JobKeeper Extension Warning – ATO Clarification of the Decline in Turnover test may adversely impact businesses who report GST on cash basis

The recent ATO clarification on the rules around the decline in turnover test for the JobKeeper extension beyond 27 September 2020, may mean some businesses who report their Business Activity Statement (BAS) on a cash basis, lose their access to JobKeeper.

Read on to see if this may impact you.

Note the comments below relate to businesses who were registered for GST prior to 1 July 2019.

To be eligible for the JobKeeper extension in the period 28 September 2020 to 3 January 2021, businesses with an annual turnover of $1 billion or less, need to demonstrate a decline in turnover of 30% or more between the September 2019 quarter and September 2020 quarter.

Under the original JobKeeper rules, a business had flexibility to work out that turnover decline. Irrespective of what basis the business used to report on its BAS, it could choose cash or accruals to calculate the decline in turnover.

This is no longer the case. The Australian Taxation is now being very prescriptive.

You must calculate your decline in turnover consistent with the cash or accruals basis of reporting the business used in the September 2019 quarter BAS.

For those business reporting on a cash basis, generally businesses with a turnover of less than $10 million, you may have experienced a decline in activity in the September 2020 quarter, but it may not be reflected in your cash receipts.

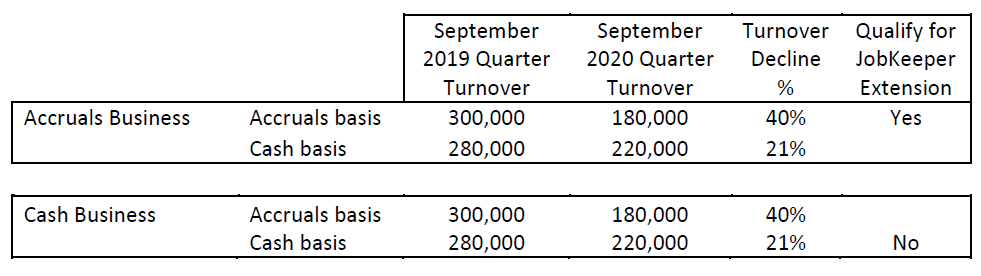

Let’s compare two businesses. Accruals Business reports its GST on an accruals basis and Cash Business reports its GST on a cash basis.

As you can see below, both businesses had the same trading conditions in the September 2019 and 2020 quarters. This included the same drop in activity due to the Stage 4 lockdowns in Melbourne.

But because Cash Business reports it’s BAS on a cash basis, and in the September 2020 quarter it collected cash from activity in May and June, it will not be eligible for the JobKeeper extension. But Accruals Business, who experienced exactly the same drop in activity will be eligible for the JobKeeper extension.

If you report your BAS on a cash basis, you need to double check now to make sure you qualify for the JobKeeper extension, as cash from the June quarters sales may mean you fail to qualify.

If you need some help to develop your Safe Harbour action plan to protect your business and personal assets such as your house, just contact me below

Contact Wayne Wanders for to see if you can access the Safe Harbour Laws

To ensure I help your business specifically, the best approach I have found is to have an obligation free session with you. In this session we will review your current business in a factual and objective manner, to better understand the challenges that you face. And this session does not need to be face to face.

At the end of this session, you will have some clarity around whether you can access the Safe Harbour Laws..

Simply fill in the contact form below or email me at wayne@aRealCFO.com.au or call me on 0412 227 052 to organise one of these obligation free sessions.

To get help you successfully navigate your way through your financial challenges so your business can survive and thrive in these uncertain times, simply use the contact form on the left to email Wayne or call him on 0412 227 052.

Let Wayne Wanders, a fully qualified and experienced CFO, help you successfully navigate your way through your financial challenges so your business can survive and thrive in these uncertain times.

Wayne Wanders, A Real CFO

wayne@aRealCFO.com.au