Other Small Business Tips to help your Business

Welcome to Wayne’s other small business tips to help your business.

These tips have been drawn from Wayne’s experience as a fully qualified Chartered Accountant for over 35 years including the last 23 years working with hundreds of startups, small and medium businesses as an Outsourced CFO and Business Advisor.

Click on the below buttons to access Free Resources developed by Wayne Wanders, A Real CFO to help your business scale and grow profitably

And Wayne is always posting about new grants, funding options and other resources on LinkedIn that can help your business scale and grow profitably. Click on the below links and connect with Wayne or follow A Real CFO on LinkedIn.

Want a confidential discussion on your business situation, help with your grant application or to learn more about my Outsourced CFO Services, simply email or call me.

Scroll below to search for the Small Business Tips that can help your business scale and grow profitably. Just click on the tip you want to look at.

Do you have enough cash in your tank?

Do you have enough cash in your tank?You wouldn’t see a team at this weekend’s Formula 1 in Melbourne start a race without knowing exactly how much fuel they need to finish. In business, cash is your fuel.But many business owners are still racing without knowing how...

Why Financial Uncertainty Is the Most Expensive Number in Your Business

Financial uncertainty is the most expensive number in your business. Learn how cash flow clarity improves decisions, confidence, and growth.

AI as a Force Multiplier for Your People — Not a Replacement for Judgement

AI as a force multiplier for your people—extending reach, capability and judgement to support better, more confident business decisions.

Why Business Prenups Matter

Why business prenups matter. A real-world example showing how lack of planning can create uncertainty, conflict, and risk for business owners.

Revenue Growth and Profitable Growth Are Not the Same

Revenue growth & profitable growth are not the same. Learn why chasing revenue can hurt cash flow & how to grow a stronger, sustainable business

Why the Smartest Leaders Hire to Cover Their Weaknesses

Why strong leaders build balanced teams instead of trying to be good at everything, and how this supports sustainable business growth.

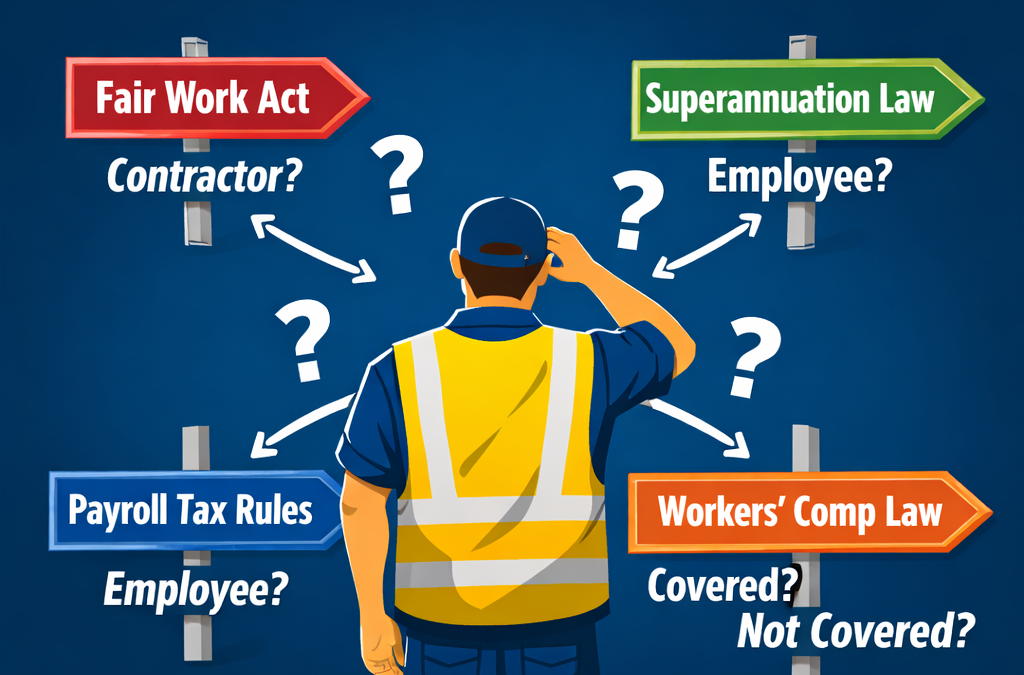

Australia’s employment laws are killing small business productivity

Australia’s confusing employment laws are hurting small business productivity. One worker, four definitions, endless compliance risk and hesitation

There is an “I” in win

Recently I spoke about how the “I” in the “A” hole of team could hurt your business.Today I want to talk about how the “I” in win can help your business.

