2021 Small Business Innovation & Research Program (SBIR Program)

Note applications for the 2021 Small Business Innovation and Research Program, or SBIR program are now closed. New challenges will be released in 2022 and applications will reopen then.

The NSW Government announced the Small Business Innovation and Research Program, or SBIR program with $24m in funding over the first 2 years of the program.

The SBIR Program provides grants to NSW small and medium businesses to develop and commercialise innovative solutions to current challenges facing the NSW Government with the ultimate aim that these solutions can be sold to other customers around the world.

The 2021 SBIR Program Challenges

The 2021 round of funding for the SBIR Program ($12m) is focused on the following 5 challenges:

- to increase the strength and resilience of communications networks in regional and remote areas (Connectivity Challenge).

- to assist passengers with vision impairments to access public transport services (Hyperlocal Navigation Challenge).

- to detect and quantify koala populations in NSW (Koala Count Challenge).

- to reduce waste associated with discarded personal protective equipment and sterile wrap (Personal Protective Equipment Challenge).

- to reduce microplastic and other contamination due to laundry services in health facilities (Water Purification Challenge).

The NSW Government will hold webinars about each challenge in July.

The SBIR Program Phases

Phase1 – Feasibility Study. You are required to submit a proposal to solve one of the 5 above challenges. These are assessed and successful applicants then receive a grant of up to $100,000 to conduct a feasibility study over a period of three months. Note, just because you apply does not mean you get a grant.

Phase 2 – Proof of Concept. If you were successful getting a feasibility study grant, you can then apply for a proof of concept grant. These applications are assessed again and successful applicants then receive a grant of up to $1m to develop a proof of concept over a period of up to 15 months. Note, just because you had a feasibility study grant, does not mean you get a proof of concept grant.

Phase 3 – After this the NSW Government may buy from you. Note, there is no commitment that the NSW Government will buy from you.

The good news is that this is not a matched funding grant and the grant amount can be up to 100 per cent of eligible project expenditure.

The bad news is that this is a competitive grant and there are a series of assessment criteria you will have to address. Also, the proposed solution must be innovative technologies and services that require development and commercialisation, not existing solutions that are already commercially available in Australia or elsewhere.

SBIR Program Eligibility

For a business too be eligible for the SBIR Program you must:

- Have an Australian Business Number (ABN)

- A small or medium-sized enterprise with under 200 full-time equivalent employees

- Be headquartered in NSW, or conduct the majority of business research and development and production operations in NSW

- Hold the Intellectual Property or the rights to commercialise the proposed solution

- If successful, undertake to conduct SBIR program-related research and development work in NSW

Eligible Expenditure

Eligible Expenditure includes:

- Labour expenditure including on-costs

- Capital equipment relevant to the project

- Material costs (including consumables specific to the project)

- Contract expenditure

- Travel expenditure

- Financial auditing of the project

- Other costs directly related to the project or project audit activities

SBIR Program Application dates

Applications for the 2021 SBIR Program have closed.

Applications will open again once the 2022 Challenges are released

More Information

For more information visit the website

Wayne Wanders is an experienced Business Advisor skilled in analysing business financial performance and cash flow. Contact Wayne below for a session with Wayne who will help you understand the real drivers of your business so you pull the right levers to profitably grow their business.

Also, if you want some more information on grants, contact me below

Contact Wayne Wanders for your FREE Business Survival Session

At the end of this session, you will have multiple ideas on how your business can survive and thrive in these uncertain times.

Simply fill in the contact form below or email me at wayne@aRealCFO.com.au or call me on 0412 227 052 to organise one of these obligation free sessions.

Wayne Wanders, A Real CFO

wayne@aRealCFO.com.au

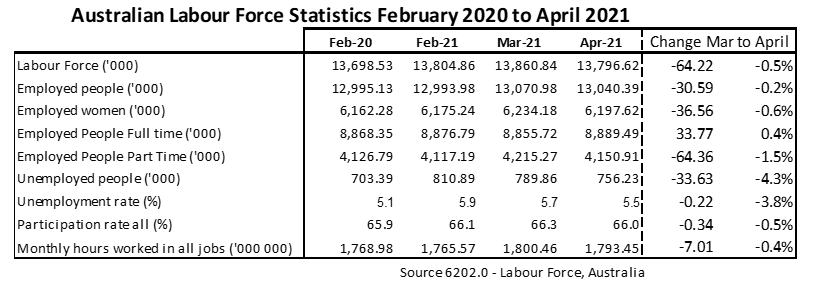

April 2021 Jobs Data

The April 2021 Jobs Data released today is the first jobs data after the end of JobKeeper.

At one level it looks like the end of JobKeeper did not have a big impact as the unemployment rate fell from 5.7% in March to 5.5% in April.

But if you look behind the numbers you see a different story.

Firstly, the number of employed people fell by nearly 31,000 between March and April. Women suffered the worst here, with the number of employed women falling by over 36,000. From a state perspective, the biggest job losses were in NSW which had nearly 37,000 less people working in April compared to March.

Secondly, the total labour force fell by over 64,000 people between March and April. This means that over 64,000 people stopped working, or stopped looking for work in April. For people who were unemployed in March and stopped looking for work in April, they are no longer counted as unemployed.

Thirdly, whilst the number of unemployed people of nearly 34,000 people in April, this can be reasonably attributed to less people looking for work and not actual job creation (especially as there are nearly 31,000 less people working in April).

My conclusion

I think the end of JobKeeper in March, has meant a lot of people gave up hope of getting work in April.

If you want a confidential discussion on your business situation, contact me below

Contact Wayne Wanders for your FREE Business Survival Session

At the end of this session, you will have multiple ideas on how your business can survive and thrive in these uncertain times.

Simply fill in the contact form below or email me at wayne@aRealCFO.com.au or call me on 0412 227 052 to organise one of these obligation free sessions.

Wayne Wanders, A Real CFO

wayne@aRealCFO.com.au