Update to the Skills Training and Technology Investment Boosts announced under the previous Liberal Government

In the last budget before the recent Federal Election, the previous government announced a Skills Training and Technology Investment Boosts.

With the change in government there was a question around whether these boosts would stay.

The new Labor government is proposing to keep these boosts (albeit with some changes to eligible expenditure) and has released the proposed legislation for these boosts.

The current proposal for each boost is set out below.

Proposed Skills and Training Boost

Businesses with turnover of less than $50 million, will be able to deduct an additional 20 per cent of expenditure incurred on external training courses provided to their Australian based employees. The external training courses will need to delivered by registered training providers in Australia. This applies to money spent from 30 March 2022 till 30 June 2024.

Proposed Technology investment boost

Businesses with turnover of less than $50 million, will be able to deduct an additional 20 per cent of expenditure on business expenses and depreciating assets that has a direct link to the entity’s digital operations, such as:

- digital enabling items – computer and telecommunications hardware and equipment, software, systems and services that form and facilitate the use of computer networks;

- digital media and marketing – audio and visual content that can be created, accessed, stored or viewed on digital devices; and

- e-commerce – supporting digitally ordered or platform enabled online transactions

An annual cap of $100,000 will apply. This applies to money spent from 30 March 2022 till 30 June 2023 (one year less than the Skills and Training Boost).

The Tax benefit

The benefit to small businesses of these 2 boosts may be nowhere near what the Government wants you to believe.

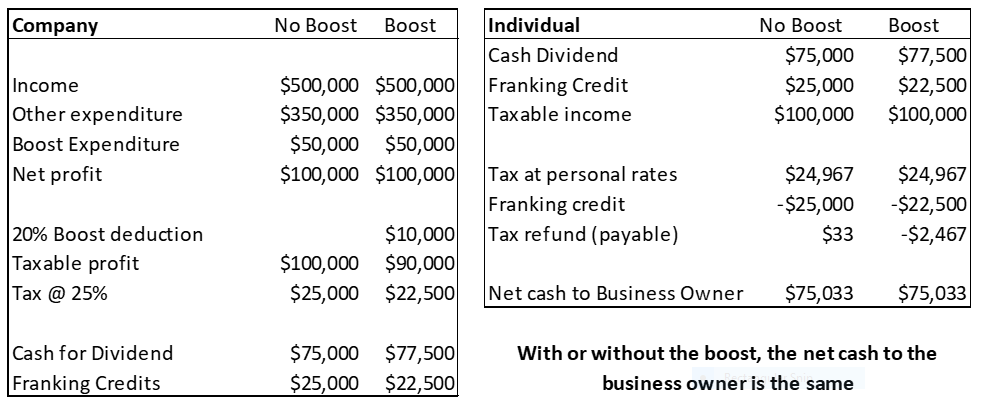

Let me demonstrate. In the image below you can see the cash outcome to the business owner if you are a small business and distribute all your profit via a dividend.

As you can see, with or without the boost, the net cash to the business owner is the same.

And this does not even take into account, you likely can’t claim the boost for any expenditure on or before 30 June 2022, till you lodge your 2023 tax return. So you will spend the money in say, June 2022 and not get a reduction in your tax payable till probably after November 2023, 18 months later.

So the message here is, don’t fall for the smoke and mirrors around the “boosts” announced in the budget. Sure if you need to spend the money, then spend it, but don’t spend it just because you think you will get a benefit.

If you want some help, contact me below.

Contact Wayne Wanders for your FREE Business Survival Session

At the end of this session, you will have multiple ideas on how your business can survive and thrive in these uncertain times.

Simply fill in the contact form below or email me at wayne@aRealCFO.com.au or call me on 0412 227 052 to organise one of these obligation free sessions.

Wayne Wanders, A Real CFO

wayne@aRealCFO.com.au