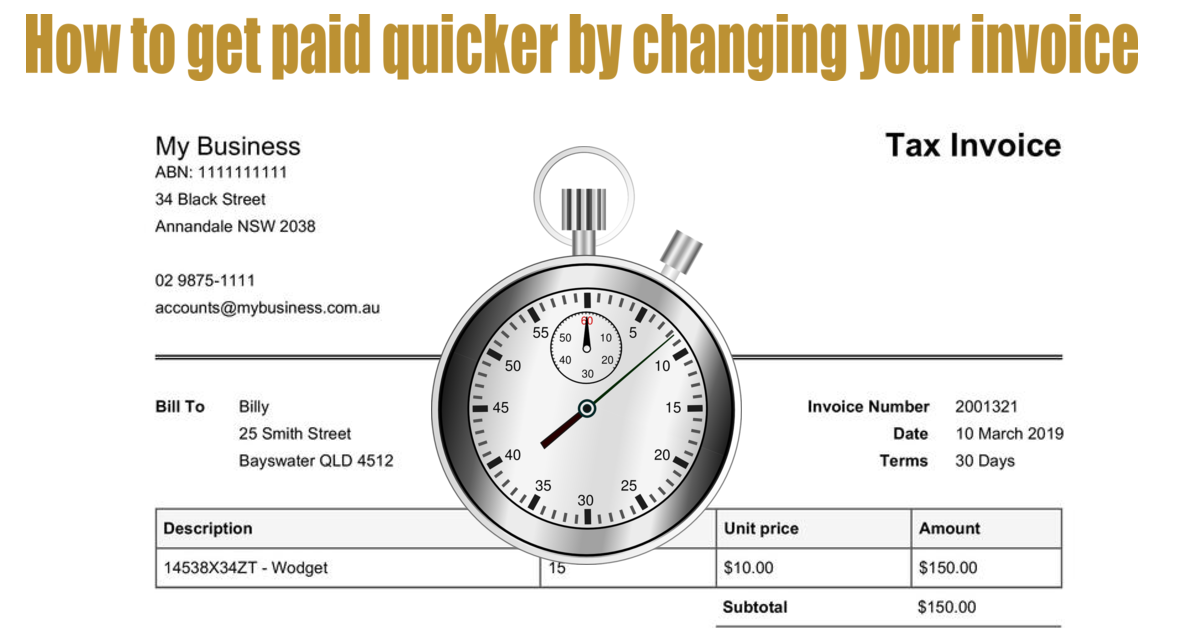

How to get paid quicker by changing your invoice

I see many businesses that just take the invoice that their accounting / sales system produces and send these out to their customers.

But often this is not the best thing to do as it can make it hard for the customer to pay you quickly.

Here are 4 changes I recommend that you make to your invoices to help your business get paid quicker.

Make sure you include a reference number

Often customers will provide the business with a purchase order. Or you and the customer have another reference number like a job reference, agreement number, booking number etc.

But quite frequently this reference number is not quoted on your invoice because your accounting / sales system does not handle this.

Leaving this reference number off your invoice will slow down the payment process, especially when you are dealing with big business and government departments. They rely on that number to track down who approved the product / service in the first place. Without it, the whole payment approval process slows down.

To get paid quicker, make sure the agreed reference number is quoted on all your invoices.

Make sure your invoice is in a format that helps the customer pay

Sometimes this is as simple as the product / service name. The customer has ordered a “widget” but your accounting / sales system calls it a “wodget”. Or even worse, your system calls it “14538X34ZT” with a meaningless description. The customer gets the invoice and the payment process slows down whilst someone confirms the “wodget” or the “14538X34ZT” on your invoice is the same as the “widget” they wanted.

Other times it is a bit more complicated. You are dealing with a big business and your product goes to multiple departments. If you send one total invoice, no one is going to approve it as they do not know what the other departments received. Rather than having one big invoice, create an invoice for each department. That way if someone is on leave, only their payment is slowed down, not the whole payment.

Often it pays to ask the customer, especially on major sales, what they want to see on their invoice. And if your accounting / sales system can’t do, pay someone to prepare an invoice outside the system with all the right information.

Don’t send out wrong invoices

I have lost count of how many times I have seen an invoice and the details are wrong. Wrong company name is the most common.

You need to get the basic details right, otherwise they start questioning the whole invoice. Or they just return it to you to fix it and this slows down the payment of your invoice.

Put an actual due date

I often see invoiced with payment terms “Due 30 Days” and there is no due date. Let’s take the example of where the manager sits on the invoice for 25 days and finally approves it. It goes to the accounts payable person who sees due date 30 days and they start the count from the day they get it.

Instead put an actual due date. That way when the accounts payable person gets it on day 25 and it has been approved, they generally are not going to wait another 30 days to pay it.

The message here is if you want to get paid quicker, make it easier for your customer to get the invoice approved and in front of the accounts payable person so they can process the payment.

If you like this, why not share this with a friend, simply click on one of the icons to the left or below

If you want to see how Wayne can help you successfully navigate your way through your financial challenges to grow your business profitably faster,

Contact Wayne and arrange a free, no obligation Discovery Session. At the end of this Discovery Session, you will have multiple ideas on how to grow your business profitably faster.

To get Wayne to help you successfully navigate your way through your financial challenges to grow your business profitably faster, simply use the contact form on the left to email Wayne or call him on 0412 227 052.

We promise to keep your email address safe.

Let Wayne Wanders, the Wealth Navigator, a fully qualified and experienced CFO, help you successfully navigate your way through your financial challenges to grow your business profitably faster.

Wayne Wanders, A Real CFO

The Wealth Navigator

wayne@aRealCFO.com.au

If you like this, why not share this with a friend, simply click on one of the icons to the left or below