NSW Covid-19 Business Grant – Applications Close 1 October 2021

Applications are closing soon on 1 October 2021

For those businesses who have annual revenue between $75,000 and $50 million for the year ended 30 June 2020 and have been impacted by the recent lockdowns in NSW, applications are now open for the Covid-19 Business Grant.

Read on to learn if you are eligible, and how to apply.

Note if your business has turnover between $30,000 and $75,000, you may be eligible for the Micro Business Grant. Click here to learn more. If your business was only impacted from 18 July, you are not entitled to this Grant but you may be eligible for JobSaver. Click here to learn more.

The Covid-19 Business Grant itself

The Covid-19 Business Grant is a once off payment designed to cover expenses incurred by eligible businesses from 1 June 2021 to 18 July 2021. Staff expenses beyond that date may be covered JobSaver (click here to learn more about JobSaver).

The grant amount depends on the decline in revenue your business experiences. The tax free grant is:

- $7,500 payment for a decline of 30% or more in revenue.

- $10,500 for a decline of 50% or more or more in revenue.

- $15,000 for a decline of 70% or more or more in revenue.

Note the revenue decline needs to be “due to the Public Health Orders” but this is not defined anywhere. If your business revenue is down year on year due to factors other than the recent Public Health Orders, you may not be eligible for this Covid-19 Business Grant.

Eligibility Rules that apply to all businesses

In order to be eligible for the Covid-19 Business Grant your business or not for profit organisation must:

- have an Australian Business Number (ABN) and be operating in NSW as at 1 June 2021;

- have total annual Australian wages of $10 million or less as at 1 July 2020;

- had an aggregated annual revenue between $75,000 and $50 million (inclusive) for the year ended 30 June 2020. Note: there are some alternative circumstances allowed by Service NSW that may mean you are eligible for this grant even if you don’t have revenue of $75,000 or above for the year ended 30 June 2020. Click here to learn more;

- have business costs for which there is no other government support available. Note: you may be asked to provide evidence of these costs;

- have experienced a decline in turnover of 30%, 50% or 70% or more due to the Public Health Orders over a minimum 2-week period from 26 June 2021 to 17 July 2021 compared to

- the same period in 2019, or

- the same period in 2020, or

- the 2-week period immediately before the Greater Sydney lockdown commenced (12 June to 25 June 2021);

- Note: there are some alternative circumstances allowed by Service NSW that may mean you are eligible for this grant even if you don’t have revenue in June / July 2019, or your revenue in June / July 2019 is not representative of your business. Click here to learn more;

- maintain your employee headcount as at 13 July 2021 for the period for which the business is receiving payments under this Grant (and subsequent JobSaver Grant). Thankfully employers will remain eligible if employees voluntarily resign.

Note:

- Non-employing businesses are not eligible to apply if persons associated with the business, and who derive income from it, have applied for, or are receiving, the Commonwealth COVID-19 Disaster Payment between 26 June and 17 July.

- You can only claim one grant per ABN, so obviously you would claim the highest grant you are eligible for.

- Multiple businesses under a single ABN are only eligible for one grant.

- Business earning passive income such as rent, interest or dividends are ineligible.

What can the funding be used for?

The Covid-19 Business Grant can be used to offset business costs incurred from 1 June 2021 to 18 July 2021. These costs may include, but are not limited to, the following expenses:

- utilities, wages and rent;

- financial, legal or other advice to support business continuity planning;

- marketing and communications activities to develop the business;

- the cost of perishable goods that can no longer be used; or

- other activities to support the operation of the business.

Evidence Required to support your application for the Covid-19 Business Grant

| Businesses on the ‘highly impacted industries list’ (see below) | Other Businesses | |

| Decline in Turnover of 30% | Declaration and details of independent accountant, tax or BAS agent | Letter from an independent accountant, tax or BAS agent |

| Decline in Turnover of 50% | Declaration and details of independent accountant, tax or BAS agent | Letter from an independent accountant, tax or BAS agent |

| Decline in Turnover of 70% | Letter from an independent accountant, tax or BAS agent | Letter from an independent accountant, tax or BAS agent |

| Eligible expenses | Declaration | Declaration |

| Headcount as at 13 July | Declaration | Declaration |

| Maintain Headcount | Declaration | Declaration |

| 2020 Tax return / notice of assessment | Copy Required | Copy Required |

If your business is in a highly impacted industry and you have suffered a revenue decline of 70% or more, you can get $10,500 of the $15,000 grant without an accountants letter. But you will need this letter to access the final $4,500 of this grant.

