0412 227 052 to organise one of these obligation free sessions.

Wayne Wanders, A Real CFO

wayne@aRealCFO.com.au

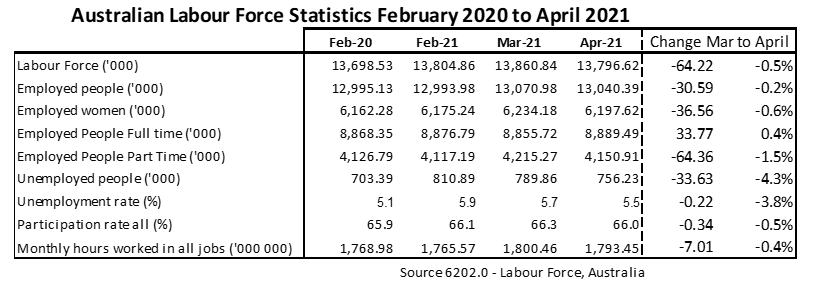

April 2021 Jobs Data

The April 2021 Jobs Data released today is the first jobs data after the end of JobKeeper.

At one level it looks like the end of JobKeeper did not have a big impact as the unemployment rate fell from 5.7% in March to 5.5% in April.

But if you look behind the numbers you see a different story.

Firstly, the number of employed people fell by nearly 31,000 between March and April. Women suffered the worst here, with the number of employed women falling by over 36,000. From a state perspective, the biggest job losses were in NSW which had nearly 37,000 less people working in April compared to March.

Secondly, the total labour force fell by over 64,000 people between March and April. This means that over 64,000 people stopped working, or stopped looking for work in April. For people who were unemployed in March and stopped looking for work in April, they are no longer counted as unemployed.

Thirdly, whilst the number of unemployed people of nearly 34,000 people in April, this can be reasonably attributed to less people looking for work and not actual job creation (especially as there are nearly 31,000 less people working in April).

My conclusion

I think the end of JobKeeper in March, has meant a lot of people gave up hope of getting work in April.

If you want a confidential discussion on your business situation, contact me below

Contact Wayne Wanders for your FREE Business Survival Session

At the end of this session, you will have multiple ideas on how your business can survive and thrive in these uncertain times.

Simply fill in the contact form below or email me at wayne@aRealCFO.com.au or call me on 0412 227 052 to organise one of these obligation free sessions.

Wayne Wanders, A Real CFO

wayne@aRealCFO.com.au