Other Small Business Tips to help your Business

Welcome to Wayne’s other small business tips to help your business.

These tips have been drawn from Wayne’s experience as a fully qualified Chartered Accountant for over 35 years including the last 23 years working with hundreds of startups, small and medium businesses as an Outsourced CFO and Business Advisor.

Click on the below buttons to access Free Resources developed by Wayne Wanders, A Real CFO to help your business scale and grow profitably

And Wayne is always posting about new grants, funding options and other resources on LinkedIn that can help your business scale and grow profitably. Click on the below links and connect with Wayne or follow A Real CFO on LinkedIn.

Want a confidential discussion on your business situation, help with your grant application or to learn more about my Outsourced CFO Services, simply email or call me.

Scroll below to search for the Small Business Tips that can help your business scale and grow profitably. Just click on the tip you want to look at.

Superannuation changes 1 July 2024

Don’t forget that from 1 July 2024 all your staff are entitled to a minimum of 11.5% superannuation

2024 Business Tax Tips

With the end of the tax year fast approaching, here are 8 business tax tips to legally minimise your 2024 tax position

Pink Floyd Time – Don’t miss the starting Gun

Pink Floyd Time - Don't miss the Starting GunI have been on a road trip from Sydney to Birdsville about 1,900 kms. One of the albums I played whilst driving was Pink Floyd’s Dark Side of the Moon. First time in ages. I was reminded of the powerful message in the...

