Indigenous Business Australia IBA Invoice Funding

Indigenous businesses can access get invoice funding and cash flow based on the value of credit sales or major contracts through the Indigenous Business Australia IBA Invoice Funding program.

Who is this for?

Invoice finance is best suited to established businesses:

- with at least 50% Indigenous ownership

- with a minimum of two years profitable trading

- with minimum annual credit sales of $500,000

- that can demonstrate sound accounting processes and reporting

- that experience seasonal sales

- that are growing rapidly

- that are smaller or undercapitalised

- that operate in markets where debtor terms exceed supplier terms

- whose owners lack the security to access bank finance.

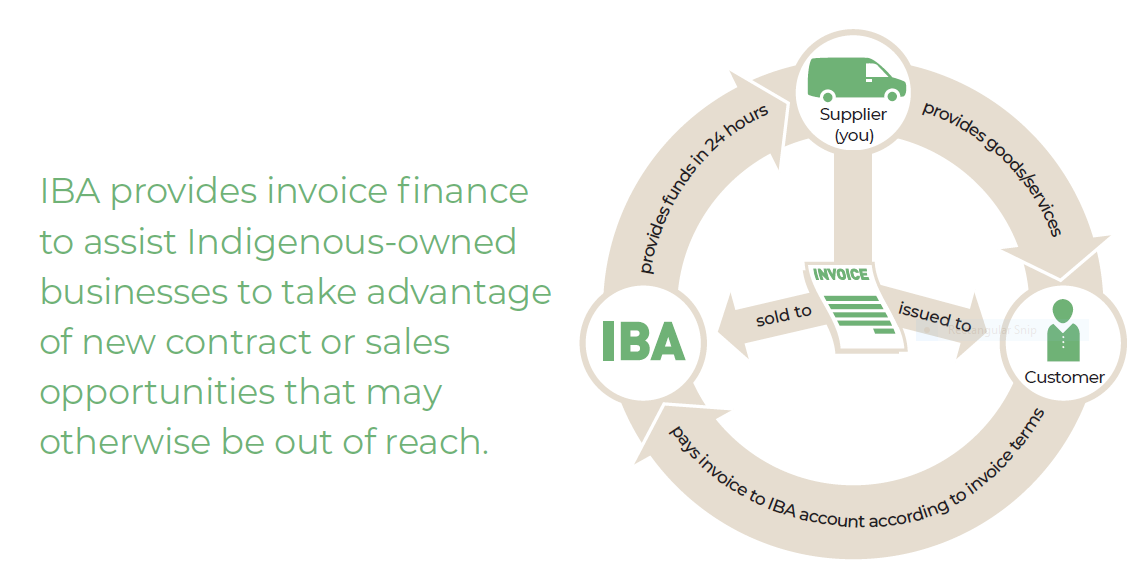

How does this work?

Once you deliver your products or services, you invoice the buyer. On a regular basis, you send your updated aged debtors ledger to IBA and we purchase all eligible new invoices. Rather than wait 60 to 90 days for your buyer to pay, you are able to request up to 80% of the value of the eligible invoices bought by IBA within 24 hours of IBA purchasing them.

When the buyer pays, you get the remaining 20% less any fees and interest

What does it cost?

The fees and charges include:

- small establishment fee to cover the cost of setting up the facility

- management fee charged as a small percentage of the value of the invoices that IBA buys from you

- interest rate payable on funds drawn is equivalent to the Reserve Bank’s official cash rate plus a risk margin based on IBA’s credit assessment

Other IBA assistance

As well as a number of different funding options, IBA also offers eligible businesses access to a range of free workshops and other business support. This includes Start-up loans and Business Loans

Learn More

To learn more about the IBA Invoice Finance click here

Wayne Wanders is an experienced Business Advisor skilled in analysing business financial performance and cash flow. Wayne may also be able to assist you in preparing your grant application. Contact Wayne below for a free no obligation session.

Also, if you want some more information on grants, contact me below

Contact Wayne Wanders for your FREE Business Survival Session

At the end of this session, you will have multiple ideas on how your business can survive and thrive in these uncertain times.

Simply fill in the contact form below or email me at wayne@aRealCFO.com.au or call me on 0412 227 052 to organise one of these obligation free sessions.

Wayne Wanders, A Real CFO

wayne@aRealCFO.com.au