Why the typical cash flow forecast template may be no good for your business

I see this time and time again, a business owner wants a cash flow forecast template. They search on the internet and see a typical cash flow forecast template on a government or banking website. Assume these must be right and download a copy.

They proceed to complete the cash flow forecast template and they now have what they think is a reliable cash flow forecast.

But here is where I see the problems start for the business.

For starters, most of these cash flow forecast templates forget about the quarterly BAS payments most small business owners need to make. The business owner forgets to include these in their forecast. Come the date when the BAS payment is due, they have a rude shock. And the shock is compounded if they don’t actually have enough money to pay the tax man!

The other and bigger problem with these cash flow forecast templates is that they often have no relationship with the real operational side of business.

For example:

- There is no relationship between collections and outstanding debtors. Often, I will see that if you take the debtors at the start of the forecast period, plus the sales, less the forecast cash collections, the debtors balance at the end of the forecast period is negative. Collections were overstated in the forecast.

- There is no relationship between payments and outstanding creditors. Often, I will see that if you take the creditors at the start of the forecast period, plus the purchases, less the forecast cash payments, the creditors balance at the end of the forecast period is double or treble what it should be. Payments were understated in the forecast.

- There is no relationship between purchases and inventory levels. Often, I will see that if you take the inventory at the start of the forecast period, plus the forecast purchases, less the cost of goods, the inventory balance at the end of the forecast period is negative. Stock purchases were understated in the forecast.

What to use instead of your typical cash flow forecast template

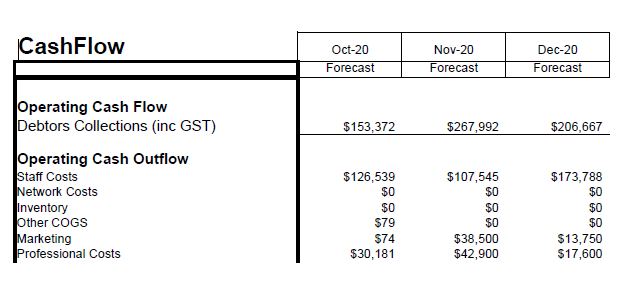

The only way to ensure that your cash flow forecast reflects the operational reality of your business is to have a 3-way forecast. This means that in addition to a cash flow forecast, you have a forecast balance sheet and profit and loss statement.

That way, you can look at the key balance sheet and profit and loss items to ensure there is not an error in one of your cash flow forecast assumptions.

Because without this check, whilst your cash flow forecast template may be mathematically correct, it may have no resemblance to your real business. And the consequences of working from a such a cash flow forecast may be dire to your business as you spend money you don’t actually have.

If you want help to prepare a 3-way forecast for your business, just contact me below

Contact Wayne Wanders for your FREE Business Survival Session

To ensure I help your business specifically, the best approach I have found is to have an obligation free session with you. In this session we will review your current business in a factual and objective manner, to better understand the challenges that you face. And this session does not need to be face to face.

At the end of this session, you will have multiple ideas on how your business can survive and thrive in these uncertain times.

Simply fill in the contact form below or email me at wayne@aRealCFO.com.au or call me on 0412 227 052 to organise one of these obligation free sessions.

To get help you successfully navigate your way through your financial challenges so your business can survive and thrive in these uncertain times, simply use the contact form on the left to email Wayne or call him on 0412 227 052.

Let Wayne Wanders, a fully qualified and experienced CFO, help you successfully navigate your way through your financial challenges so your business can survive and thrive in these uncertain times.

Wayne Wanders, A Real CFO

wayne@aRealCFO.com.au