Tech Central Scale Up Accommodation Rebate

The Tech Central Scale Up Accommodation Rebate Program will help technology businesses in the scale up phase of growth to establish in Tech Central by providing a 40% rebate on eligible rental costs and 30% rebate on eligible fit out costs.

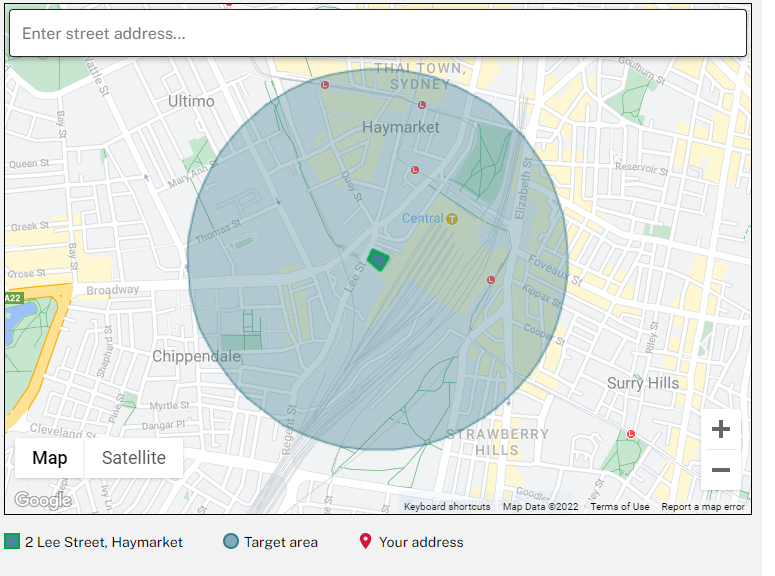

Where is Tech Central?

Tech central is an area within a 500 metre radius of 2 Lee Street Haymarket Sydney.

Funding Available under the Tech Central Scaleup Accommodation Rebate Program

The maximum rebate amount is $1,940,000 per application split:

- 40% rebate on eligible rental expenses up to a maximum of $600,000 per annum for the first two years and up to $300,000 in the third year.

- 30% rebate on eligible hard fit out expenses up to a maximum of $440,000 (capped at $220 per square metre up to 2,000 metres).

Eligibility for the Tech Central Scale Up Accommodation Rebate Program

To be eligible, you must:

- be an incorporated company, registered for GST with a ABN and a bank account and operating for at least 3 years.

- be a Scaleup Technology Business establishing in or expanding within the Tech Central. This is defined as a business which:

- develops and commercialises new technology as part of their core service or product offering

- employs at least 10 full time equivalent roles in NSW

- is generating revenue from core services or products and has achieved an average growth of 20% or more in either employment or revenue year on year, for at least 3 years immediately prior to the date of your complete application or at the calendar month end prior to the date of your complete application.

- Have an eligible commercial lease, sub lease or occupancy agreement. Note retail leases are excluded.

You must also primarily use the premises for research and development activities which include:

- development of new products, technologies and business models

- using or leveraging technology

- developing further intellectual property in NSW

- enabling and contributing to the growth of the innovation and technology ecosystem in NSW

- partnering with research and knowledge institutions to achieve commercial outcomes

Eligible lease, sub lease or occupancy agreement

If you are not currently located in Tech Central, the new lease, sub lease or occupancy agreement must be for at least 300 square metres for a minimum of three years within Tech Central.

If you are currently located in Tech Central, you must be able to demonstrate you are increasing the total commercial leased space by an additional 300 square metres or more for a minimum of three years within Tech Central.

How to Apply

To learn more and apply for the Tech Central Scaleup Accommodation Rebate click here.

Note applications close 17:00 AEST on Friday 16 June 2023 or when the Program funding has been fully exhausted, whichever occurs first

If you want some help, contact me below.

Contact Wayne Wanders for your FREE Business Survival Session

At the end of this session, you will have multiple ideas on how your business can survive and thrive in these uncertain times.

Simply fill in the contact form below or email me at wayne@aRealCFO.com.au or call me on 0412 227 052 to organise one of these obligation free sessions.

Wayne Wanders, A Real CFO

wayne@aRealCFO.com.au