Understanding the impact of preference shares – Value vs Valuation

Yesterday Cut Through Ventures released its “The State of Australian Startup Funding 2024” report which contains some great reading for founders. One thing that caught my eye was some commentary on preference shares value vs valuation. How shares issued during various capital rounds can distort the view of value of a business to the founders, as distinct to the valuation of the business to the outside world.

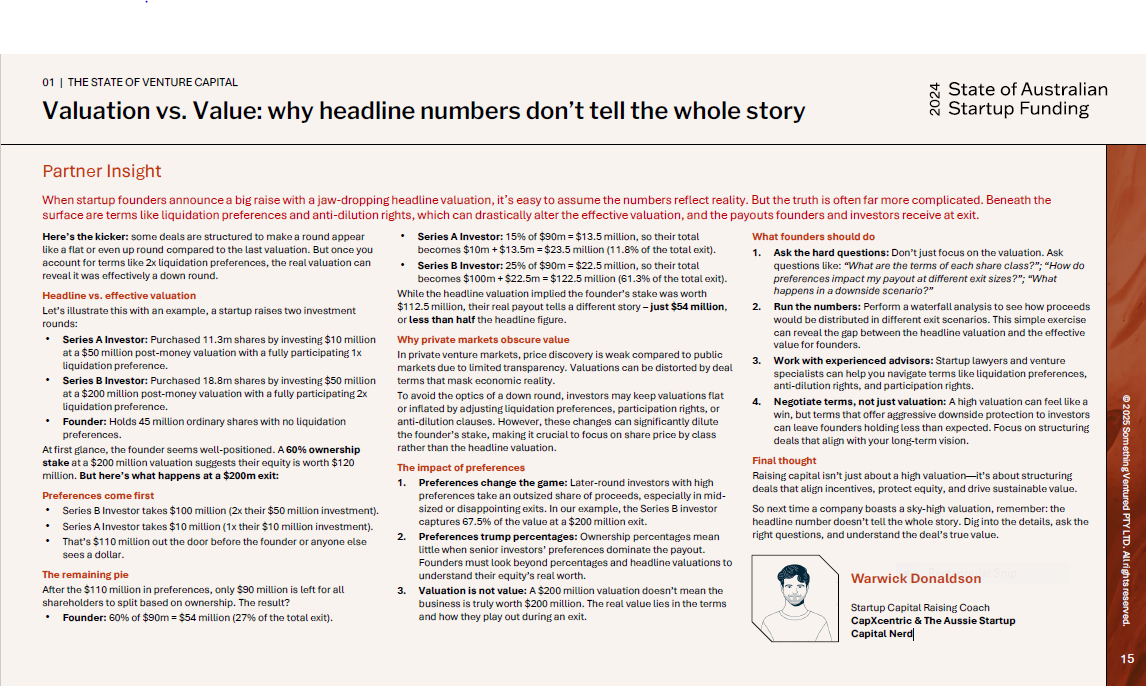

The report has an example of a business that has series B investors who acquire 25% of a business for $50m with a fully participating 2x liquidation preference. Effectively valuing the business at post money valuation of $200m.

The founders and staff hold 60% of the business so in theory their shares are worth $120m. Doesn’t this look great and make a good headline.

But once you take into consideration, the preferences of the Series B investors, plus the preference for Series A investors (who at the time acquired 20% of a business with a fully participating 1x liquidation preference for $10m for a post money valuation of $50m), the reality is somewhat different.

If the business was sold for $200m, the founders and staff, who own 60% of the business would only receive $54m or 27%.

The value of the business to the founders and staff is $54m even though they hold 60% of a business with a valuation of $200m. Clearly in this example value is significantly different valuation.

And here is the real kicker. What if the business did not do the Series B and instead was able to sell the business for $150m – the pre money valuation? The founders would have received around $72m of the $150m sale. So immediately after the Series B, the founders and staff have experienced a down round in the value of their shares from $72m to $54m.

Message for founders

Do the deal waterfall to understand the impacts and whether a new capital raising with a headline increase in valuation per share will result in a down round in the value of the shares you and others who invested earlier in your business hold.

If you want to access the full report click here.

Contact Wayne on wayne@arealcfo.com.au or 0412 227 052.

Click on the below buttons to access free Resources developed by Wayne Wanders, A Real CFO to help your business scale and grow profitably

Want a confidential discussion on your business situation, help with your grant application or to learn more about my Outsourced CFO Services, simply email me at wayne@aRealCFO.com.au or call me on 0412 227 052