JobKeeper Alternative Turnover Test

On 23 April the ATO issued the JobKeeper Alternative Turnover Tests details to help businesses who failed the standard decline in turnover (revenue) test to be eligible for the JobKeeper payment.

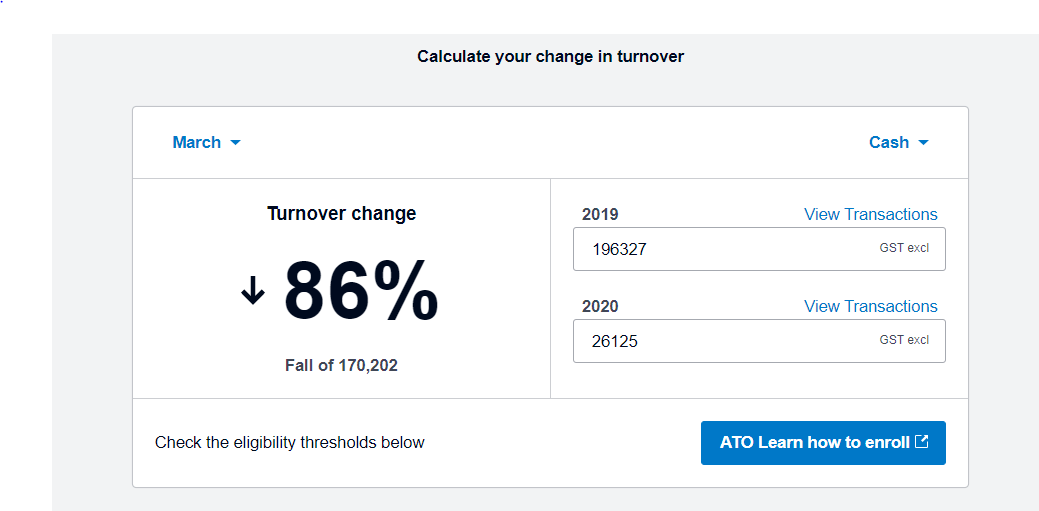

The standard test was a % fall in revenue (30% for businesses with less than $1 billion in revenue), between the current period in 2020 and the same period in 2019. For example, comparing March 2020 with March 2019, April 2020 with April 2019 or the April to June 2020 quarter with April to June 2019 quarter.

As this was not always a reflection of real decline in revenue especially for businesses:

- not around in March 2019, or

- those affected by floods, droughts etc in 2019 which meant their revenue was suppressed then,

the legislation allowed for an alternate test.

And this is what the ATO released on April 23, being guidelines as to what the JobKeeper Alternative Turnover Test are.

Set out below are some details of the key JobKeeper Alternative Turnover Test.

Business commenced before 1 March 2020 but after the relevant comparison period. For example, business started 15 July 2019.

For businesses started before 1 December 2019 there are two choices here being:

- the average monthly turnover of every whole month since the business started till 1 March 2020. If the comparison period is quarterly, multiply this by 3.

- The average monthly turnover for the period December 2019 to February 2020. If the comparison period is quarterly, the total

For businesses started after 1 December 2019 but before 1 March 2020,

- the average monthly turnover of every whole month since the business started till 1 March 2020. If the comparison period is quarterly, multiply this by 3.

- If you started in February, the average daily revenue x 29.

The business was affected by drought or other declared natural disaster during the relevant comparison period

The comparison period is the same period in the year immediately.

For example, if you were drought or flood impacted in 2019, instead of comparing March 2020 with March 2019, you compare with March 2018.

Growth businesses that had substantial increase in turnover

This applies if your business had substantially increased its revenue by:

- 50% or more in the 12 months immediately before the applicable turnover test period; or

- 25% or more in the 6 months immediately before the applicable turnover test period, or

- 5% or more in the 3 months immediately before the applicable turnover test period.

The comparison period is the average turnover from the 3 months immediately before the test period. For example, for the month of March 2020, you are comparing this with the average of the 3 months December, January and February. If for the June 2020 quarter, you are comparing this with the March 2020 quarter.

Disposals, acquisitions and restructures

This applies where a business has acquired or disposed of part of the business, or undertook a restructure after the relevant comparison period. Basically, the business is not the same business in that period as it is now.

The comparison period is the month after the month in which the last disposal, acquisition or restructure occurred.

Impacted by the recent bushfires

If your business qualified for the ATO’s Bushfires 2019–2020 lodgement and payment deferrals, then for most of the above alternate tests, exclude the calendar months covered by the Bushfires 2019–2020 lodgement and payment deferrals from the alternative revenue calculation, unless those are the only months since the entity commenced the business.

Which test to use

If you fall into more than one JobKeeper Alternative Turnover Test, you can choose which alternative decline in turnover test to apply.

You only need to satisfy one of the tests and it does not matter if you do not satisfy one of the other tests that applies to you.

So, if you fail one test, try the next one.

Contact Wayne Wanders for your FREE Business Survival Session

To ensure I help your business specifically, the best approach I have found is to have an obligation free session with you. In this session we will review your current business in a factual and objective manner, to better understand the challenges that you face. And this session does not need to be face to face.

At the end of this session, you will have multiple ideas on how your business can survive and thrive in these uncertain times.

Simply fill in the contact form below or email me at wayne@aRealCFO.com.au or call me on 0412 227 052 to organise one of these obligation free sessions.

To get help you successfully navigate your way through your financial challenges so your business can survive and thrive in these uncertain times, simply use the contact form on the left to email Wayne or call him on 0412 227 052.

Let Wayne Wanders, a fully qualified and experienced CFO, help you successfully navigate your way through your financial challenges so your business can survive and thrive in these uncertain times.

Wayne Wanders, A Real CFO

wayne@aRealCFO.com.au