JobKeeper 2 Tier payment rates

If you are expecting to be eligible for the #JobKeeper beyond 27 September, you must remember the JobKeeper 2 Tier Payment Rates will apply, what the ATO calls Tier 1 and Tier 2.

From 28 September 2020 to 3 January 2021, eligible Tier 1 employees attract a $1,200 a fortnight JobKeeper payment. Eligible Tier 2 employees attract only $750 a fortnight.

From 4 January to 28 March 2021, eligible Tier 1 employees attract a $1,000 a fortnight JobKeeper payment. Eligible Tier 2 employees attract only $650 a fortnight.

You need to ensure you are classifying your eligible employees properly between Tier 1 and Tier 2 or you may be out of pocket. For example, you pay an employee $1,200 a fortnight, but if you are only entitled to a $750 JobKeeper reimbursement, you will be out of pocket $450 per fortnight.

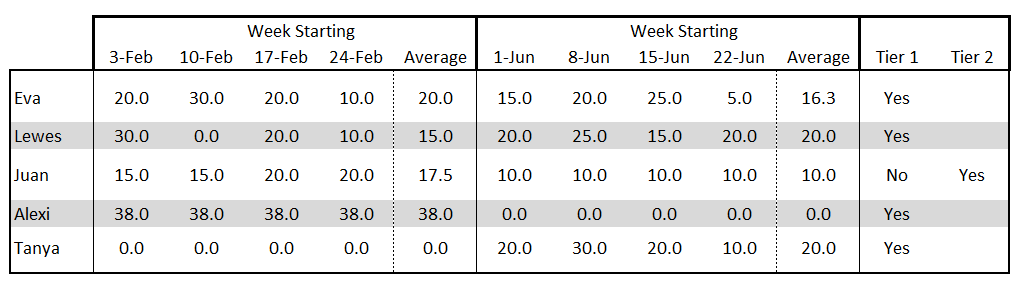

So, what are the two tiers?

Tier 1 – those eligible employees who were working or 20 hours or more a week on average, and those eligible business participants who were actively engaged in the business for 20 hours or more per week on average; in the four weeks of pay periods before either 1 March 2020 or 1 July 2020.

Tier 2 – all other eligible employees or business participants.

Here are some examples.

Make sure you work out which tier each employee will be on now, so you can communicate with your staff as soon as possible. This is especially important if you need to vary what you want to pay them and / or vary the hours they work.

Don’t leave this till too late as you may end up being out of pocket.

If you need some help here, just contact me below

Contact Wayne Wanders for to see if you can access the Safe Harbour Laws

To ensure I help your business specifically, the best approach I have found is to have an obligation free session with you. In this session we will review your current business in a factual and objective manner, to better understand the challenges that you face. And this session does not need to be face to face.

At the end of this session, you will have some clarity around whether you can access the Safe Harbour Laws..

Simply fill in the contact form below or email me at wayne@aRealCFO.com.au or call me on 0412 227 052 to organise one of these obligation free sessions.

To get help you successfully navigate your way through your financial challenges so your business can survive and thrive in these uncertain times, simply use the contact form on the left to email Wayne or call him on 0412 227 052.

Let Wayne Wanders, a fully qualified and experienced CFO, help you successfully navigate your way through your financial challenges so your business can survive and thrive in these uncertain times.

Wayne Wanders, A Real CFO

wayne@aRealCFO.com.au