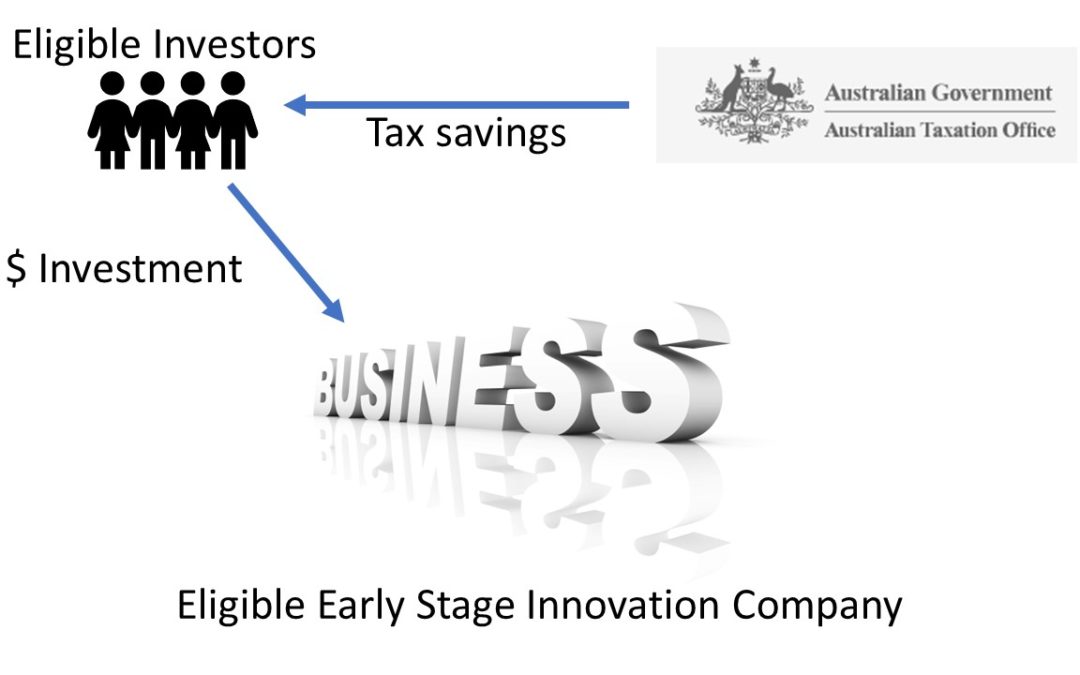

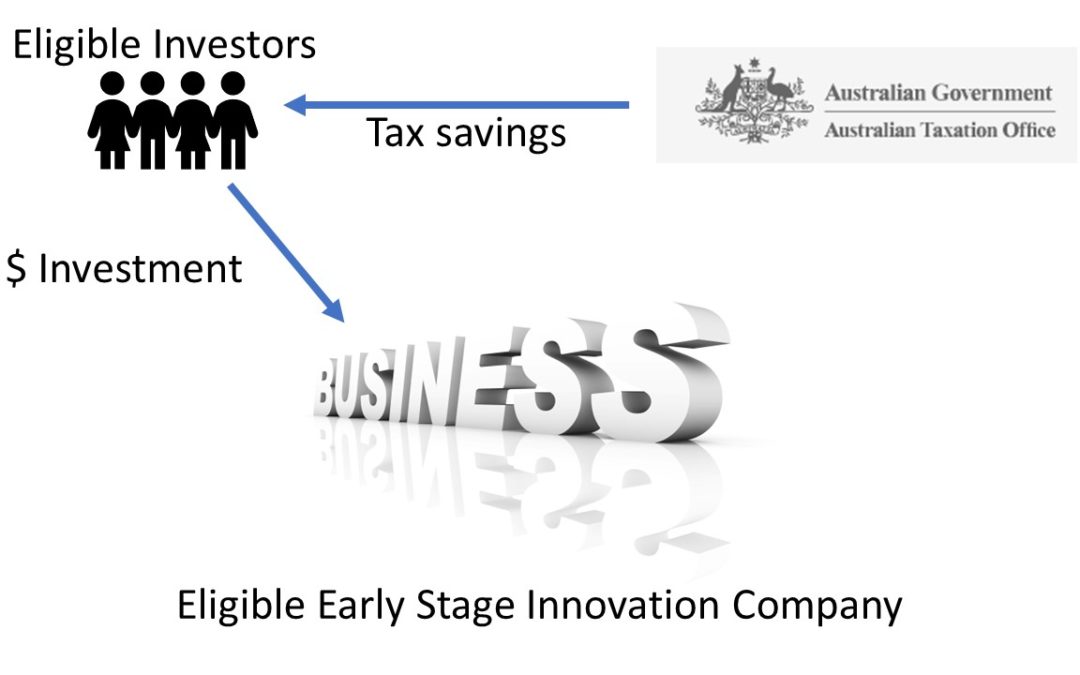

ESIC – Tax incentives for early stage investors

There is a special class of company, called Early Stage Innovation Company (ESIC), that can pass certain tax incentives onto their investors