Note. Service NSW reserves the right to audit any of the evidence supporting the above declarations.

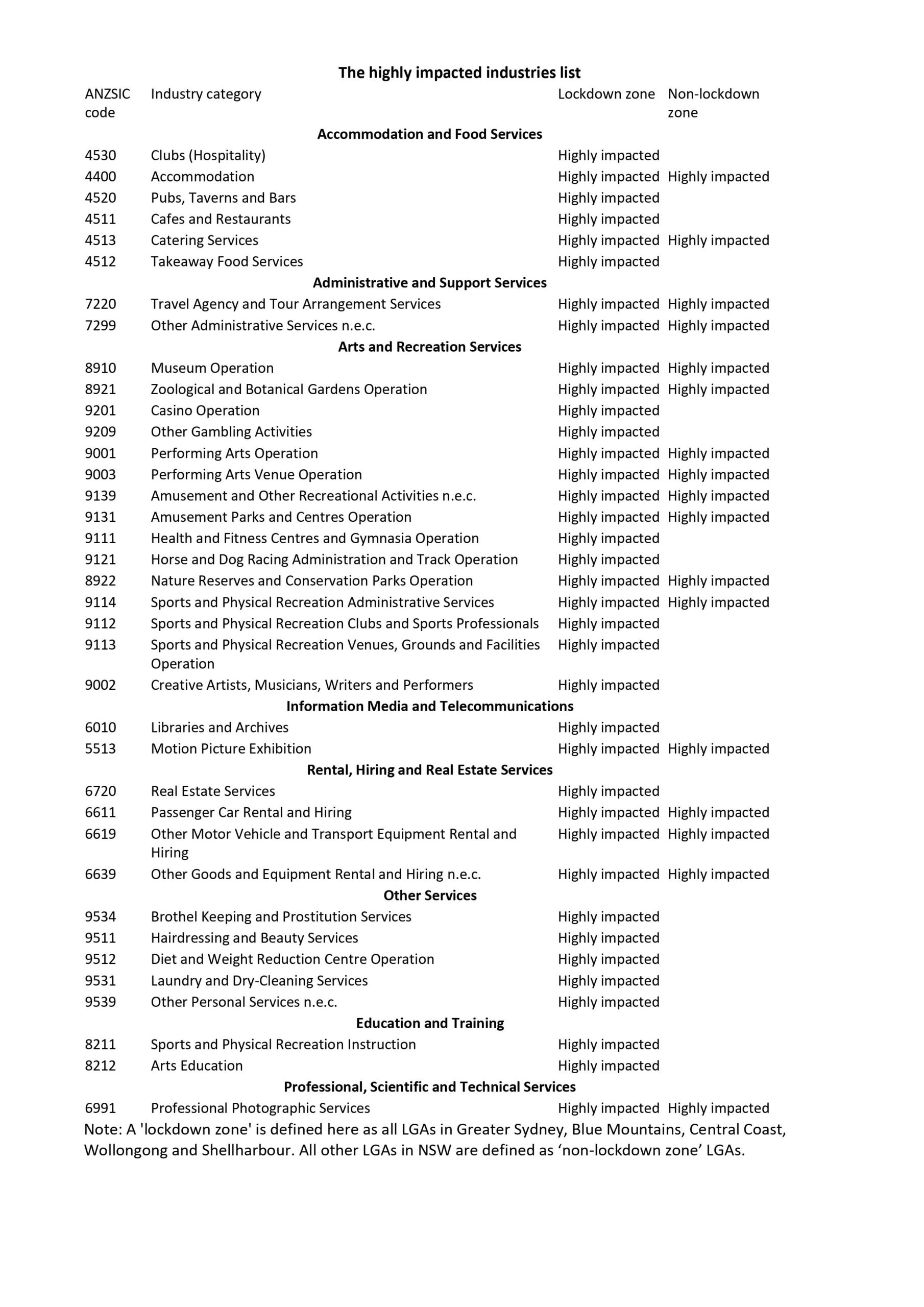

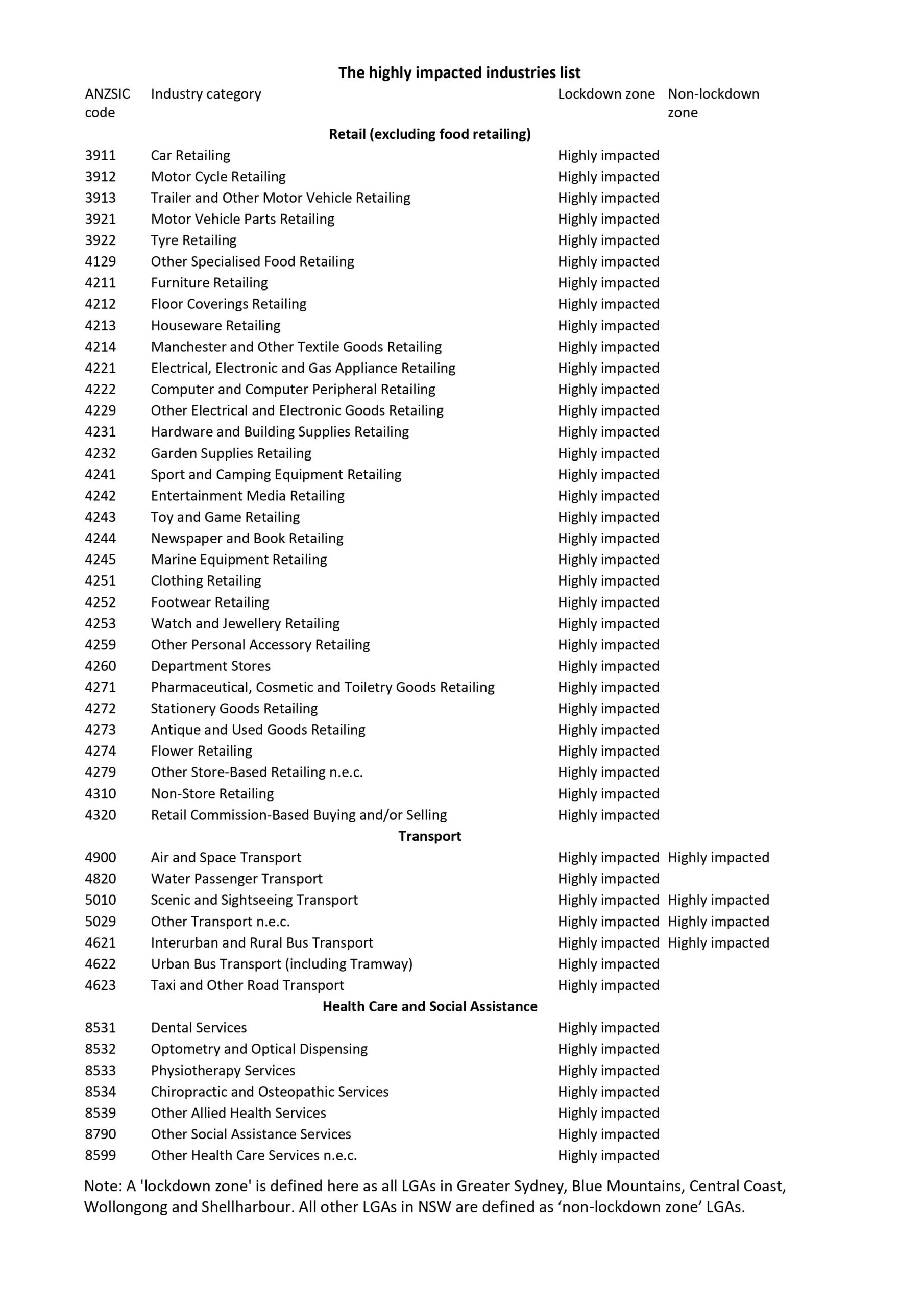

The highly impacted industries list

How to Apply

Note applications close 1 October 2021.

Click here to get more information from the Service NSW website and the link to apply

If you want a confidential discussion on your business situation, or help with this grant contact me below

Contact Wayne Wanders for your FREE Business Survival Session

To ensure I help your business specifically, the best approach I have found is to have an obligation free session with you. In this session we will review your current business in a factual and objective manner, to better understand the challenges that you face. And this session does not need to be face to face.

At the end of this session, you will have multiple ideas on how your business can survive and thrive in these uncertain times.

Simply fill in the contact form below or email me at wayne@aRealCFO.com.au or call me on 0412 227 052 to organise one of these obligation free sessions.

To get help you successfully navigate your way through your financial challenges so your business can survive and thrive in these uncertain times, simply use the contact form on the left to email Wayne or call him on 0412 227 052.

Let Wayne Wanders, a fully qualified and experienced CFO, help you successfully navigate your way through your financial challenges so your business can survive and thrive in these uncertain times.

Wayne Wanders, A Real CFO

wayne@aRealCFO.com.au