Thinking of a setting up a Social Enterprise

3 times in the past week someone has asked me about setting up a social enterprise to use their business model to reinvest all or part of their profits to address societal issues.

But there is no such legal term as “Social Enterprise” in Australia. For example, you can’t go ASIC (Australian Securities and Investment Corporation) or the ACNC (The Australian Charities and Not-for-Profits Commission) and say you want to set up a social enterprise.

As such, some people get confused and stuck on how to do this – so this blog is aimed to help you understand more about social enterprises.

What structure do you use to set up a social enterprise

From my perspective, those who are thinking about a social enterprise, the first and most important thing you need to determine before you start, is what sort of structure you want to operate under and how you want to fund the social outcomes you are trying to deliver.

You can be a “For Profit Social Enterprise”.

These are enterprises that generate profit to make contributions or donations that support their social mission. Thank You Water and Who Gives a Crap toilet paper are examples of this. In this version you typically have shareholders who would be entitled to their share of the dividend and the assets of the social enterprise. These businesses need to balance out returns to shareholders with contributions to their social mission.

You can be a “Not For Profit Social Enterprise”.

These are enterprises use their assets for the stated purpose of the enterprise. In this version you typically have members who are not entitled to any of the returns or assets of the social enterprise. A Not For Profit Social Enterprise can be a charity and can apply for what is known as “deductible gift recipient”, which allows you to receive tax deductible gifts or donations.

Or you can have a hybrid organisation which has a combination of for profit and not for profit organisations. In this way you can have a for profit business generating returns which helps partially fund your social purpose. The balance of the funds can come from donations or philanthropic grants for example.

Factors influencing your structure

When thinking about your structure things to consider include:

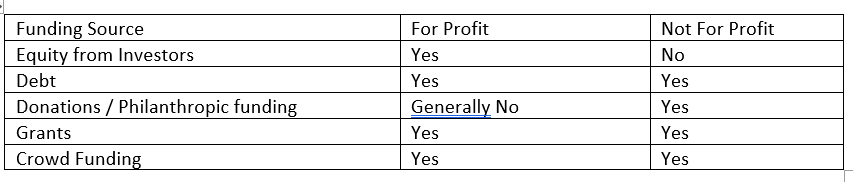

- Where will your funding come from?

Donations and philanthropic funding can generally only be directed to not for profits. For profit entities can seek equity investors to raise funds by issuing shares. Similarly, not for profits can also seek investors to raise funds through impact investment usually involving debt.

- Where do you want profits to go?

In a not for profit, profits are not distributed outside of the organisation – which means no dividends or distributions can be made to members, and all profits are directed to achieving the organisation’s mission.

In a for profit social enterprise, profits are normally partially distributed to investors and partially reinvested into the social purpose of the organisation.

- Does your organisation hope to access charitable and other tax concessions?

Charitable concessions are typically only available to not for profits registered as charities. Deductible Gift Recipient status endorsement so that people can claim a tax deduction for donations made, is even more limited to not for profits.

Additional Resources

Thankfully some organisations understand the complexity round the term social enterprise and publish some handy free guides. One such organisation is Justice Connect with their Not-for-profit Law program. Click here to access their guides around setting up a social enterprise.

Contact Wayne on wayne@arealcfo.com.au or 0412 227 052.

Click on the below buttons to access free Resources developed by Wayne Wanders, A Real CFO to help your business scale and grow profitably

Want a confidential discussion on your business situation, help with your grant application or to learn more about my Outsourced CFO Services, simply email me at wayne@aRealCFO.com.au or call me on 0412 227 052