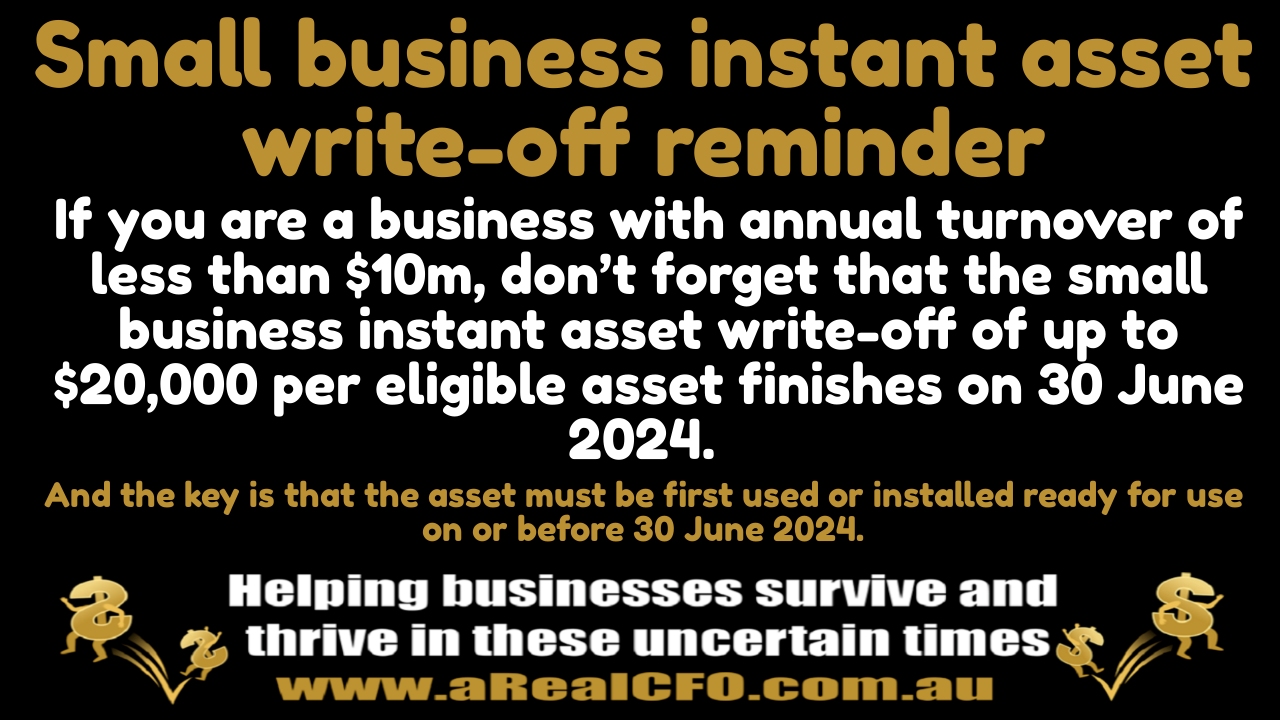

Small business instant asset write-off reminder

If you are a business with annual turnover of less than $10m, don’t forget that the small business instant asset write-off of up to $20,000 per eligible asset finishes on 30 June 2024.

And the key is that the asset must be first used or installed ready for use on or before 30 June 2024.

And if you want help to scale and grow your business profitably, please to contact me below

Contact Wayne Wanders for your FREE Discovery Session to learn how your business can scale and grow profitably

To ensure Wayne helps your business specifically, the best approach Wayne has found is to have an obligation free Discovery Session with you. In this session we will review your current business in a factual and objective manner, to better understand the challenges that you face.

At the end of this Discovery Session, you will have multiple ideas on how your business can scale and grow profitably.

Simply fill in the contact form below or email Wayne at wayne@aRealCFO.com.au or call Wayne on 0412 227 052 to organise one of these obligation free Discovery Sessions.

To get Wayne to help your business, simply use the contact form on the left to email Wayne or call him on 0412 227 052.