Why your business needs a 3 way forecast

Today I want to talk about why your business needs a 3 way forecast instead of just a cash flow forecast.

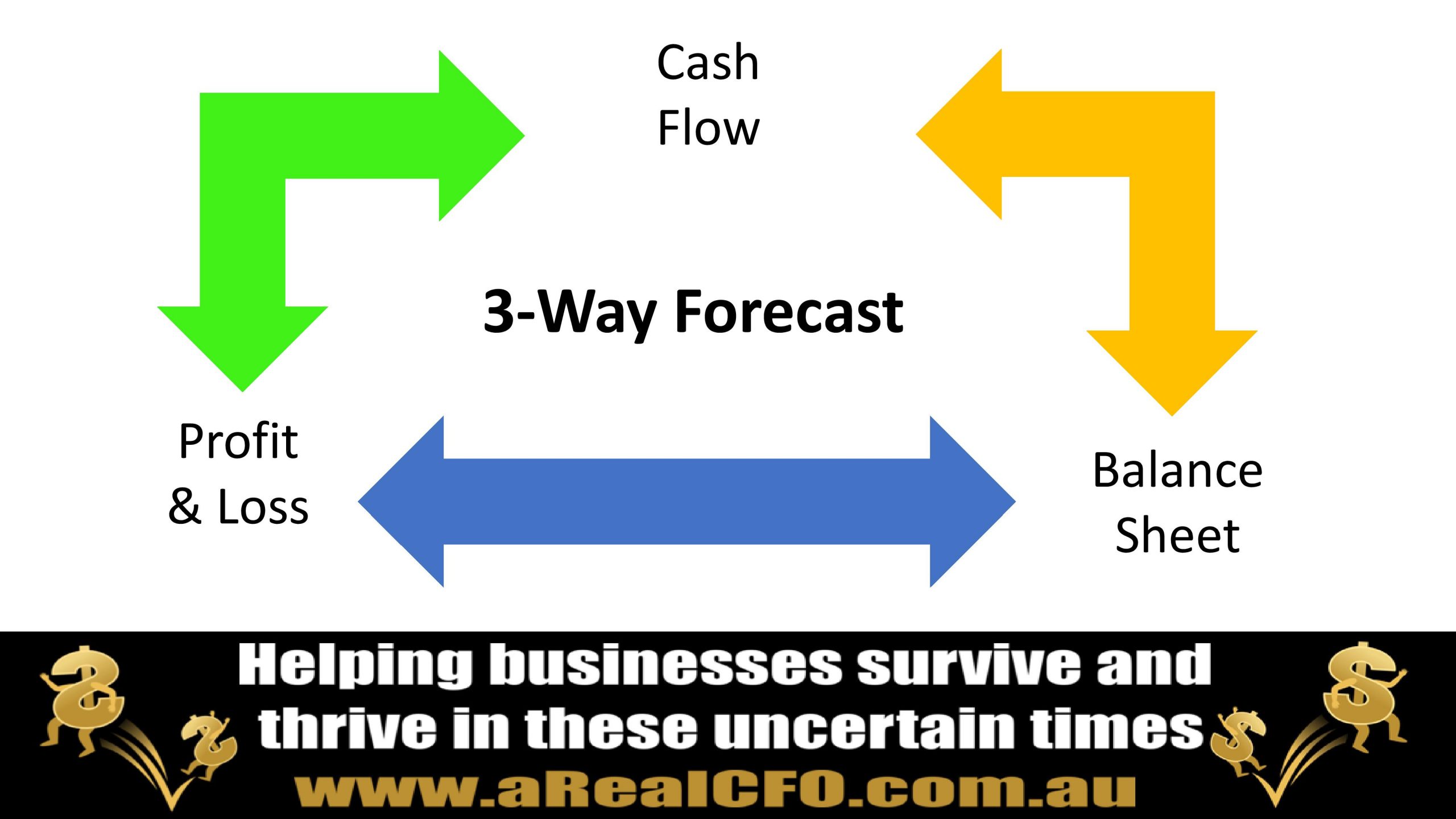

A 3 way forecast is a forecast that combines a cashflow forecast with a balance sheet and profit and loss forecast.

If you think about your business, it is not just about cash. For example, you increase staffing to drive more sales (profit and loss), which drives higher debtors and employment obligations like super (balance sheet) which then turns into cash in from debtors and cash out to employees (cashflow).

If this is how your business cycle works, why just forecast cash?

You need to understand the impact of your decisions on your entire business, not just cash. In particular for many businesses you need to know how much money you will have tied up in working capital. Working capital for many businesses is their debtors, inventory or work in progress, and creditors.

A 3 way forecast presents a complete picture of what your business is forecast to look like in the future. Giving you a much better view of the overall health of your business.

So just forecasting cash is like driving a car at night with just the parking lights on. Yes, you can still see, but not clearly enough to identify all the obstacles in your way.

And a plus of a 3 way forecast is that it reduces errors in the process. I have seen time and time again when businesses just do a cash forecast, there are errors.

For example, I will see that if you take the debtors at the start of the forecast period, plus the sales, less the forecast cash collections, the debtors balance at the end of the forecast period is negative. Collections were overstated in the forecast. Or if you take the creditors at the start of the forecast period, plus the purchases, less the forecast cash payments, the creditors balance at the end of the forecast period is double or treble what it should be. Payments were understated in the forecast.

And this is why your business needs a 3 way forecast instead of just a cash flow forecast.

If you want help to prepare a 3 way forecast for your business, just contact me below

Contact Wayne Wanders for your FREE Business Survival Session

To ensure I help your business specifically, the best approach I have found is to have an obligation free session with you. In this session we will review your current business in a factual and objective manner, to better understand the challenges that you face. And this session does not need to be face to face.

At the end of this session, you will have multiple ideas on how your business can survive and thrive in these uncertain times.

Simply fill in the contact form below or email me at wayne@aRealCFO.com.au or call me on 0412 227 052 to organise one of these obligation free sessions.

To get help you successfully navigate your way through your financial challenges so your business can survive and thrive in these uncertain times, simply use the contact form on the left to email Wayne or call him on 0412 227 052.

Let Wayne Wanders, a fully qualified and experienced CFO, help you successfully navigate your way through your financial challenges so your business can survive and thrive in these uncertain times.

Wayne Wanders, A Real CFO

wayne@aRealCFO.com.au