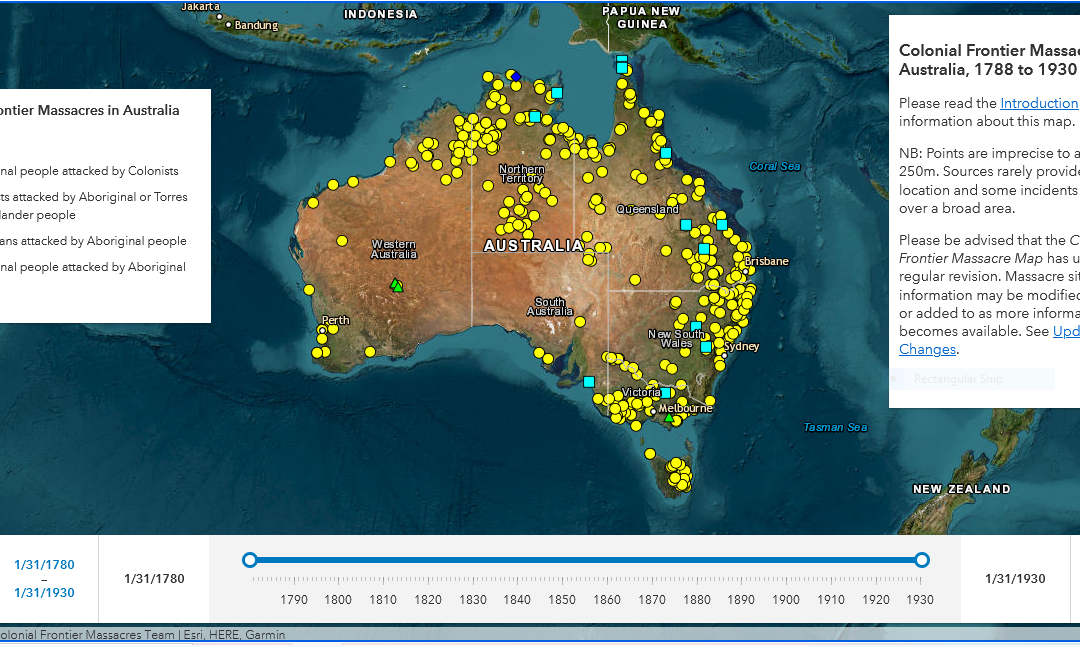

National Sorry Day 2024

National Sorry Day 2024

Today, 26 May is National Sorry Day. It is a day to recognise the grief, suffering and loss suffered by the stolen generations and the mistreatment of Australia’s first nations peoples.

What is in the 2024-25 Federal budget for Business Owners

Wayne Wanders A Real CFO talking about how little there is in the 2024-25 Federal budget for Business Owners

The Ticking Time Bomb: How Small Issues Can Bite Your Business

The Ticking Time Bomb: How Small Issues Can Bite Your Business

Small business instant asset write-off reminder

If you are a business with annual turnover of less than $10m, don’t forget that the small business instant asset write-off of up to $20,000 per eligible asset finishes on 30 June 2024.

Sole Trader or Company

People often ask me whether they should operate as a sole trader or company – read on to learn my thoughts on this

ESIC – Tax incentives for early stage investors old

There is a special class of company, called Early Stage Innovation Company (ESIC), that can pass certain tax incentives onto their investors

2023 Startup Muster

The 2023 Startup Muster measures and publishes the progress, challenges and opportunities within the Australian startup ecosystem

Payday Super Submission

Here is my feedback around payday super and the “Securing Australians’ Superannuation Budget 2023-24 Consultation paper”

Unfair Contract legislation is changing from 10 November 2023

Did you know that from 10 November 2023, more of your customers may come under the unfair contract legislation.

Thinking of a 2023 Christmas shutdown for your business – then you need to read this

If you are thinking of a Christmas shutdown for your business in December 2023 / January 2024, you need to be aware of the rules around this

What can Sporting terms teach business

sporting teams can teach business about how to get the best outcome. It needs planning, practice, training and execution

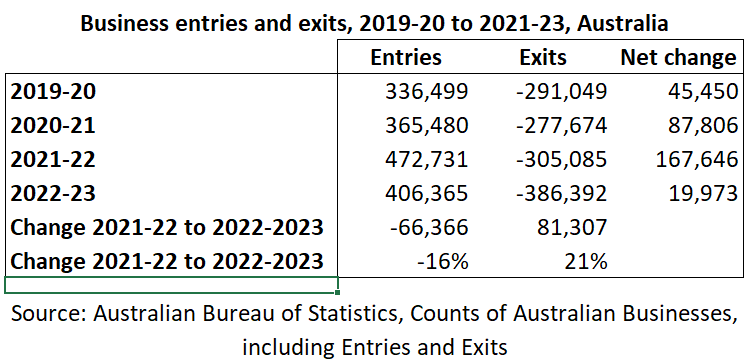

Business Exits June 2023

Here is another example of the impact of product and labour constraints and interest rates on Australian Business Exits

Are you looking for the electric toothbrush of your business?

