Why a focus on revenue can mean your business ends up Growing Broke!

On a recent radio interview, I talked about why a focus on increasing revenue can mean your business ends up growing broke. Today I want to show how this can happen.

Business 101

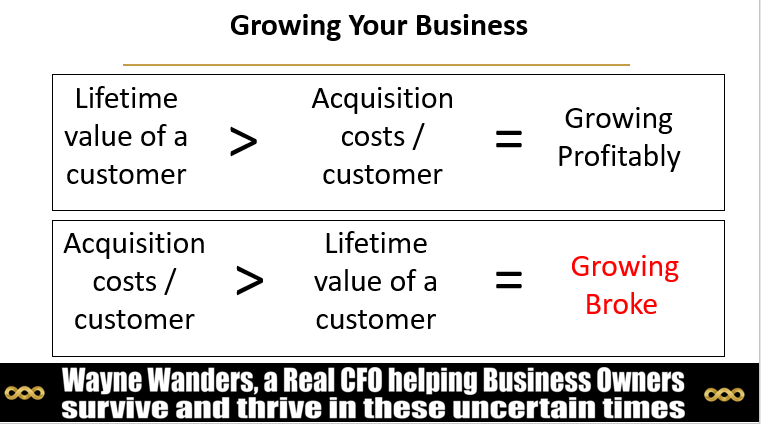

Many business books and accountants won’t tell you this, but there is a really simple rule when you are trying to grow your business. And this rule is:

Putting it another way:

Let’s look at an example of Growing Broke

You are selling a product or service for $40 a month. It costs you $35 to deliver that product or service. You are making $5 a month ($40 – $35) from that customer.

Now, on average you keep a customer for 10 months. The lifetime value of that customer is $50 (being $5 per month x 10 months).

If it costs you $60 to acquire that customer, every time you add a new customer you are growing broke by $10.

Why, because revenue goes up by $400 ($40 x 10), but your costs go up by $410 ($35 x 10 + $60). Their lifetime value is $50 but it costs you $60 to acquire them.

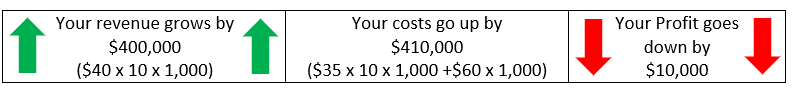

If you add 1,000 of these customers, this is what happens:

This is why many businesses end up growing broke. And that’s why ………………………

What can you do to stop growing broke?

If you have your accounting system set up to tell you this information, you can now start to make some business decisions to turn this around.

In this case can you:

- Get more revenue from the customer each month?

- Increase the time the customer stays with you?

- Reduce the costs to deliver the product or service?

- Reduce the costs to acquire the customer?

- Do all or several of these?

These are specific actions and targets that you can now pass onto your team. You are much more likely to get a positive outcome, from these questions, than you would from a generic question of why aren’t we making money.

How do you determine your acquisition costs and lifetime value of your customer?

Unfortunately, I see very few accounting systems set up to provide the above information, hence why very few businesses actually ask these questions.

To overcome this, I have developed my unique “Bucket Accounting System”. To learn more about my Bucket Accounting system click here

If you want a confidential discussion on your business situation, contact me below

Contact Wayne Wanders for your FREE Business Survival Session