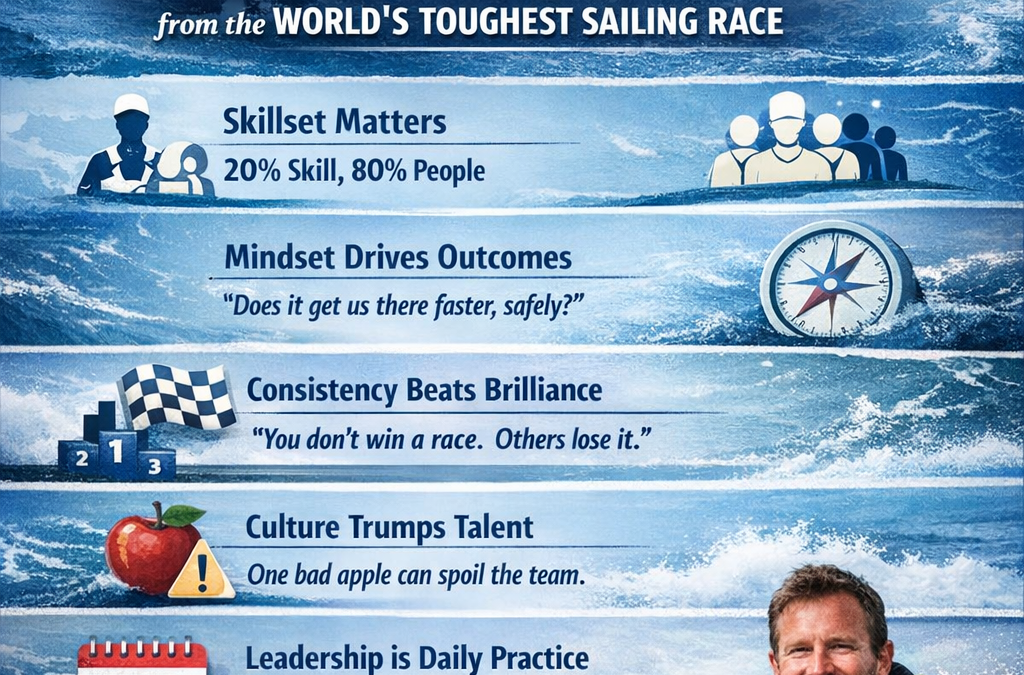

5 Leadership Lessons from the World’s Toughest Sailing Race

Learn five leadership lessons from the world’s toughest sailing race and how they apply to building strong teams and growing a business.

Find Your Talent, Invest in It, Build Your Strength in Business

Discover why focusing on your strengths drives better business results. Learn how identifying talent and investing in it leads to real growth and engagement.

Focus on Strengths, Not Weaknesses

It is my belief that there is no point focusing on your weaknesses, you have to focus on your strengths and double down on them

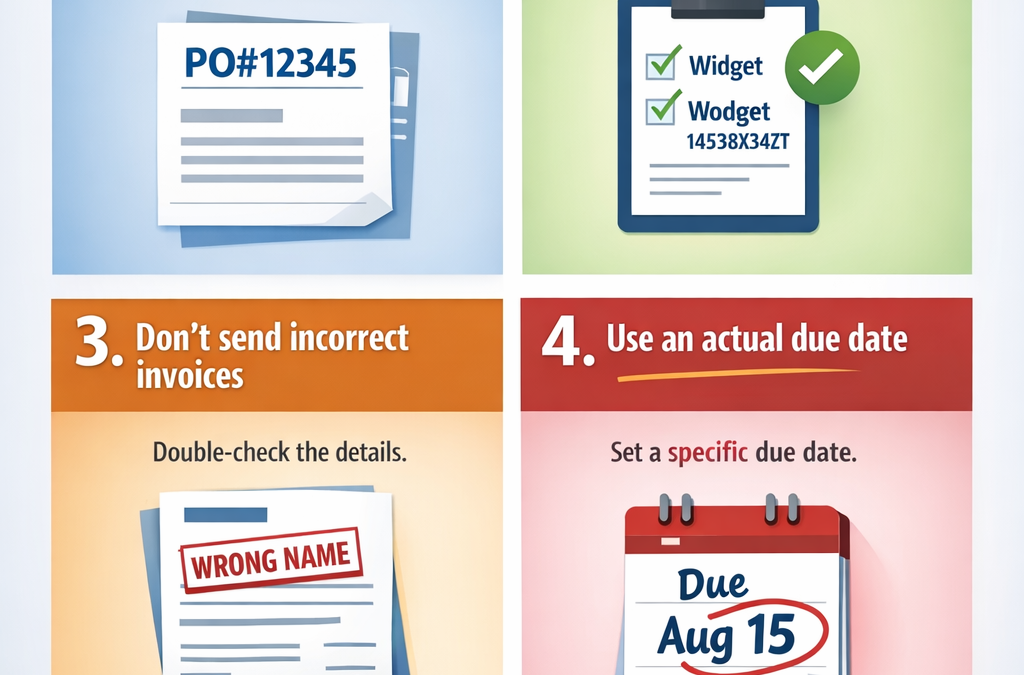

4 tips to get invoices paid faster

Small changes in how you invoice can make a big difference to your cash flow. Here are 4 tips to get invoices paid faster