What’s an electric toothbrush got to do with my business you say? Let me explain

Temporary Full Expensing finishes 30 June 2023

One of the stimulus measures announced during Covid was temporary full expensing which will finish on 30 June 2023

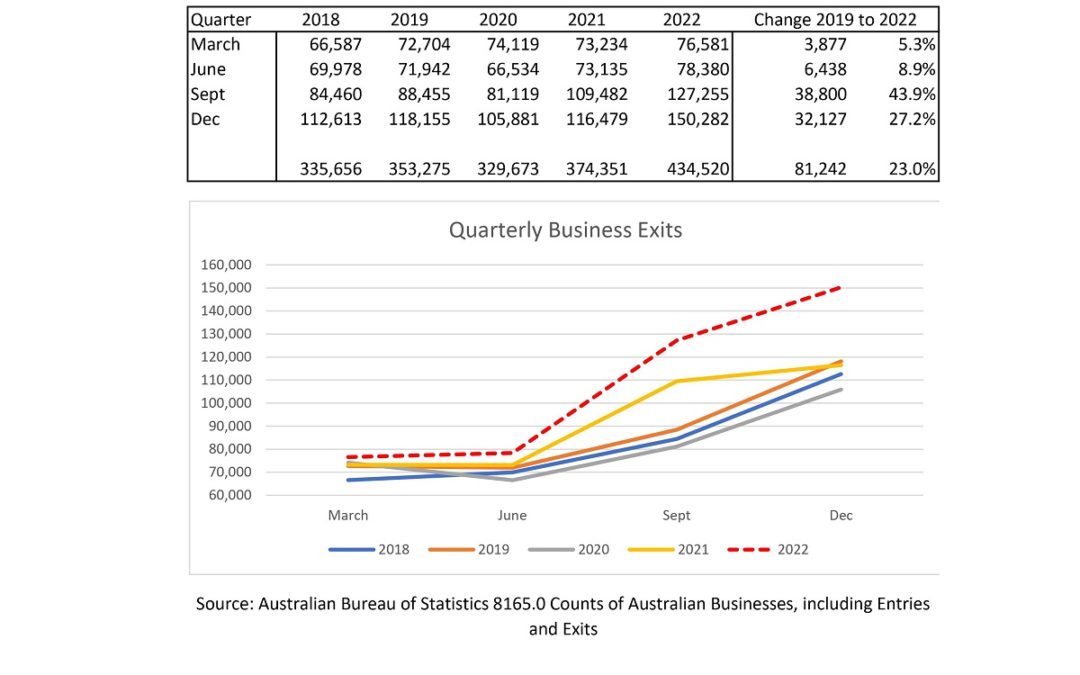

Quarterly Business Exits Dec 2022

Quarterly business Exits show the impact of lockdowns, product and labour constraints and now interest rates on Australian Businsess

Changes are coming to the Professional Employees Award 2020

Changes coming in terms of the Professional Employees Award around ordinary hours of work and overtime payments.

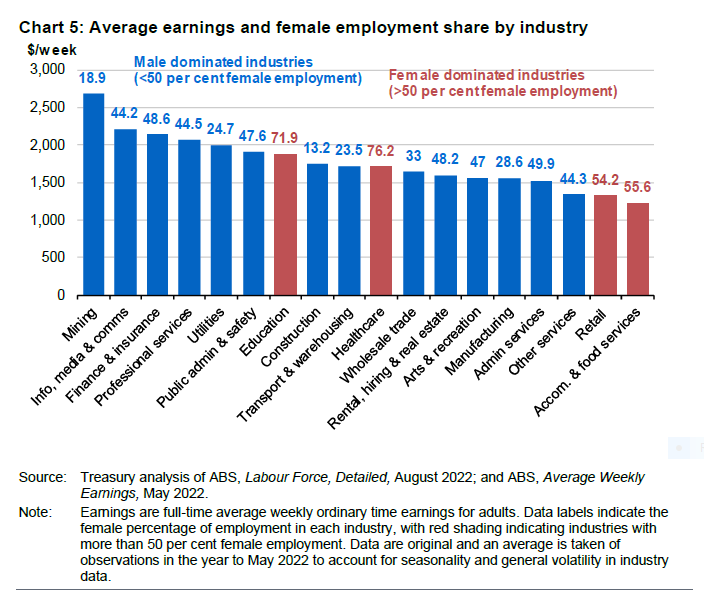

The Budget and the Gender Pay Gap

Do the politicians mouth platitudes about the gender pay gap, but have no real intention of closing the Gender Pay Gap?

