Why the Wage Theft issues will lead to the Death of the Salaried Employee

The starting point of this is to understand how the award system works for salaried employees. Effectively as a salaried employee you get paid the higher of your salary for that pay period, or what the award says you should be paid.

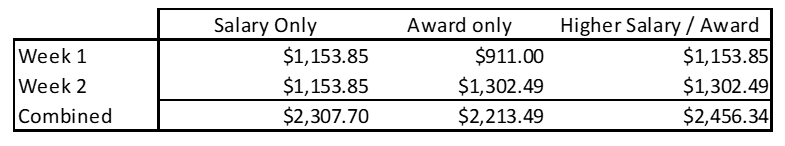

Let’s say you are a retail department manager employed on an annual salary of $60,000 and are paid weekly. This equates to a weekly pay of $1,153.85 under your employment contract.

One week you work the standard 38 hours Monday to Friday working no overtime and finishing by 6pm. Under the award for this position, you would normally be paid $911.00. But because you have a salaried employment agreement, you are paid $1,153.85. Which is $242.85 above the award!

The next week you work on a public holiday and both Saturday and Sunday. Now under the award you would (should) be paid $1,302.49, which is $148.64 above the weekly salary.

There is no allowance for the fact that last week you were paid $242.85 above the award.

So why will this spell the end of the salaried employee?

If you look at the below table you will see that based on the higher of the award / salary you would be paid $2,456.34 for the two weeks.

Show me a business owner / manager who would not want to find a 10 percent saving. Especially a small business owner who is probably not even paying themselves properly. Even if the saving was only 5 percent, they will still be interested in this.

And here is the worst bit.

The pay you will get paid $2,213.49, which is even lower than what they were paying you under the salaried employment agreement ($2,307.70). So, instead of your income increasing because the company now pays you properly for the weeks the award is higher than your salary, you lose out on those weeks where you were previously paid above the award.

And before people attack – I am not condoning wage theft where you pay people the incorrect pay. People should get paid what they are legally entitled.

What I am saying is that 20 or 30 years ago, many people were switched to being a salaried employee because of the hassle of tracking time. It was so much easier just pay say $1,153.85 (in this example) a week without a timesheet, believing the above award salary covered your legal entitlements, even if this was over an extended period such as a month or quarter.

But now the laws are changing and as a business owner / manager you have to track the time of their salaried employees. And once they start doing this, they will realise that it is cheaper just to pay you as an hourly employee. Because there will be weeks where the award is lower than your salary.

They will start to switch people from salaried employment to an hourly wage rate. Now, maybe they can’t change your employment contract, but the next person who gets employed in the same role will be employed as an hourly employee. And if you change companies, chances are you will be employed as an hourly employee.

The solution to wage theft will lead to the death of the salaried employee.

And the unintended consequence is, that by getting paid more today, you probably will end up getting paid less tomorrow.

If you want to see how Wayne can help you successfully navigate your way through your financial challenges to grow your business profitably faster,

Wayne Wanders, A Real CFO

The Wealth Navigator

wayne@aRealCFO.com.au