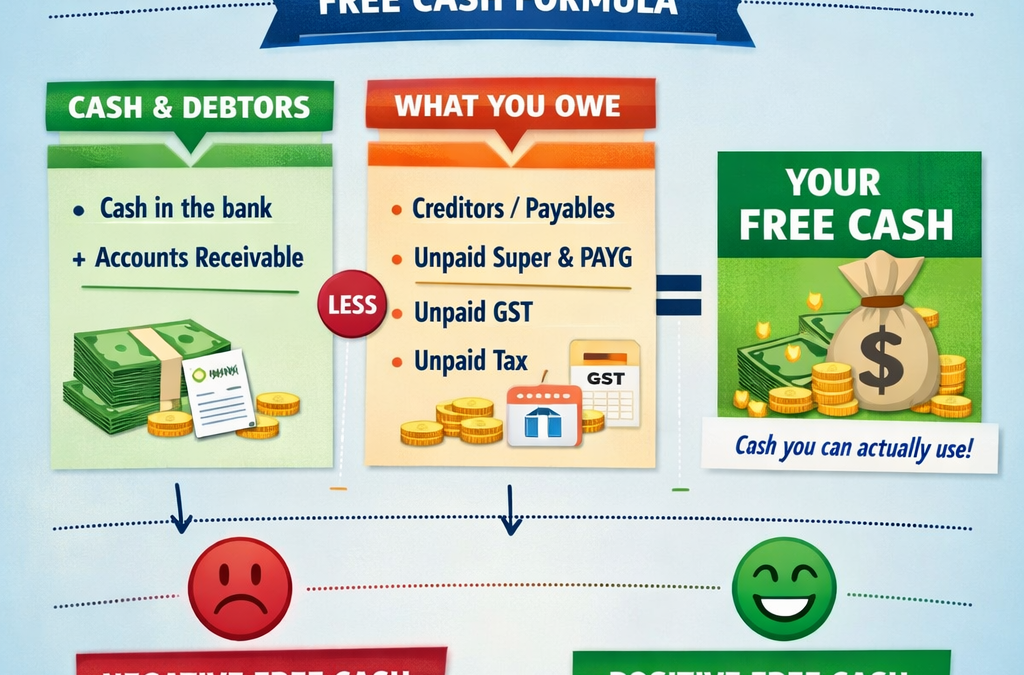

Free Cash: Why Every Business Owner Must Understand Their Balance Sheet

Free cash shows how much money your business can actually use. Learn how to calculate it and why your balance sheet matters

Cash Flow Problems Don’t Kill Businesses

Cash flow problems in business are common. What kills businesses is slow financial decision-making. Learn how faster decisions protect cash flow

Is Decision Fatigue Costing You Money?

Decision fatigue could be costing you money. Learn how mental overload affects choices and how to make better decisions when it matters most

In the “A” Hole

Many people say that there is no “I” in team, but they forget you can find one in the “A” hole.

Are You Running Your Business Inside a Filter Bubble?

Over time, we start seeing the world and our business through a filter bubble shaped by our own experience, assumptions, and beliefs

