The Boost Smoke and Mirrors in the 2022 – 2023 budget

Learn about the Boost Smoke and Mirrors in the 2022–23 budget

In the 2022 – 23 budget released on 29 March 2022, there was 2 “boosts” allowing businesses with turnover of less than $50 million, to be able to deduct an additional 20 per cent of applicable expenditure. These were the Skills and Training Boost and the Technology Investment boost.

The benefit to small businesses of these 2 “boosts” may be nowhere near what the Government wants you to believe.

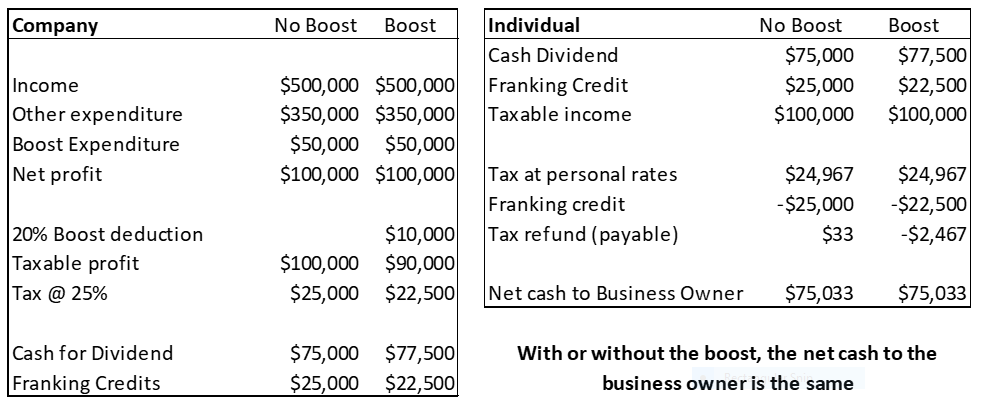

Let me demonstrate. In the image below you can see the cash outcome to the business owner if you are a small business and distribute all your profit via a dividend.

As you can see, with or without the boost, the net cash to the business owner is the same.

And this does not even take into account, you can’t claim the boost for any expenditure on or before 30 June 2022, till you lodge your 2023 tax return. So you will spend the money in say, June 2022 and not get a reduction in your tax payable till probably after November 2023, 18 months later.

So the message here is, don’t fall for the smoke and mirrors around the “boosts” announced in the budget. Sure if you need to spend the money, then spend it, but don’t spend it just because you think you will get a benefit.

If you want some help, contact me below.

Contact Wayne Wanders for your FREE Business Survival Session

At the end of this session, you will have multiple ideas on how your business can survive and thrive in these uncertain times.

Simply fill in the contact form below or email me at wayne@aRealCFO.com.au or call me on 0412 227 052 to organise one of these obligation free sessions.

Wayne Wanders, A Real CFO

wayne@aRealCFO.com.au