NSW Storm and flood disaster recovery small business grant

Applications are now open for the February and March 2022 storm and flood disaster recovery small business grant

If your business has been impacted by the severe weather and flooding in February and March 2022, you may be eligible for the NSW Storm and Flood Disaster Recovery Small Business Grant.

This is a grant of up to $50,000 to help pay for costs of clean-up and reinstatement of your small business, after it has suffered direct damage as a result of the severe weather and flooding from 22 February 2022.

Eligible Businesses / Sole traders

Your business must:

- employ 20 or less full time equivalent employees;

- hold an active Australian Business Number (ABN) at the time of severe weather and flooding;

- be located in the Defined Disaster Area and suffered direct damage as a result of the severe weather and flooding;

- be primarily responsible for meeting the costs of recovering from the damage;

- be intending to re-establish the business in the same area.

Sole traders with no employees who fulfil the above criteria are eligible to apply if you can show that you derive a majority of your income from the small business.

Which areas are covered by the recent severe weather and flooding?

To be eligible for the Storm and Flood Disaster Recovery Small Business Grant in respect of the most recent severe weather and flooding, your business needs to operate in the following local government areas, Armidale; Ballina; Bellingen; Byron; Clarence Valley; Coffs Harbour; Glenn Innes Severn; Hornsby; Kempsey; Kyogle; Lismore; Nambucca; Port Macquarie/Hastings; Richmond; Tenterfield; The Hills; Tweed.

What costs are covered?

Costs could include, but are not limited to:

- payment for tradespeople to conduct safety inspections

- equipment and materials required for cleaning up

- equipment and materials essential for immediately resuming operations

- payment for a cleaner if the service would not have been needed, or exceeds ordinary cleaning costs, in the absence of the disaster

- the removal and disposal of debris, damaged materials or damaged stock

- repairing premises and internal fittings

- leasing temporary premises, replacing or repair of motor vehicles, or replacing lost or damaged stock, if it’s essential for resuming operations.

Note if you are going to make a claim under your insurance policy, or you receive donations to cover the costs incurred, you can not also include those costs in any grant application. Also you can not claim any loss of income.

What Funding is available?

The maximum grant amount available is $50,000.

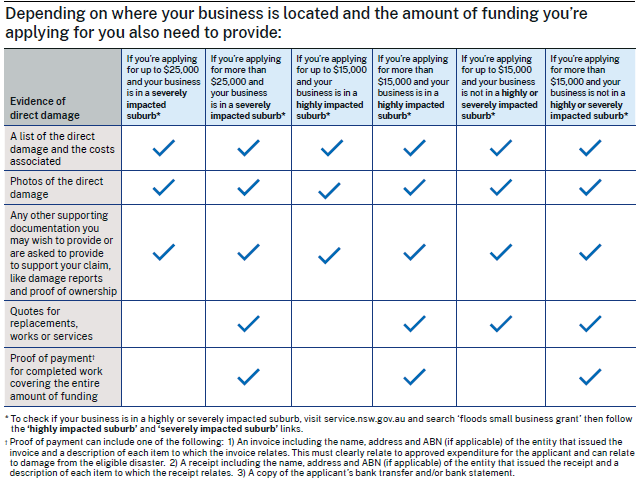

For claims up to $15,000 all you need are quotes. You don’t have need to paid for this at the time of claiming.

If you want to claim above $15,000, you will need valid tax invoices for the first $15,000, and evidence of payment of the relevant costs.

Note you can submit a second application, if your first claim was under $50,000.

How to Apply

To learn more and apply click here

If you want a confidential discussion on your business situation, or help to increase your free cash me below.

Contact Wayne Wanders for your FREE Business Survival Session