In Financial Distress? Safe Harbour vs proposed new Debt Restructuring process

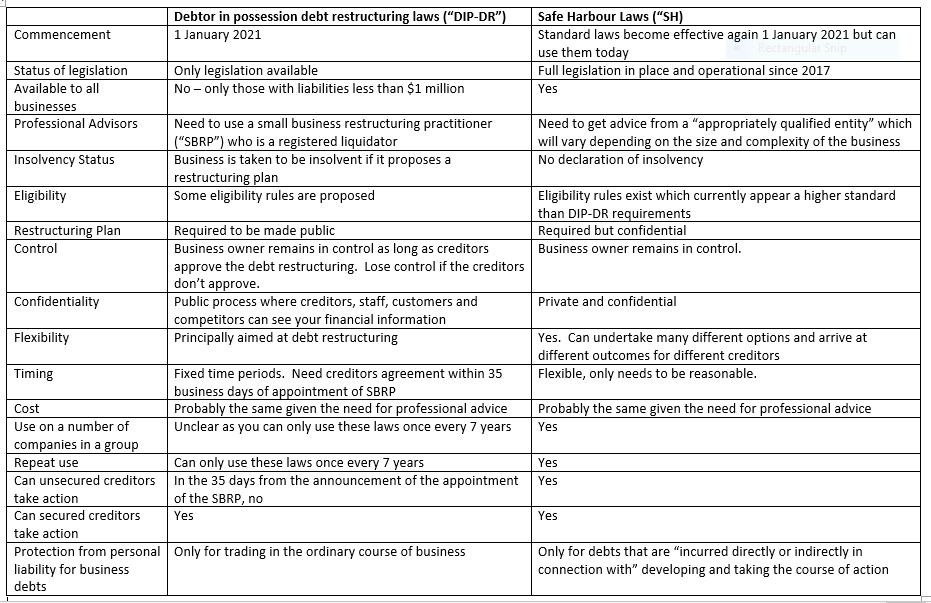

The list below compares these proposed laws with the existing safe harbour laws. That way, if your business is in financial distress, you can make a more educated decision of which of these approaches you want to take.

So, which one should you use?

If your liabilities are over $1 million or you have used the debtor in possession debt restructuring laws in other business, you can’t use the debtor in possession debt restructuring laws for this business. You either use the safe harbour laws, or place your business into voluntary administration and lose control of your business

If you need more time than 35 days, want to keep your financial affairs private, or are looking at more than a debt restructuring, the safe harbour laws appear to be more appropriate for you.

If you are looking for a simple extended debt repayment plan across all creditors, then the debtor in possession debt restructuring laws may be appropriate.

If you are suffering from financial distress and you want to try and save your business, without putting your personal assets at risk, we are happy to come and have an obligation free chat with you to see if utilising the Safe Harbour laws or the new debtor in possession process is the best option for your business.

Contact Wayne Wanders for to see if you can access the Safe Harbour Laws

At the end of this session, you will have some clarity around whether you can access the Safe Harbour Laws..

Simply fill in the contact form below or email me at wayne@aRealCFO.com.au or call me on 0412 227 052 to organise one of these obligation free sessions.

Wayne Wanders, A Real CFO

wayne@aRealCFO.com.au