NSW Small Business Support Program

Applications are now open for the NSW Small Business Support Program

Under the Small Business Support Program, eligible employing businesses will receive 20% of NSW weekly payroll for the month of February (i.e. 4 weeks only), as a lump sum, with a minimum payment of $750 per week and a maximum payment of $5,000 per week. As the program is limited to the 4 weeks in February 2022, this equates to a minimum lump sum payment of $3,000 and a maximum lump sum payment of $20,000 for eligible employing businesses.

Eligible non employing businesses will receive $500 per week (paid as a lump sum of $2,000).

To be eligible for the Small Business Support Program, your business must:

- be a NSW business with aggregated annual turnover of between $75,000 and $50 million (inclusive) for the year ended 30 June 2021 or 30 June 2020; and,

- experienced a decline in turnover of 40% or more due to impacts of the Omicron COVID-19 strain during the month of January 2022, compared to January 2021 or January 2020; and,

- experienced a decline in turnover of 40% or more due to the impacts of the Omicron COVID-19 strain from 1-14 February 2022, compared to the same fortnight in February 2021 if you used January 2021 as your first comparison period, or to in February 2020 if you used January 2020 as your first comparison period; and,

- maintain your employee headcount from 30 January 2022 till 28 February 2022.

Certain entities, such as those primarily earning passive income (rents, interest, or dividends), government agencies, local governments, banks and universities are not eligible.

For non-employing businesses, the business receiving payments must be the primary income source (i.e. 50% or more of total income) for the associated individual.

Registered charities are not eligible if they are receiving COVID-19 support from the NSW Department of Communities and Justice Social Sector Support Fund.

How funding may be used

The funding is to help eligible businesses cover business costs and survive the immediate impacts of the Omicron wave of COVID-19. These costs may include, but are not limited to:

- salaries and wages

- utilities and rent

- financial, legal or other advice

- marketing and communications

- perishable goods, or

- other business costs.

Evidence to Support your application for the Small Business Support Program

Evidence you need to supply to support your application for the Small Business Support Program includes:

- Most recent income tax return for year ended 30 June 2020 or 30 June 2021 only, showing annual turnover of between $75,000 and $50 million (inclusive) (unless you have a substituted accounting period).

- Evidence of how the weekly payroll amount was calculated (if you are an employing business). This could be copies of your BAS / IAS or you Single Touch Payroll Reports

- Identifying how the Public Health Order has directly impacted the turnover of the business.

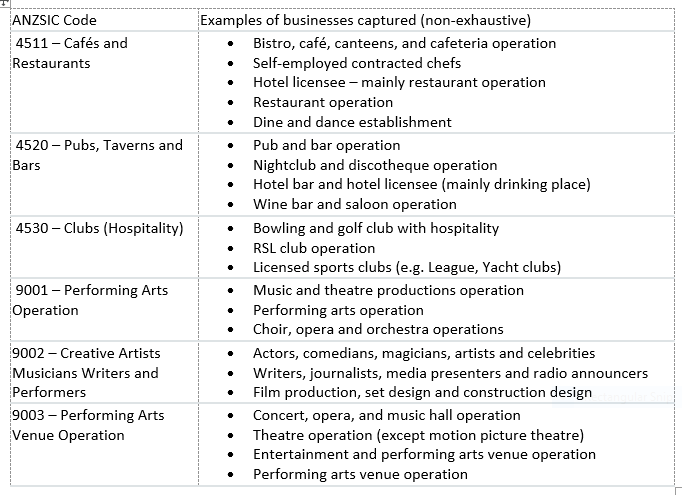

If your business has an ANZSIC code in the list below all you need to do is make a declaration about your revenue decline in January and 1-14 February 2022. You do not appear to need an accountants letter.

If your business does not have an ANZSIC code in the above list, you must submit supporting evidence to demonstrate a 40% decline in turnover during the month of January 2022, compared to January 2021 or January 2020 through either:

- Business Activity Statements or Instalment Activity Statements for January 2022 and January 2021/January 2020, or

- a letter from a qualified accountant, registered tax agent or registered BAS agent.

In respect of the period 1 to 14 February 2022 compared to the same fortnight in February in the comparison year used for January’s decline in turnover, it is just a declaration.

Alternate Rules

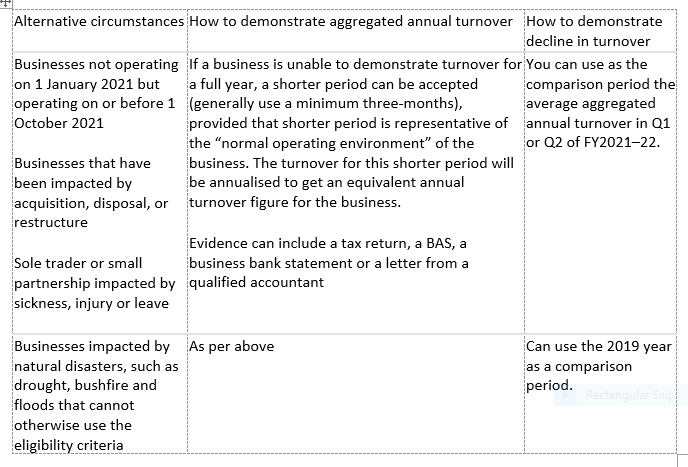

If your business:

- is a new business not operating on 1 January 2021;

- affected by drought, bushfires or other natural disasters;

- turnover is impacted by business acquisition, disposal or business restructure; or

- is a sole trader or small partnership impacted by sickness, injury or leave,

your business may still be eligible for the Small Business Support Program.

The alternate tests are as set out below:

How to Apply

Just like JobSaver, applications will be online via the Service NSW website.

Click here to get more information from the Service NSW website and this will have the link to apply once applications open.

Applications will close at 11:59pm on 31 March 2022.

If you want help to improve your your businesses chances thriving and surviving in these uncertain times contact me below.

Contact Wayne Wanders for your FREE Business Survival Session