How the Research and Development Tax Incentive (R&D Tax incentive) for Small and Medium Business can put money into your bank account

Did you know that the Research and Development Tax Incentive (R&D Tax Incentive) is the largest grant / rebate program for small and medium businesses in Australia.

For example, according to ATO data, in the 2020-2021 income tax year, nearly 10,000 businesses with turnover less than $20 million spent just over $6 billion on eligible research and development expenditure. And out of this there was $2.7 billion in refundable tax offsets.

Refundable tax offsets means that if you are in a nil tax paying position, such as with a tax loss, you could get a tax refund from this refundable tax offset and money paid into your bank account.

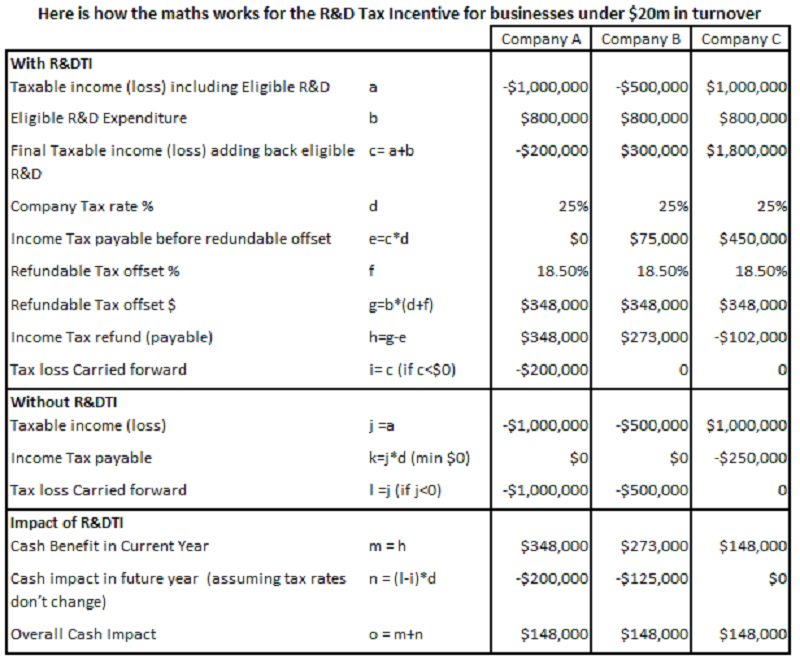

Here is how the maths works for the R&D Tax Incentive for businesses under $20m in turnover

Here are some examples with 3 different companies spending $800,000 in eligible Research and Development to show how the R&D Tax Incentive works.

As you can see in the above examples, Company A gets $348,000 cash paid into their bank account as a tax refund, in the year the R&D is claimed. But their carried forward tax losses are reduced by $800,000 so they pay an extra $200,000 in tax in later years. Giving them overall cash benefit of $148,000. But they get to use the $348,000 to fund the next years expenditure without relying on other funding sources and by the time they need to pay the tax, the business should be generating sufficient cash to cover this.

For company B, it gets $273,000 cash paid into their bank account as a tax refund, in the year the R&D is claimed. But their carried forward tax losses are reduced by $500,000 so they pay an extra $125,000 in tax in later years. Giving them the same overall cash benefit of $148,000. and they get to use the $273,000 to fund the next years expenditure without relying on other funding sources and by the time they need to pay the tax, the business should be generating sufficient cash to cover this.

For company C, it gets to reduce its tax bill from $250,000 to $102,000 in the year the R&D is claimed. Also giving them the same overall cash benefit of $148,000.

And the reason why the overall benefit of the R&D Tax Incentive is $148,000 for each, is that this is equal to $800,000 in eligible R&D expenditure * the R&D Tax incentive Refundable Tax offset of 18.5%.

So what is eligible Research and Development?

Eligible R&D activities are either Core R&D activities which are experimental activities:

- whose outcome cannot be known or determined in advance on the basis of current knowledge, information or experience, but can only be determined by applying a systematic progression of work.

- that are conducted for the purpose of generating new knowledge;

and supporting R&D activities directly related to at least one core activity.

In other words, you should not know the outcome before you start. And failure here is good as it demonstrates true R&D.

Other Things to be aware of re the R&D Tax Incentive

Firstly, your eligible R&D must be above $20,000 unless you use a registered Research Service Provider to conduct the R&D.

Secondly, you will need to ensure you properly document everything to support your claim. And it is better to do this from the start, not when you are preparing your tax return.

Thirdly, don’t forget the cash benefit will be reduced by the costs incurred to document and claim the R&D Tax incentive. Let’s say you spend $40,000 on eligible R&D. The benefit to you is $7,400 in this case. If you spend more than $7,400 to get this benefit you are going backwards, and I would not recommend you do this.

Lastly, this is a 2 stage process. You start by applying to AusIndustry and once approved, can include the R&D Tax Incentive in your tax return. But be aware, the statutory deadline to apply to AusIndustry is within 10 months after the income period closes. If the company has a 30 June year end, this means companies need to apply by the next 30 April, but you can lodge your tax return later.

Contact Wayne Wanders for your FREE Business Survival Session