Budget October 2022-23 – A budget that forgot about small business

Budget October 2022-23 – A budget that forgot about small businessAs part of the 2022 Federal Election, the Labor Party promised a “Better deal for small business”. Sounds great but Labor’s policy document at the time was very light on detail, and in my view this...

1 October 2022 Pay Rate Changes

Don’t forget the 1 October 2022 Pay Rate changes for any of your staff on selected awards, they may be entitled to a pay rise

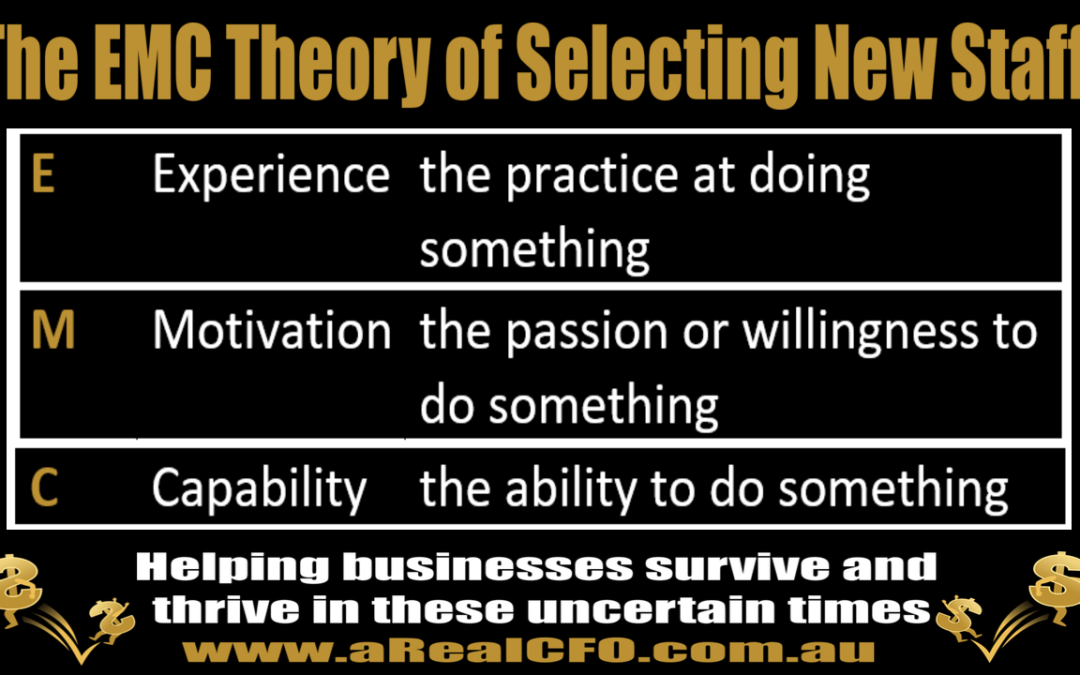

Struggling to Find Experienced staff

If you are struggling to find experienced staff, Cadel Evan’s EMC theory of how he selected his team members when he was professionally riding both mountain and road bikes may be able to help.

Right now, many business owners are struggling to find experienced staff to fill vacancies

What can sporting teams teach business 2022?

What can sporting teams teach business?Do you think that sporting clubs can teach business a trick or two? Well I do. And let me explain why. Let's have a look at the 4 footy teams lined up for the grand finals this week. You've had the Swans and Geelong in Melbourne...