ESIC – Tax incentives for early stage investors

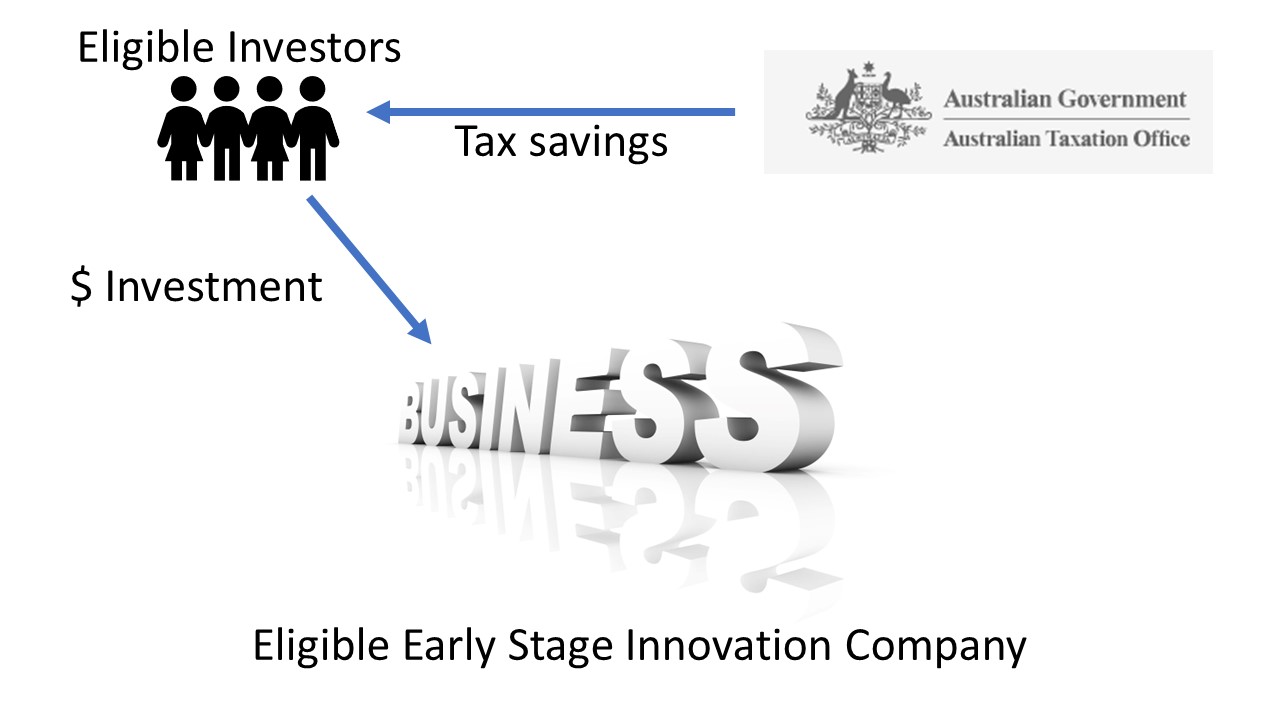

There is a special class of companies, called Early Stage Innovation Companies (ESIC), that are eligible for certain tax incentives that they can pass onto their investors. Making investing in these businesses potentially more attractive than investing in other businesses.

What are the tax incentives?

There are 2 incentives available:

- A non-refundable tax offset equal to 20% of the investment, which arises in the year of the investment. In other words you can use this tax offset to reduce the tax payable on other income, which can be used over several years.

- A modified CGT treatment which includes disregarding the capital gains (and losses) on shares held in an ESIC between 1 and 10 years.

For a sophisticated investor, there is no investment limit but the maximum tax offset is capped at $200,000 on $1m+ investment.

If you are a not a sophisticated investor, there is a maximum investment of $50,000 in any income tax year and a maximum tax offset of $10,000.

How does your business qualify as an ESIC?

Your business will qualify as an ESIC if it is not a foreign company and meets:

- The early stage test; and

- Either the 100-point innovation test; or Principles-based innovation test

Note these tests are conducted at the time of the investment in the business and if the investment is over several periods you will need to retest.

You can self-assess, seek an advisor comfort letter or seek a private ruling from the ATO.

Early stage test

For the early stage part, the company must meet 4 requirements, which are:

- Your company must be incorporated or registered on the Australian Business Register within the last 3 income years; or incorporated within the last 6 income years, must have incurred total expense of $1m or less and across the last 3 income years

- Your company’s (plus any wholly owned subsidiaries) expenses did not exceed $1m in the previous income year

- Your company’s (plus any wholly owned subsidiaries) assessable income did not exceed $200,000 in the previous income year, and

- Your company’s equity interest is not listed in the official list of any stock exchange in Australia or abroad.

100-point innovation test

To qualify for the 100 point innovation test, the company must obtain at least 100 points by meeting certain objective innovation criteria such as whether the company has claimed the research and development tax incentives, participated in an eligible accelerator program, or previously obtained external investment.

This is tested immediately after the relevant shares are issued to the investor (test time).

Principles-based innovation test

There are 5 requirements of the principles-based test. The company:

- must be genuinely focused on developing one or more new or significantly improved innovations for commercialisation.

- has high growth potential

- has the potential to be able to successfully scale up.

- has the potential to address a broader than local market.

- has the potential to be able to develop a competitive advantage for that business.

What investments qualify for the ESIC investments

Apart from the company needing to qualify as an ESIC, for the investor to get the tax incentives, investors must have purchased new equity shares directly from the company.

And the investor can’t:

- be a public company or a wholly owned subsidiary

- invest more than $50,000 in any 1 tax year in 1 or more ESIC’s if not a sophisticated investor test

- be an affiliate of the ESIC at the time the shares are issued

- Acquire shares under an employee share scheme

- immediately after they are issued with the new shares that carry the right to:

- Receive more than 30% of any distribution of income or capital by the company.

- Exercise, or control the exercise of, more than 30% of the total voting power in the company

Learn More

Click here to read the ATO guidelines on ESIC

Wayne Wanders is an experienced Business Advisor and Outsourced CFO who can help to scale and grow your business profitably. Wayne may also be able to assist you in preparing any grant application.

Contact Wayne on wayne@arealcfo.com.au or 0412 227 052.

Click on the below buttons to access free Resources developed by Wayne Wanders, A Real CFO to help your business scale and grow profitably

And Wayne is always posting about new grants, funding options and other resources on LinkedIn that can help your business scale and grow profitably. Click on the below links and connect with Wayne or follow A Real CFO on LinkedIn.

Want a confidential discussion on your business situation, help with your grant application or to learn more about my Outsourced CFO Services, simply email me at wayne@aRealCFO.com.au or call me on 0412 227 052