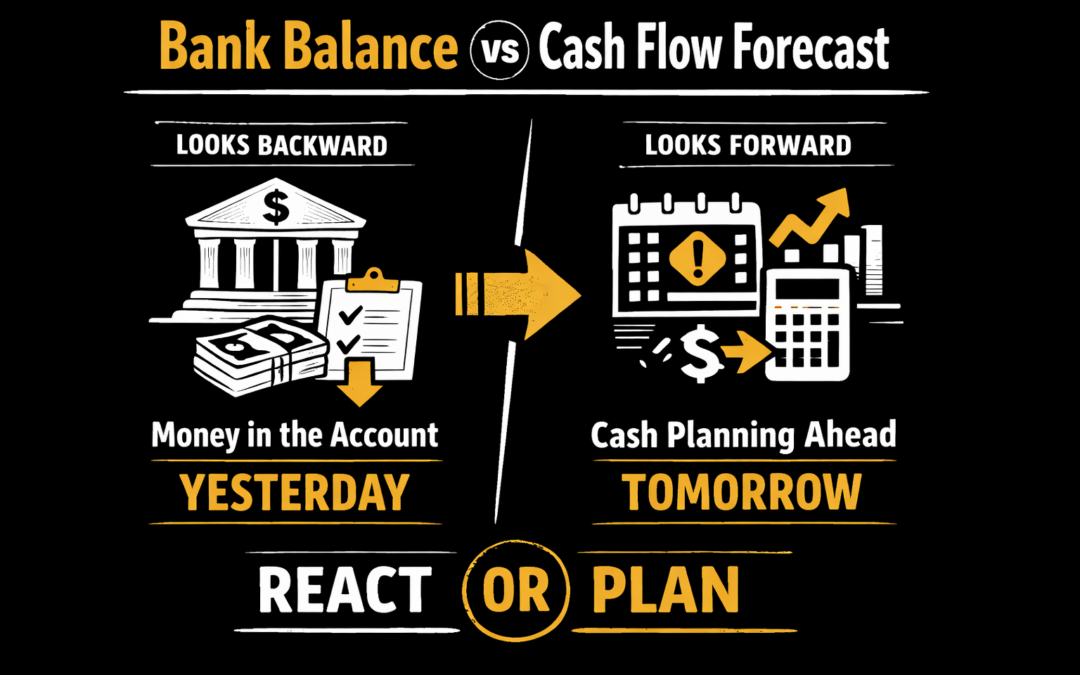

Bank Balance vs Cash Flow Forecast

Bank balance shows today. A cash flow forecast shows what’s coming. Learn why relying on your bank balance alone puts your business at risk.

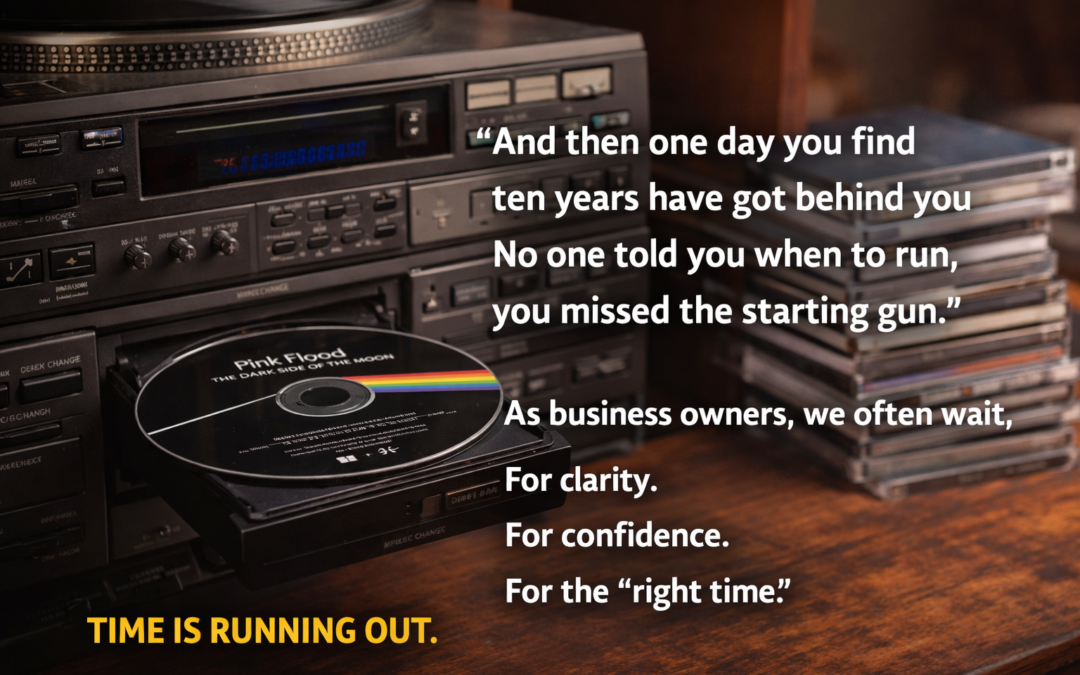

Time does not wait

Time does not wait – What’s one decision you’ve been putting off that future-you will thank you for making today

Mistakes in Your Business Are Hurting Your Cash Flow

Is your cash flow hurting because of mistakes in your sales / delivery processes that you don’t know about? Read on to learn more.

The Benefits of Forecasting

The benefits of forecasting include better decision-making, early cash flow visibility and proactive planning for business owners.

Solve Bigger Problems, and Your Business Will Grow

When you solve bigger problems, value becomes obvious, and price becomes secondary.

Stop Start Keep

If you want 2026 to be a year of clarity, momentum and better decisions — this Stop Start Keep exercise is powerful place to start.

Control the Controllables

So take a page from Glenn McGrath’s playbook. Focus only on what you can influence and Control the controllables, and innovate now.

Introduction to University Accelerators / Incubators in NSW

Founder looking for some support in 2026 from one of the various university accelerators / incubators in NSW, here is a list I am aware of.