Equity Hybrids

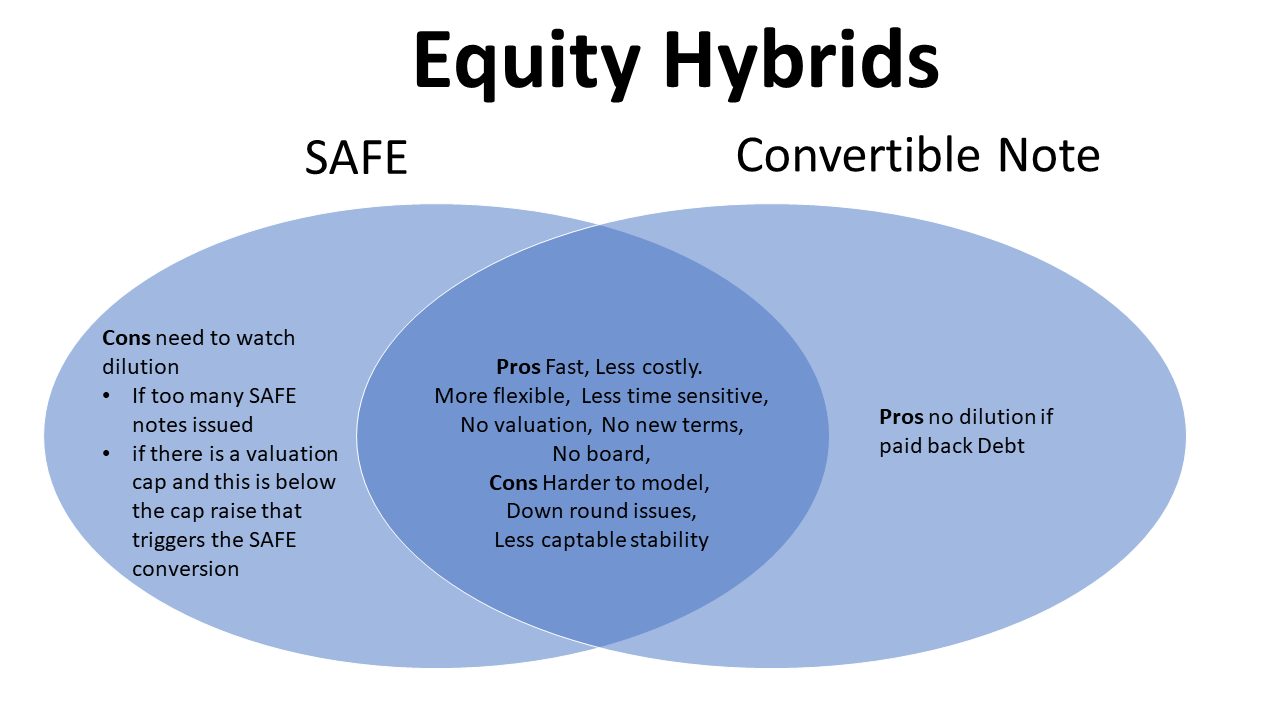

Today I want to talk about equity hybrids, specifically SAFE (Simple Agreement for Future Equity) and convertible notes.

These funding tools are commonly used by early-stage and growing businesses that need capital but want to avoid locking in a valuation too early. While they can be extremely effective, they also come with trade-offs that founders need to understand before using them.

What Are Equity Hybrids?

Equity hybrids sit between debt and equity.

They allow a business to raise capital now, with the equity outcome determined later, usually when a formal capital raise occurs. This can be helpful when a business is still evolving and valuation is difficult to pin down.

The two most common forms are:

- SAFE (Simple Agreement for Future Equity)

- Convertible Notes

While they share similarities, they behave quite differently in practice.

SAFE (Simple Agreement for Future Equity)

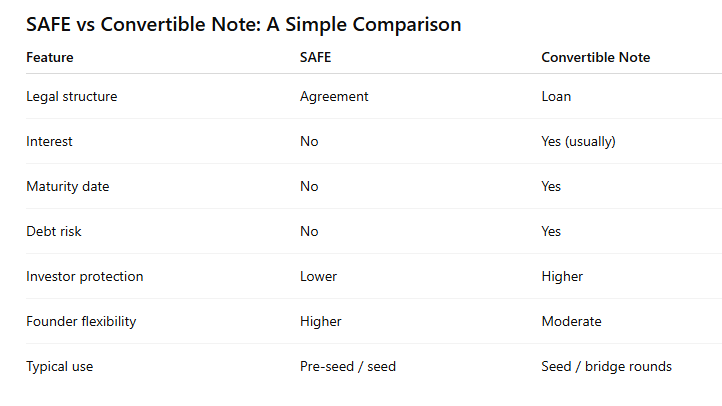

A SAFE is exactly what the name suggests, a simple agreement for future equity.

It allows an investor to provide funding today, with the right to convert that investment into equity at a later date, typically when a formal capital raise occurs.

How it works

A SAFE usually converts to equity at a discount to the share price of a future capital raise, for example:

- 15% discount on a capital raise exceeding $X million

This avoids the need to value the business at a very early stage, which is often difficult and subjective.

Importantly, a SAFE:

- Is not a loan

- Does not attract interest

- Has no maturity date

Key characteristics

- No immediate ownership or voting rights

- Conversion only occurs if a qualifying event happens

- If the business fails before conversion, SAFE holders may receive nothing

Because of this, SAFEs are generally used in pre-seed, seed, or bridge rounds.

Pros of SAFEs

- Fast to implement

- Lower legal cost

- More flexible

- Less time pressure

- No valuation required

- No new shareholder rights or board involvement

Cons of SAFEs

- Harder to model outcomes

- Can create dilution surprises later

- Less cap table stability

- Risk of excessive dilution if too many SAFEs are issued

- Valuation caps can significantly impact ownership if the eventual raise is well above the cap. Read my separate blog on “How to Set the Valuation Cap in a SAFE Note – And Why It Matters” here

Convertible Notes

A convertible note is a short-term debt instrument that can convert into equity at a later date.

Unlike a SAFE, this is a loan — usually with full creditor rights.

How it works

A convertible note:

- Converts to equity at a future funding round

- Often includes a discount (e.g. 15%)

- Usually has a maturity date

- May accrue interest, which is either:

- Paid periodically

- Paid at maturity

- Capitalised into the conversion

If a qualifying capital raise does not occur before maturity, the lender may have the right to request repayment or renegotiate terms.

Convertible notes are often used:

- At early stages when valuation is uncertain

- As bridge financing between equity rounds

- When investors want more protection than a SAFE provides

Key characteristics

- No immediate ownership or voting rights

- If the business fails, noteholders rank as creditors

- More structure and formality than SAFEs

Pros of Convertible Notes

- Fast to implement

- Lower cost than a full equity round

- Flexible structure

- Less time sensitive

- No immediate valuation

- Potentially no dilution if repaid

- No new board or governance requirements

Cons of Convertible Notes

- Harder to model

- Down-round risk

- Less cap table stability

- Creates debt on the balance sheet

Final Thoughts

Equity hybrids can be incredibly effective when used well. They allow founders to raise capital quickly, defer valuation, and maintain momentum during critical growth phases.

However, they are not “set and forget” instruments.

Contact Wayne on wayne@arealcfo.com.au or 0412 227 052.

Click on the below buttons to access free Resources developed by Wayne Wanders, A Real CFO to help your business scale and grow profitably

Want a confidential discussion on your business situation, help with your grant application or to learn more about my Outsourced CFO Services, simply email me at wayne@aRealCFO.com.au or call me on 0412 227 052