Funding Stages Explained

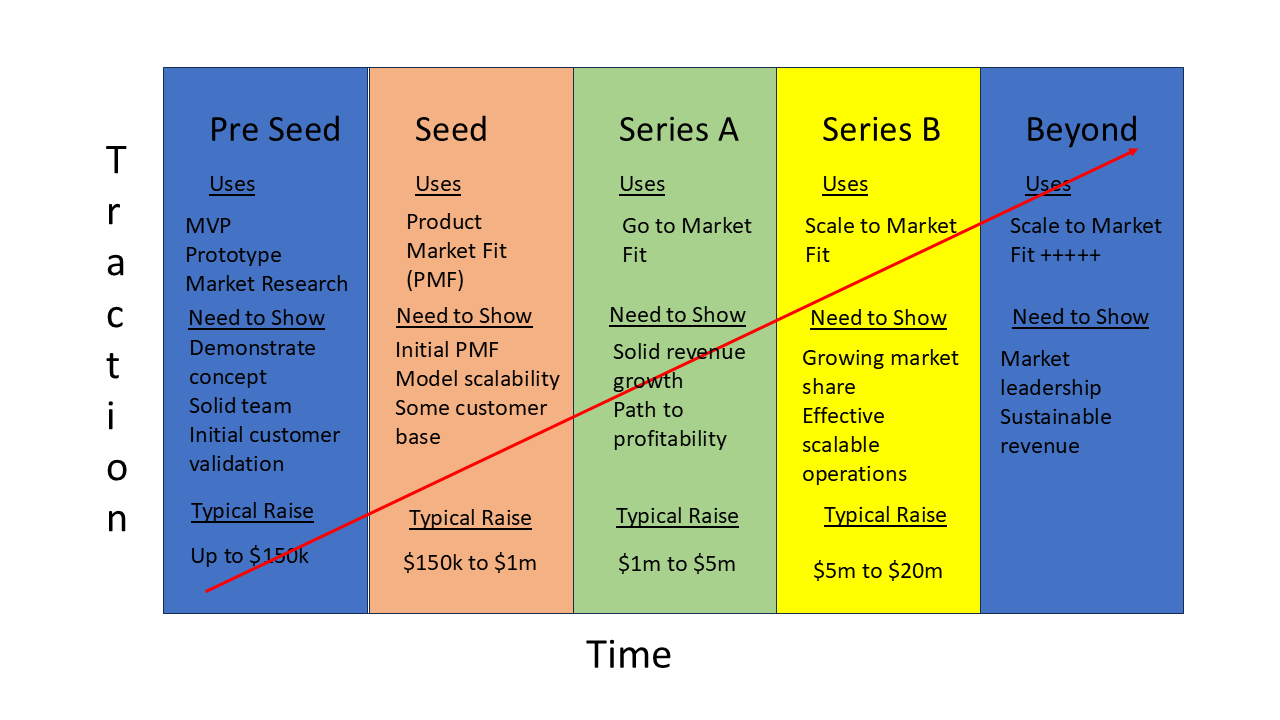

When a founder is trying to grow their business and seek funding from investors, they often hear terms such as seed, series A, series B. For some new to the startup world these terms may be confusing.

To help reduce this confusion, here are the key funding stages explained.

Pre Seed

Pre-seed funding is the earliest stage of funding.

At this stage, founders are working with a very small team (or even by themselves) and are developing a prototype or proof-of-concept. The money to fund a pre-seed stage typically comes from the founders themselves, their family, friends and fans, and maybe an angel investor or an incubator. Founders looking to fund MVP Prototype / Market Research / Initial Traction but pre revenue.

Need to Show: Demonstrate concept; Solid team; Initial customer validation

Typical raise – up to $150k.

Seed

This is the seed that will (hopefully) grow the company. Seed funding is used to take a startup from idea to the first steps. Another way to describe this as the money that helps you determine if you can make customers happy. Product Market Fit (PMF).

Seed funding may be raised from family and friends, angel investors (most common), incubators, and venture capital firms that focus on early-stage startups. A seed round should raise roughly 12–18 months of operating runway.

This is also the endpoint for many startups. If they can’t gain traction before the money runs out, then they’ll fold.

Need to Show: Initial PMF; Model scalability; Some customer base

Typical raise – $150k to $1m.

Series A

Series A funding rounds are typically undertaken after a startup has obtained some product traction and user base, and has demonstrated potential for exponential growth through revenue, KPIs, or other metrics. The founder has to be able to prove that the great idea will make a great company. Another way to describe this as the money that helps you build the factory that produces $Xm in happy customers. The Go to Market Fit.

The money raised in this round often comes from angel investors or VC funds.

Need to Show: Solid revenue growth; Path to profitability

Typical raise – $1m to $5m.

Series B

Series B funding rounds focus on scaling the startup once they have proved their product/market fit. The Scale to Market Fit #1. Capital is used to increase market share, grow the team and continue expansion.

Series B funding often comes from VC funds and often from the same investors who led the previous round. It may also attract investments from later-stage VC funds.

Need to Show: Growing market share; Effective scalable operations

Typical raise – $5m to $20m.

Series C and beyond

Further funding rounds are designed to continue scaling the company, whether by developing new products, making acquisitions, increasing market share, expanding internationally, or preparing the company for exit such as an Initial Public Offering (IPO). The Scale to Market Fit ++++.

Funding rounds Beyond B generally come from large VC funds, private equity firms, and investment funds.

Contact Wayne on wayne@arealcfo.com.au or 0412 227 052.

Click on the below buttons to access free Resources developed by Wayne Wanders, A Real CFO to help your business scale and grow profitably

Want a confidential discussion on your business situation, help with your grant application or to learn more about my Outsourced CFO Services, simply email me at wayne@aRealCFO.com.au or call me on 0412 227 052