SME Commercial Tenancies Code of Conduct

The Federal Government has announced a new short term SME Commercial Tenancies Code of Conduct.

Who does the SME Commercial Tenancies Code of Conduct apply to?

Firstly, the lease must be a commercial lease such as for an office, retail premise or an industrial site. This code does not apply to residential leases

Secondly, your business must have revenue of less than $50 million.

Thirdly, if your business qualifies for the JobKeeper scheme, you are included. If you a charity, your revenue has to have fallen by at least 15%. For all other businesses, your revenue has to have fallen by at least 30%. There is nothing to say you have applied for the JobKeeper Scheme, just that you are eligible.

If your business does not qualify for the JobKeeper Scheme you will need to demonstrate financial stress or hardship. In theory, if your revenue has fallen by say 25%, you may be still able to access this code of conduct.

What does this SME Commercial Tenancies Code of Conduct mean?

The code of conduct effectively requires the landlord and the tenant to negotiate in good faith within some core leasing principles.

The code of conduct is not an excuse not to pay your rent, as adjusted under the code, or to breach other conditions in the lease agreement. If you unilaterally decide to stop paying all of your rent, the code of conduct ceases to apply, and the landlord has full recourse to all termination provisions under the lease, including eviction.

At the same time, if you pay the adjusted rent during the applicable periods, which may be lower than the rent in the lease agreement, the landlord can’t evict you, nor can they call on your security such as a bank guarantee.

Hence why the term “good faith” in the code. Both parties need to act in good faith and you must, unless the landlord agrees otherwise, to pay the adjusted rent.

Also, these are minimum principles in most cases – there is nothing to stop you negotiating a better deal with your landlord.

How long does this SME Commercial Tenancies Code of Conduct apply?

Technically, this code of conduct applies for the period during which the JobKeeper program remains operational. Which at this stage is till 27 September 2020.

But parts of the code continue to apply beyond this date, during a reasonable subsequent recovery period for each tenant. Note, there is no definition of what a reasonable recovery period is and this will need to be determined on a case by case basis.

What are the leasing principles?

You as the business owner can seek rent reductions during the COVID-19 pandemic period and a subsequent reasonable recovery period, consistent with the fall in your revenue. For example, if your revenue has fallen by 50% you can ask for and should receive a rent reduction of 50%. Note there is nothing to stop you from negotiating a better reduction.

The rent reduction can be either a:

- Waiver, which means that you get a permanent rent reduction from the landlord. In other words a partial “rent holiday”.

- Deferral, which means you get a short term “rent loan” which must repaid to the landlord at some time in the future.

Rent Waiver or Rent Holiday

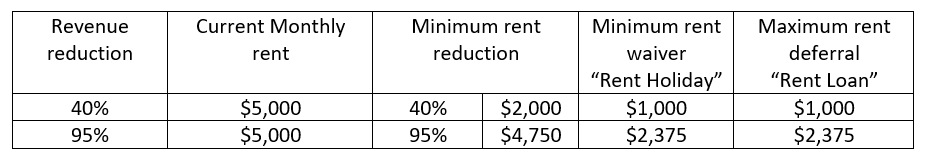

Unless the tenant agrees a lower amount, the rent waiver must be at minimum 50% of the rent reduction. For example:

In the first example you get a minimum rent holiday of $1,000 a month which will not need to be paid to the landlord.

If the lease expires before the government declares the COVID-19 pandemic over, the tenant should be provided with an opportunity to extend its lease at the same terms.

Rent Deferral or Rent Loan

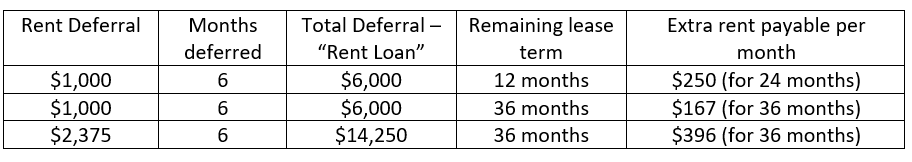

Unless otherwise agreed, the amount that was deferred (the “rent loan”) must be paid back over the greater of the balance of the lease or 24 months. For example:

Special conditions around the repayment of the “rent loan” include:

- The landlord can’t charge you any interest on the “rent loan”.

- No repayment should commence until the earlier of the COVID-19 pandemic ending (as defined by the Australian Government) or the existing lease expiring, and taking into account a reasonable subsequent recovery period.

- If the lease expires before the “rent loan” is repaid (the first example above), the tenant should be provided with an opportunity to extend its lease for an equivalent period of the deferral at the same or better terms.

Outgoings

Any reduction in outgoings such as land tax, council rates, common area electricity, insurance, etc should be passed onto the tenant.

Rent Increases

Any rent increases in the lease are frozen (other than rent based on turnover) during the duration of the COVID-19 pandemic and a reasonable subsequent recovery period.

Contact Wayne Wanders for your FREE Business Survival Session

At the end of this session, you will have multiple ideas on how your business can survive and thrive in these uncertain times.

Simply fill in the contact form below or email me at wayne@aRealCFO.com.au or call me on 0412 227 052 to organise one of these obligation free sessions.

Wayne Wanders, A Real CFO

wayne@aRealCFO.com.au